- France

- /

- Capital Markets

- /

- ENXTPA:AMUN

A Fresh Look at Amundi (ENXTPA:AMUN) Valuation After UniCredit Announces Major Asset Withdrawal

Reviewed by Simply Wall St

Amundi (ENXTPA:AMUN) shares dropped after news emerged that UniCredit plans to reduce its investments managed by Amundi to almost zero over the next two years. Investors are closely watching this change.

See our latest analysis for Amundi.

The market reaction to the UniCredit news capped a year where Amundi’s momentum had started to build, supported by resilient inflows, a record €2.32 trillion in assets under management, and solid demand from Asia. While the total shareholder return over the past year is a modest 2.9%, Amundi’s three-year total return of 62.1% reminds investors of its longer-term growth potential. Even as shares trade at €64.5, investors are re-calibrating risk in the wake of this evolving partnership.

If this shift in client relationships sparks your curiosity, it might be the perfect moment to broaden your portfolio and discover fast growing stocks with high insider ownership

With earnings holding up and new assets flowing in, yet looming uncertainty over the UniCredit partnership, the key question is whether Amundi’s current price offers a bargain or if future risks are already factored into the valuation.

Most Popular Narrative: 14.8% Undervalued

With Amundi trading at €64.5 and a narrative fair value set at €75.74, the widely-followed valuation suggests the shares have meaningful upside. This perspective captures both the present risks and latent growth signals in Amundi’s business.

The partnership with SBI in India and a direct presence in other Asian markets underscore an expected rise in revenues from increased market penetration and capturing growing client assets in these regions. Strategic investments in fixed income platforms, which have generated notable inflows, suggest enhanced long-term revenue growth driven by demand for secure and attractive return solutions.

Want to know what propels Amundi’s premium value? The key driver is bold expansion plans across new geographies and product categories. Wondering how earnings projections and shifting profit margins combine in this narrative? Click through for the full breakdown and see what most investors are betting on.

Result: Fair Value of €75.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including the potential impact of new French tax proposals and ongoing competition within Europe. Both factors could limit Amundi’s upside.

Find out about the key risks to this Amundi narrative.

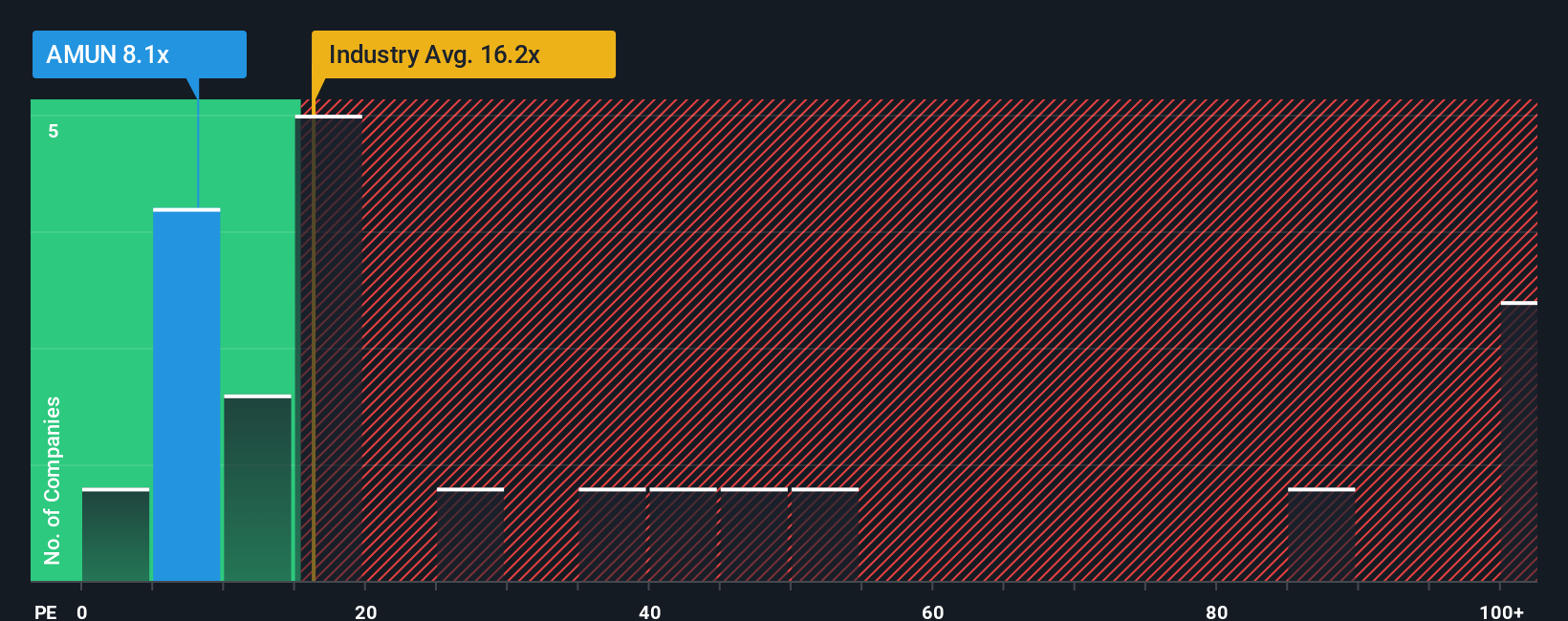

Another View: Market Multiples

While the narrative fair value leans toward significant upside, Amundi’s current share price trades at just 8.2 times earnings. That is roughly half the average for the European Capital Markets industry and well below similar peers. The fair ratio sits at 20.3 times earnings, hinting at possible undervaluation. However, why does such a wide gap persist?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Amundi for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 831 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Amundi Narrative

If you have a different perspective or want to dive deeper into Amundi’s story, you can craft your own analysis in just a few minutes. Do it your way

A great starting point for your Amundi research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why stop at just one opportunity? Get ahead of the crowd by tapping into other high-potential stocks using the Simply Wall Street Screener’s expert picks below.

- Uncover tomorrow’s market movers by browsing these 26 AI penny stocks with breakthrough innovations in artificial intelligence, automation, and data science.

- Turboboost your passive income by zeroing in on businesses offering strong payouts with these 24 dividend stocks with yields > 3% now yielding over 3%.

- Chase rare growth stories that fly under the radar and could be undervalued right now via these 831 undervalued stocks based on cash flows before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AMUN

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives