- France

- /

- Diversified Financial

- /

- ENXTPA:ALHYP

HiPay Group SA (EPA:ALHYP) Looks Inexpensive After Falling 27% But Perhaps Not Attractive Enough

HiPay Group SA (EPA:ALHYP) shares have had a horrible month, losing 27% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 21% share price drop.

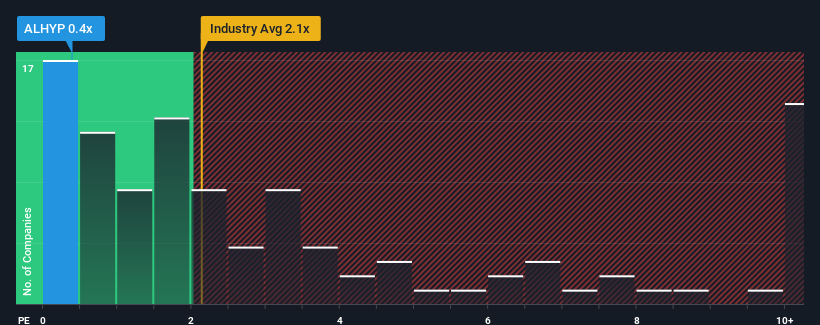

Following the heavy fall in price, HiPay Group's price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Diversified Financial industry in France, where around half of the companies have P/S ratios above 2.2x and even P/S above 7x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for HiPay Group

How Has HiPay Group Performed Recently?

Recent times have been pleasing for HiPay Group as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on HiPay Group.How Is HiPay Group's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like HiPay Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 7.5%. Pleasingly, revenue has also lifted 36% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 4.9% as estimated by the sole analyst watching the company. With the industry predicted to deliver 91% growth, the company is positioned for a weaker revenue result.

With this information, we can see why HiPay Group is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

The southerly movements of HiPay Group's shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of HiPay Group's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

You need to take note of risks, for example - HiPay Group has 4 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if HiPay Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALHYP

HiPay Group

Provides augmented payment solutions in France and rest of Europe.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives