- France

- /

- Hospitality

- /

- ENXTPA:SW

Sodexo (ENXTPA:SW): Examining Valuation After Recent Modest Earnings Growth

Reviewed by Kshitija Bhandaru

See our latest analysis for Sodexo.

While the past month’s 5% share price gain hints at a return of investor optimism, Sodexo’s year-to-date share price is still down overall. Its 1-year total shareholder return has slid slightly into the red. Momentum appears to be steady rather than surging, reflecting a period of consolidation as the company balances short-term challenges and long-term stability.

If today's movement in Sodexo has you watching the broader market, it's a good moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading well below analyst targets despite steady performance, the question remains: is Sodexo undervalued at current levels, or is the market simply reflecting its future growth outlook?

Most Popular Narrative: 17.9% Undervalued

The most widely followed narrative puts Sodexo’s fair value nearly 18% above its last close. This suggests analysts see room for significant upside from here.

Sodexo's focus on refining its portfolio mix and accelerating innovation within North America's Education sector is expected to drive improved growth and performance starting in fiscal year '26. This is likely to positively impact future revenue.

Want to know what could propel Sodexo far beyond its recent share price? The real story is in bold profit margin expansion and a future P/E multiple more often associated with industry leaders. Wondering what deep financial assumptions are driving such an optimistic outlook? Uncover the exact figures and turning points that shape this valuation.

Result: Fair Value of €66.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks such as slower margin improvement or delays in contract ramp-ups could challenge the positive growth outlook projected by analysts.

Find out about the key risks to this Sodexo narrative.

Another View: Our DCF Model Offers a Different Perspective

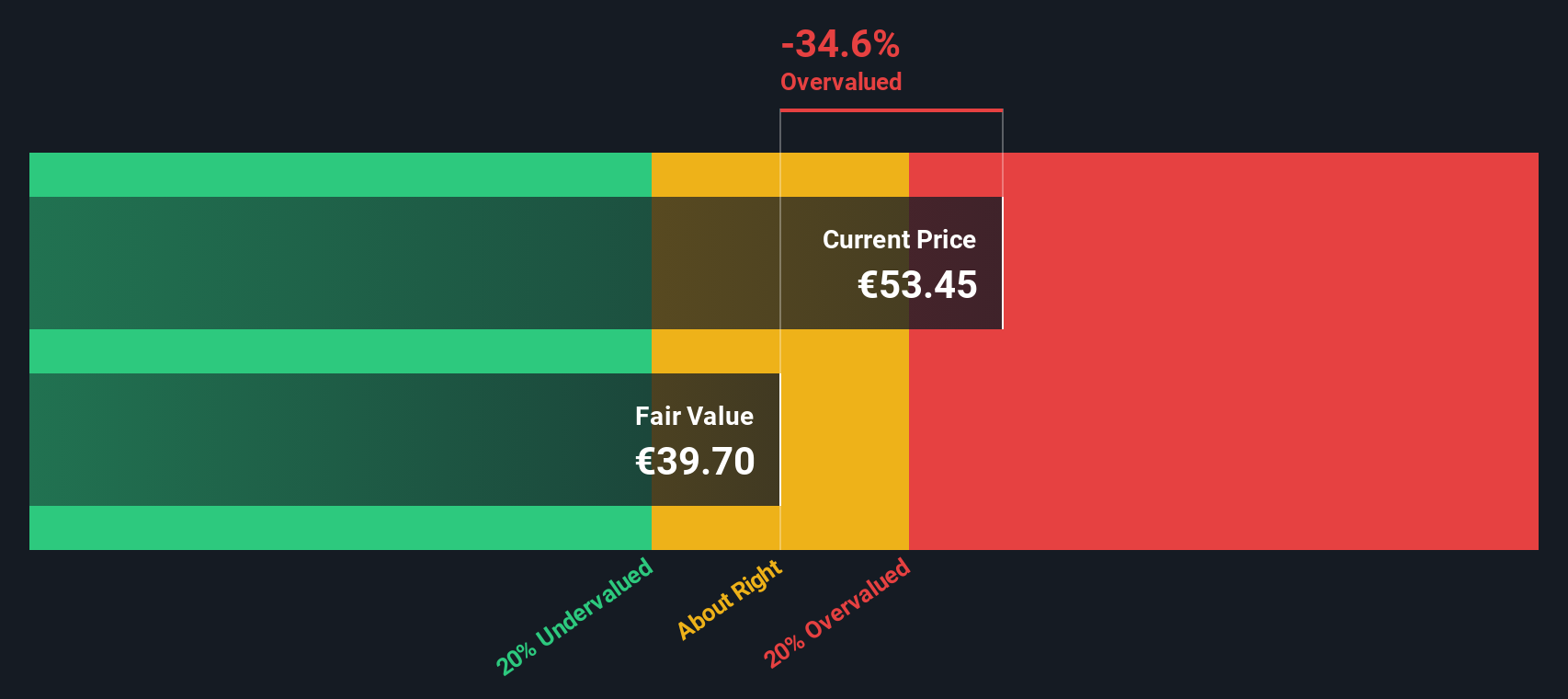

While the main narrative leans on analyst targets and future earnings multiples, our DCF model tells a more cautious story. According to our calculations, Sodexo is currently trading above its fair value estimate, which introduces a layer of valuation risk for investors. This could mean the market is factoring in stronger future growth than the underlying fundamentals support.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sodexo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sodexo Narrative

If you see things differently or want to dive into the numbers yourself, you can build your own view in just a few minutes with Do it your way.

A great starting point for your Sodexo research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Get ahead of the curve by acting now. These unique stock ideas could unlock the next big winner for your portfolio, and you’ll want to catch them before the crowd.

- Uncover overlooked gems offering resilient yields when you check out these 19 dividend stocks with yields > 3% that boast strong dividends and reliable income streams.

- Capitalize on the explosive potential of technological breakthroughs by reviewing these 24 AI penny stocks reshaping industries with advanced artificial intelligence.

- Seize first-mover advantage on hidden opportunities among these 3562 penny stocks with strong financials showing promising growth and financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SW

Sodexo

Provides food services and facilities management services worldwide.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives