- New Zealand

- /

- Telecom Services and Carriers

- /

- NZSE:SPK

3 Dividend Stocks To Consider With Yields Up To 9.6%

Reviewed by Simply Wall St

As global markets navigate a period of economic uncertainty with central banks adjusting interest rates and inflationary pressures persisting, investors are increasingly seeking stability through dividend stocks. In such an environment, selecting stocks that offer reliable dividend yields can provide a steady income stream and potentially mitigate market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.23% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.00% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.19% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.96% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.61% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.36% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

Click here to see the full list of 1831 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

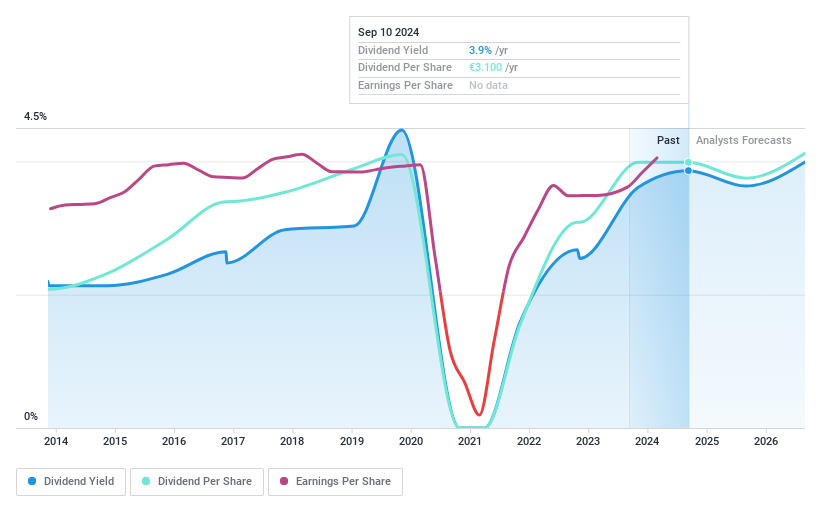

Sodexo (ENXTPA:SW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sodexo S.A. is a global provider of food services and facilities management solutions, with a market cap of €11.77 billion.

Operations: Sodexo S.A. generates revenue from its operations across Europe (€8.45 billion), North America (€11.11 billion), and the Rest of the World (€4.24 billion).

Dividend Yield: 3.3%

Sodexo's dividend strategy shows mixed signals for investors. While the company recently proposed a 17.8% increase in its ordinary dividend to €2.65 per share, aligning with a 50% payout ratio, its dividends have been volatile over the past decade. Despite this, dividends are well-covered by earnings and cash flows with payout ratios of 52.6% and 40.3%, respectively. However, Sodexo's high debt level and low dividend yield compared to peers may concern some investors seeking stability in dividend stocks.

- Unlock comprehensive insights into our analysis of Sodexo stock in this dividend report.

- Upon reviewing our latest valuation report, Sodexo's share price might be too optimistic.

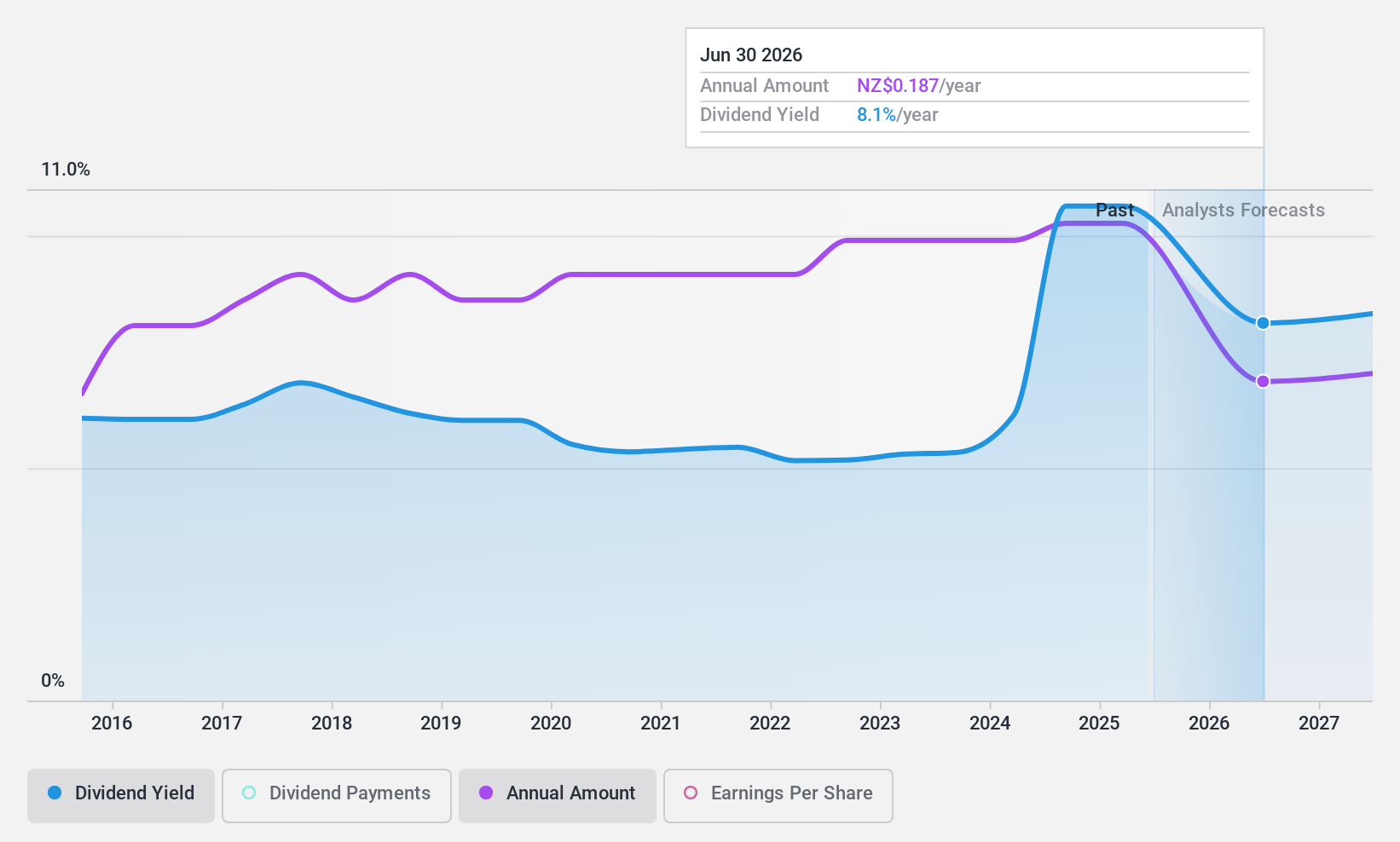

Spark New Zealand (NZSE:SPK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Spark New Zealand Limited, along with its subsidiaries, offers telecommunications and digital services in New Zealand and has a market capitalization of NZ$5.31 billion.

Operations: Spark New Zealand Limited generates revenue from various segments, including NZ$180 million from Voice, NZ$1.47 billion from Mobile, NZ$613 million from Broadband, NZ$527 million from IT Products, NZ$165 million from IT Services, and NZ$37 million from Data Centres.

Dividend Yield: 9.7%

Spark New Zealand's dividend yield of 9.69% is among the highest in the NZ market, but its sustainability is questionable due to high payout ratios, with dividends not well-covered by earnings or cash flows. Despite a decade of stable and growing dividends, recent guidance indicates a decrease from 27.5 to 25 cents per share for 2025. The company faces financial challenges with declining profit margins and high debt levels, alongside leadership changes as Stewart Taylor becomes CFO in December 2024.

- Click to explore a detailed breakdown of our findings in Spark New Zealand's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Spark New Zealand shares in the market.

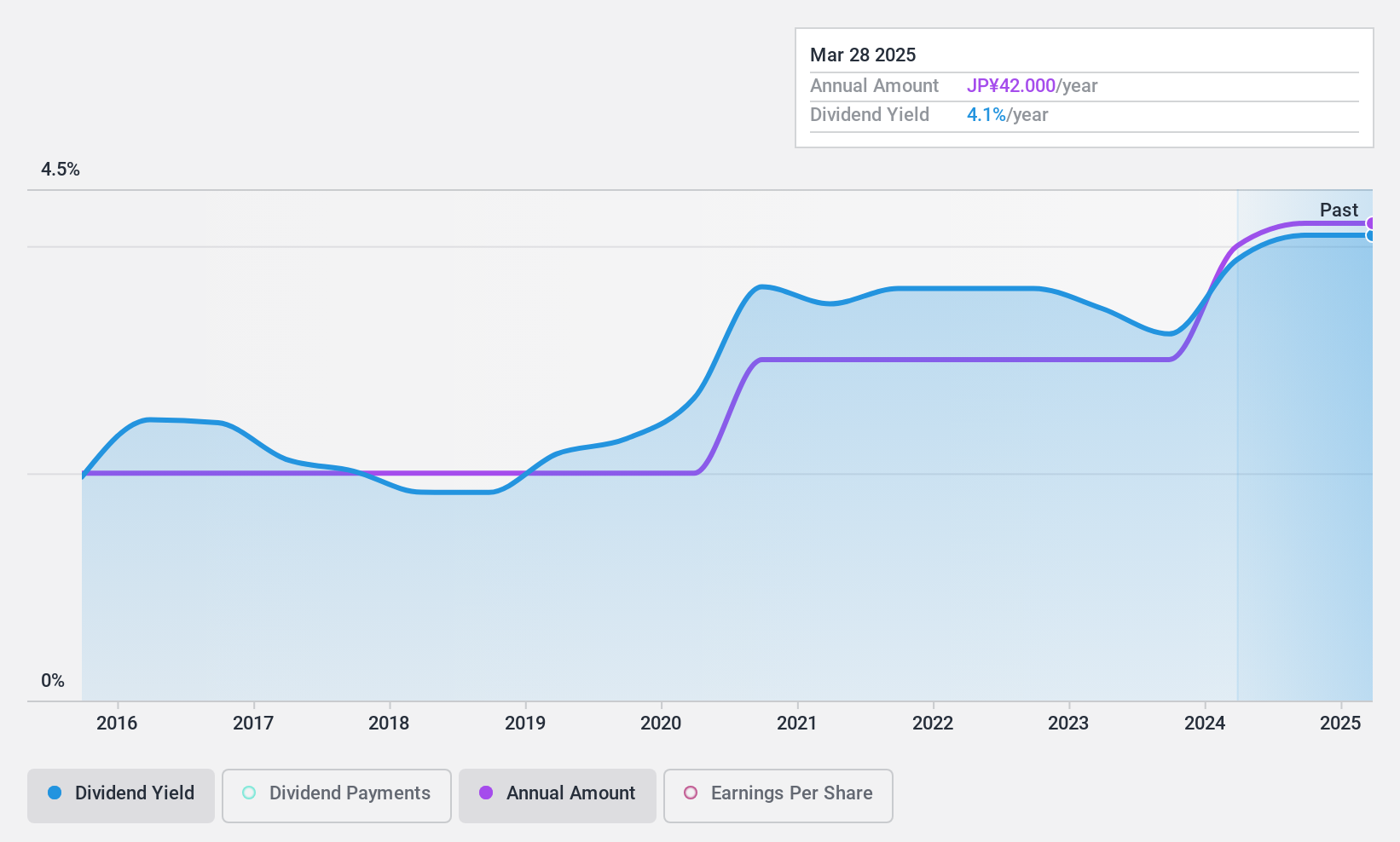

Hisaka Works (TSE:6247)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hisaka Works, Ltd. manufactures and sells industrial machinery globally with a market cap of ¥30.08 billion.

Operations: Hisaka Works, Ltd.'s revenue is primarily derived from its Heat Exchanger segment at ¥15.69 billion, followed by Process Engineering at ¥14.95 billion and Valve sales contributing ¥4.93 billion.

Dividend Yield: 3.9%

Hisaka Works' dividend yield of 3.9% is competitive within the JP market, ranking in the top 25%. Although dividends have been stable and growing over the past decade, they are not covered by free cash flows despite a low payout ratio of 45.9%. Recent earnings growth of 35% suggests potential for future stability. The company completed a share buyback worth ¥389.03 million, which could impact future dividend policies and financial flexibility.

- Take a closer look at Hisaka Works' potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Hisaka Works is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Reveal the 1831 hidden gems among our Top Dividend Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:SPK

Spark New Zealand

Provides telecommunications and digital services in New Zealand.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives