- Spain

- /

- Hotel and Resort REITs

- /

- BME:SCHST

Discovering Europe's Hidden Stock Gems This April 2025

Reviewed by Simply Wall St

As Europe grapples with the ripple effects of unexpected U.S. trade tariffs, resulting in significant declines across major indices like the STOXX Europe 600, investors are searching for opportunities amidst the turbulence. In such volatile conditions, identifying stocks with robust fundamentals and strong market positioning can be crucial for navigating uncertainty and uncovering hidden gems.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nederman Holding | 69.60% | 11.43% | 16.35% | ★★★★★★ |

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| ABG Sundal Collier Holding | 0.61% | -2.06% | -8.96% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Nordeste Properties SOCIMI (BME:SCHST)

Simply Wall St Value Rating: ★★★★★★

Overview: Nordeste Properties SOCIMI, S.A. specializes in owning and renting real estate properties for hotel use in Spain, with a market capitalization of €619.63 million.

Operations: Nordeste Properties SOCIMI generates revenue primarily through renting real estate properties for hotel use, amounting to €36.54 million.

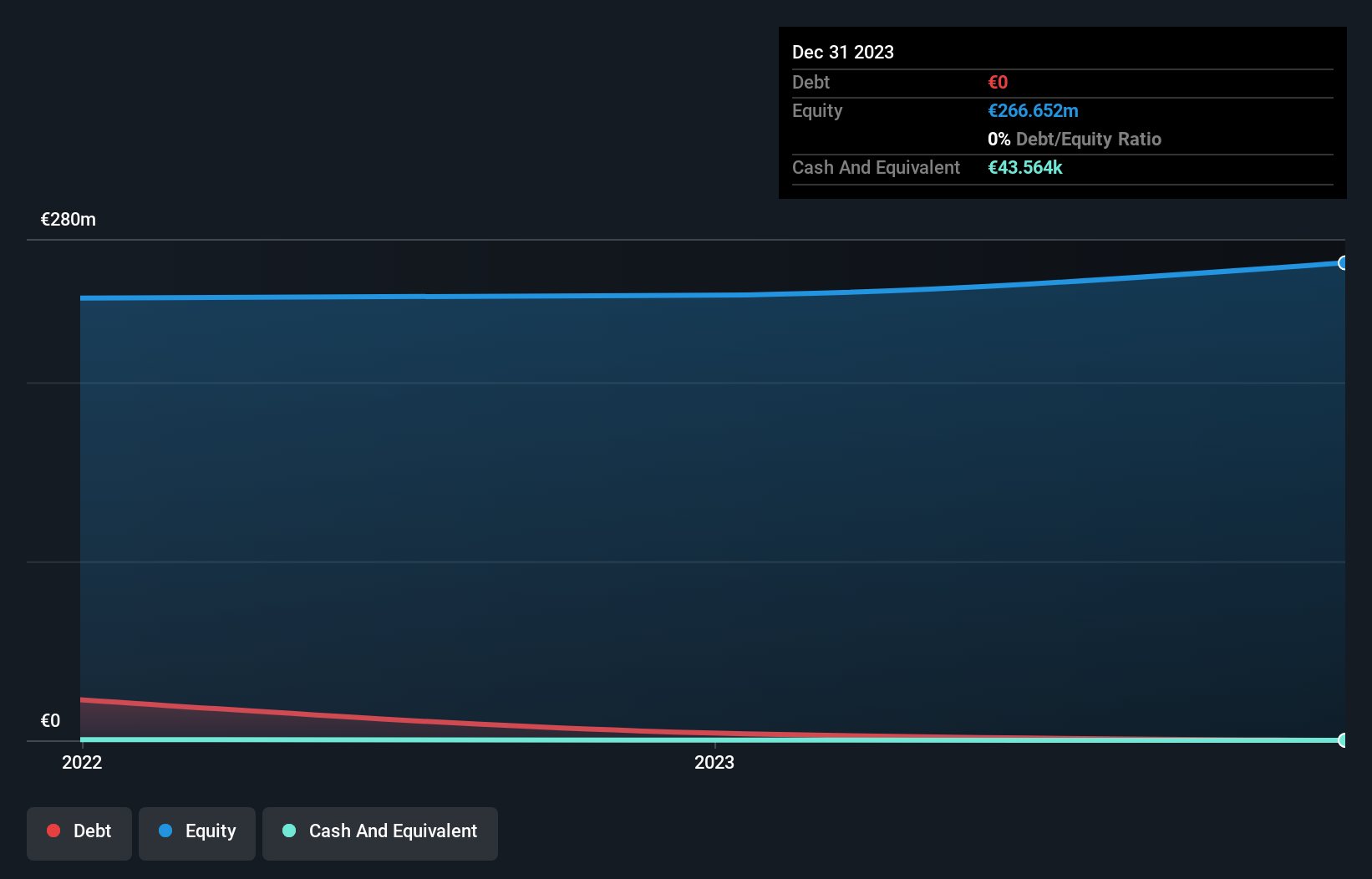

Nordeste Properties SOCIMI, a small player in the European real estate sector, has shown remarkable earnings growth of 544.5% over the past year, outpacing the Hotel and Resort REITs industry average of 6.3%. With no debt on its books for five years, it seems financially stable and able to cover interest payments without concern. Trading at 25.1% below its estimated fair value suggests potential for appreciation. Despite these positives, recent financial data is outdated by over six months, which might affect investor confidence in current performance metrics. A cash dividend of €0.01 was announced recently with an ex-dividend date on March 18, 2025.

- Click to explore a detailed breakdown of our findings in Nordeste Properties SOCIMI's health report.

Hotel Majestic Cannes (ENXTPA:MLHMC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hotel Majestic Cannes owns and operates a hotel, with a market capitalization of €318.39 million.

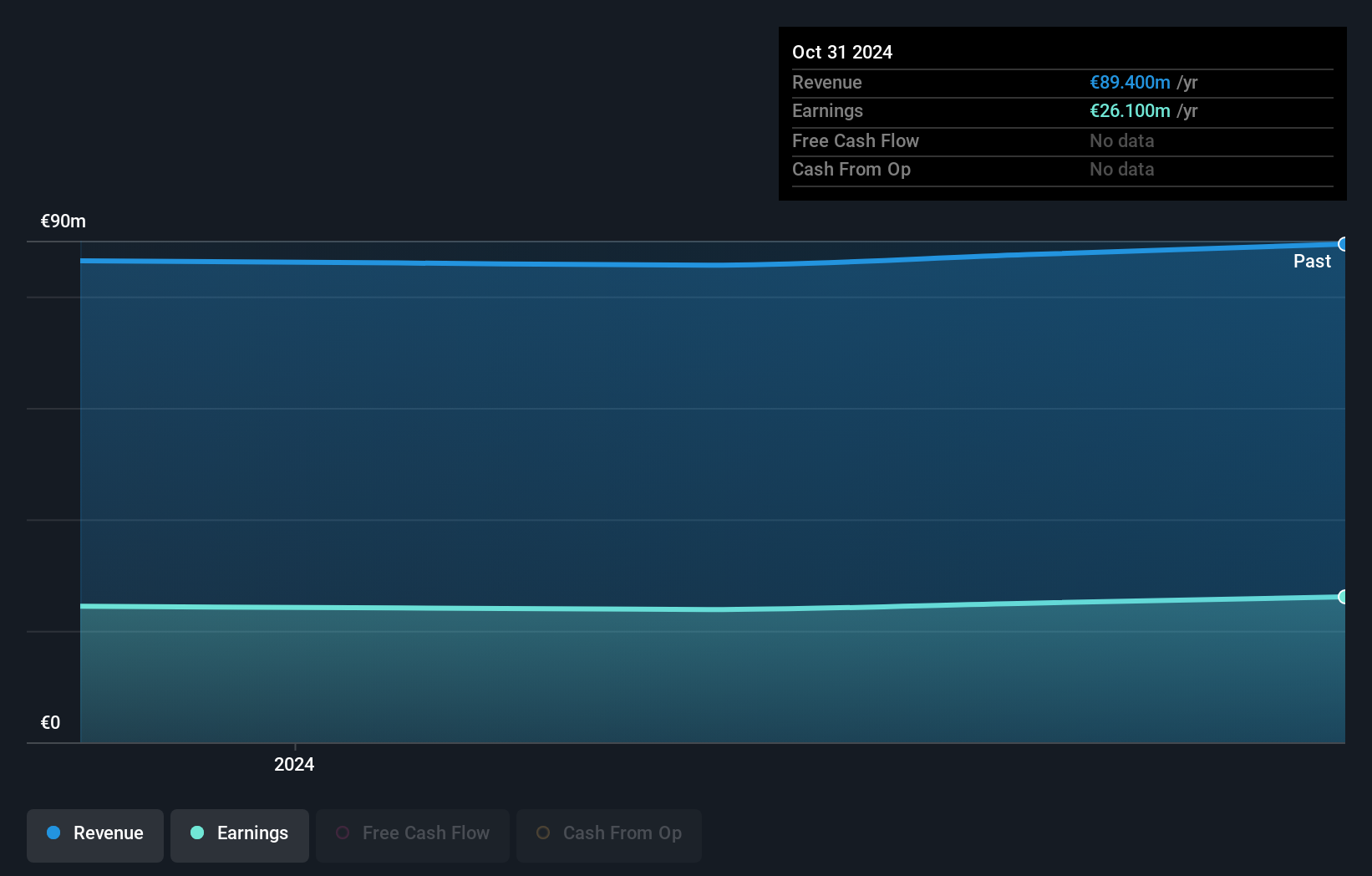

Operations: The primary revenue stream for Hotel Majestic Cannes is its Hotels & Motels segment, generating €89.40 million. The company has a market capitalization of €318.39 million.

Hotel Majestic Cannes, a niche player in the hospitality sector, recently reported annual earnings growth of 7%, outpacing the industry average of 2.6%. With a net income increase to €26.1 million from €24.4 million and sales rising to €89.4 million, this company demonstrates robust financial health. Its price-to-earnings ratio stands at 12.2x, which is attractive compared to the broader French market's 13.7x benchmark, suggesting potential value for investors seeking opportunities in smaller European stocks. Additionally, Hotel Majestic Cannes has more cash than its total debt and earns more interest than it pays out, indicating sound financial management practices.

PharmaSGP Holding (XTRA:PSG)

Simply Wall St Value Rating: ★★★★★☆

Overview: PharmaSGP Holding SE is a company that produces and distributes over-the-counter medications and healthcare products in Germany, with a market capitalization of €294.96 million.

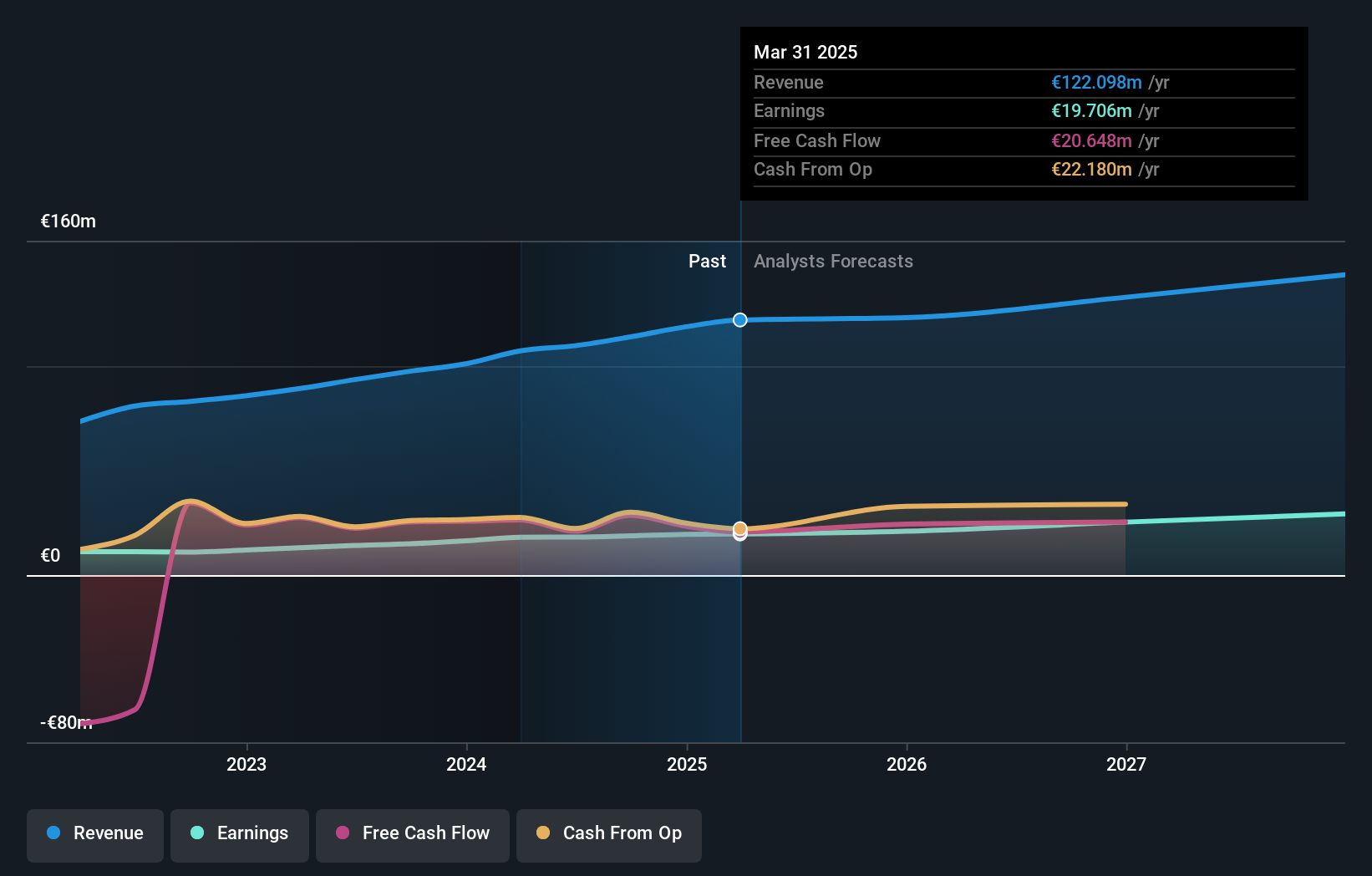

Operations: PharmaSGP generates revenue primarily from its pharmaceuticals segment, which accounts for €114 million. The company reports a market capitalization of €294.96 million.

PharmaSGP, a nimble player in the pharmaceuticals sector, has shown resilience with its earnings growing at 5.1% annually over the past five years. Trading at a significant 53% below its estimated fair value, it presents an intriguing opportunity for those eyeing undervalued stocks. Despite having high net debt to equity ratio of 85%, its interest payments are well covered by EBIT at 8.7 times, indicating solid financial management. While earnings growth last year was robust at 25%, it lagged behind industry averages, yet forecasts suggest a promising annual growth rate of over 14%.

Key Takeaways

- Unlock our comprehensive list of 339 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordeste Properties SOCIMI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:SCHST

Nordeste Properties SOCIMI

Owns and rents real estate properties for hotel use in Spain.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives