- France

- /

- Hospitality

- /

- ENXTPA:HDP

The Les Hôtels de Paris (EPA:HDP) Share Price Is Up 86% And Shareholders Are Holding On

Les Hôtels de Paris SA (EPA:HDP) shareholders might be concerned after seeing the share price drop 16% in the last quarter. But that shouldn't obscure the pleasing returns achieved by shareholders over the last three years. In fact, the company's share price bested the return of its market index in that time, posting a gain of 86%.

View our latest analysis for Les Hôtels de Paris

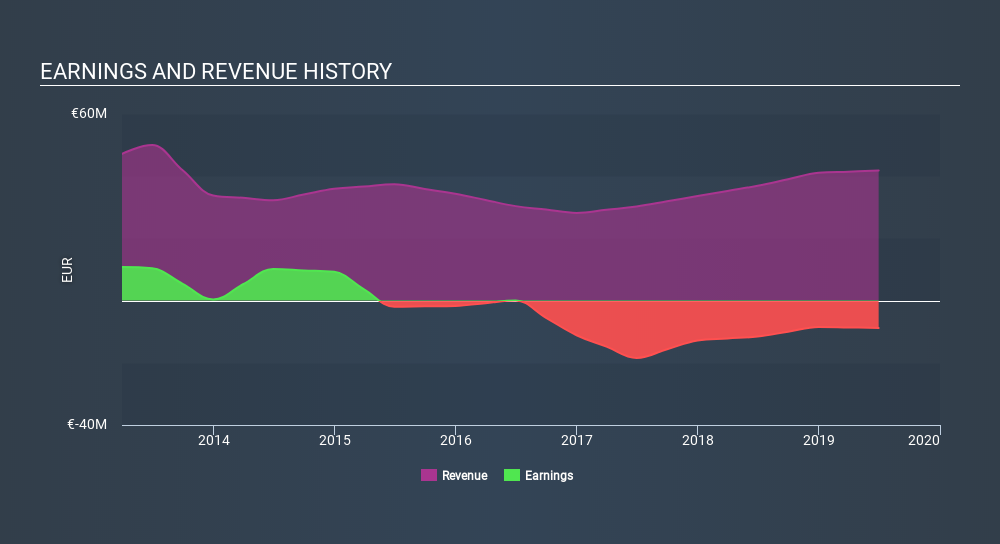

Les Hôtels de Paris wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years Les Hôtels de Paris has grown its revenue at 14% annually. That's a very respectable growth rate. The share price gain of 23% per year shows that the market is paying attention to this growth. Of course, valuation is quite sensitive to the rate of growth. Keep in mind that the strength of the balance sheet impacts the options open to the company.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Les Hôtels de Paris's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Les Hôtels de Paris shareholders have received a total shareholder return of 28% over one year. There's no doubt those recent returns are much better than the TSR loss of 1.0% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Les Hôtels de Paris better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with Les Hôtels de Paris (including 1 which is makes us a bit uncomfortable) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTPA:HDP

Low and slightly overvalued.

Market Insights

Community Narratives