Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Elior Group SA (EPA:ELIOR) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Elior Group

What Is Elior Group's Net Debt?

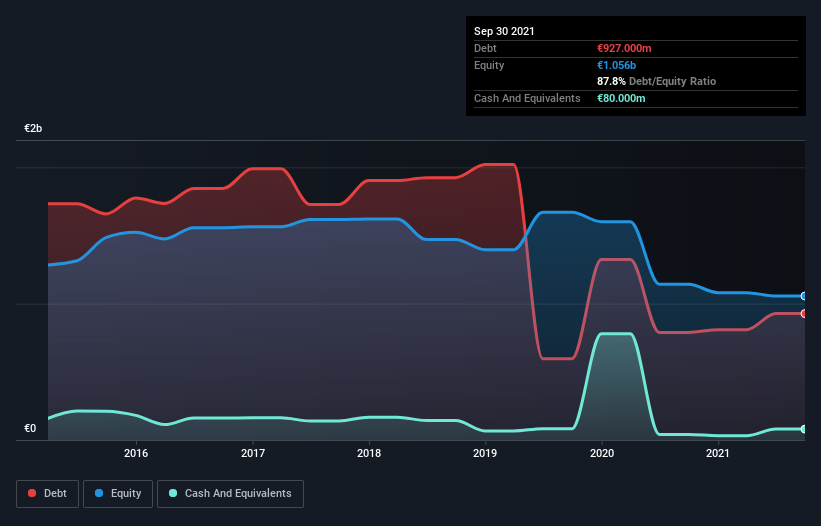

You can click the graphic below for the historical numbers, but it shows that as of September 2021 Elior Group had €927.0m of debt, an increase on €789.0m, over one year. However, it also had €80.0m in cash, and so its net debt is €847.0m.

How Healthy Is Elior Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Elior Group had liabilities of €1.26b due within 12 months and liabilities of €1.22b due beyond that. On the other hand, it had cash of €80.0m and €598.0m worth of receivables due within a year. So its liabilities total €1.80b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the €1.10b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Elior Group would likely require a major re-capitalisation if it had to pay its creditors today. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Elior Group's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Elior Group had a loss before interest and tax, and actually shrunk its revenue by 7.0%, to €3.7b. That's not what we would hope to see.

Caveat Emptor

Over the last twelve months Elior Group produced an earnings before interest and tax (EBIT) loss. To be specific the EBIT loss came in at €87m. When we look at that alongside the significant liabilities, we're not particularly confident about the company. It would need to improve its operations quickly for us to be interested in it. Not least because it had negative free cash flow of €34m over the last twelve months. That means it's on the risky side of things. For riskier companies like Elior Group I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Elior Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ELIOR

Elior Group

Offers contract catering and support services in France and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives