- France

- /

- Hospitality

- /

- ENXTPA:CDA

Shareholders Will Probably Not Have Any Issues With Compagnie des Alpes SA's (EPA:CDA) CEO Compensation

Key Insights

- Compagnie des Alpes will host its Annual General Meeting on 14th of March

- CEO Dominique Thillaud's total compensation includes salary of €400.0k

- Total compensation is 52% below industry average

- Over the past three years, Compagnie des Alpes' EPS grew by 105% and over the past three years, the total loss to shareholders 11%

The performance at Compagnie des Alpes SA (EPA:CDA) has been rather lacklustre of late and shareholders may be wondering what CEO Dominique Thillaud is planning to do about this. At the next AGM coming up on 14th of March, they can influence managerial decision making through voting on resolutions, including executive remuneration. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We think CEO compensation looks appropriate given the data we have put together.

View our latest analysis for Compagnie des Alpes

Comparing Compagnie des Alpes SA's CEO Compensation With The Industry

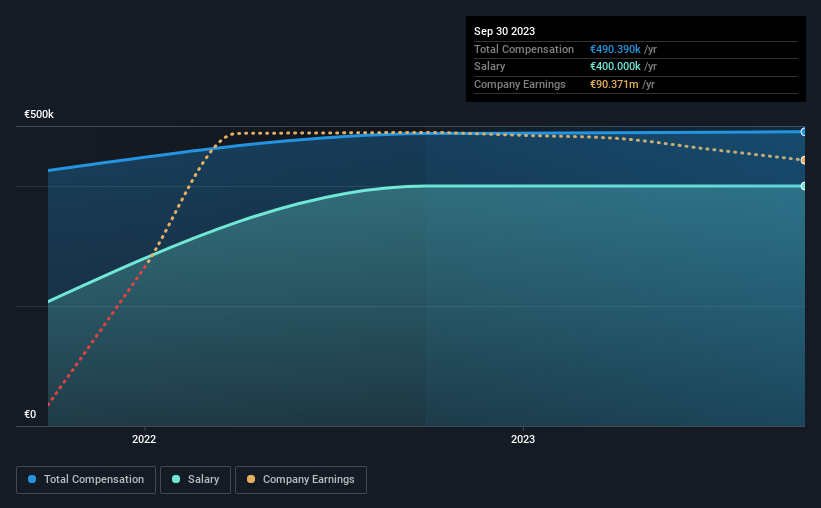

According to our data, Compagnie des Alpes SA has a market capitalization of €668m, and paid its CEO total annual compensation worth €490k over the year to September 2023. This means that the compensation hasn't changed much from last year. We note that the salary portion, which stands at €400.0k constitutes the majority of total compensation received by the CEO.

On comparing similar companies from the French Hospitality industry with market caps ranging from €365m to €1.5b, we found that the median CEO total compensation was €1.0m. That is to say, Dominique Thillaud is paid under the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €400k | €400k | 82% |

| Other | €90k | €87k | 18% |

| Total Compensation | €490k | €487k | 100% |

On an industry level, around 46% of total compensation represents salary and 54% is other remuneration. Compagnie des Alpes is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Compagnie des Alpes SA's Growth Numbers

Compagnie des Alpes SA's earnings per share (EPS) grew 105% per year over the last three years. It achieved revenue growth of 17% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Compagnie des Alpes SA Been A Good Investment?

With a three year total loss of 11% for the shareholders, Compagnie des Alpes SA would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Despite the strong EPS growth recently, the share price has not performed to expectations and it suggests that other factors might be driving it, apart from fundamentals. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board and assess if the board's plan is likely to improve company performance.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 3 warning signs for Compagnie des Alpes that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:CDA

Compagnie des Alpes

Engages in the operation of leisure facilities in France and internationally.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives