- France

- /

- Hospitality

- /

- ENXTPA:BAIN

Why Investors Shouldn't Be Surprised By Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco's (EPA:BAIN) P/S

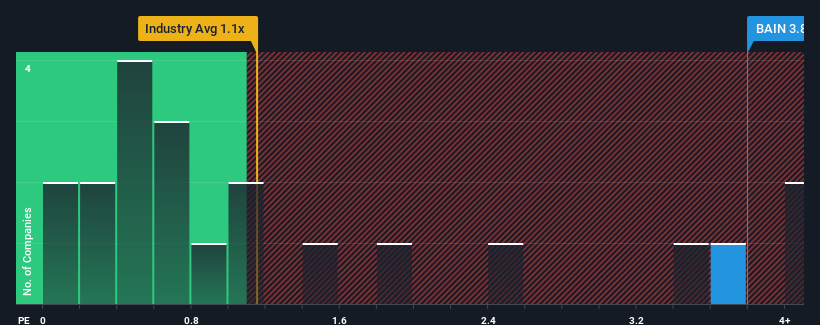

When you see that almost half of the companies in the Hospitality industry in France have price-to-sales ratios (or "P/S") below 1x, Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco (EPA:BAIN) looks to be giving off strong sell signals with its 3.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco

What Does Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco's P/S Mean For Shareholders?

The recent revenue growth at Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco would have to be considered satisfactory if not spectacular. It might be that many expect the reasonable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 5.5%. This was backed up an excellent period prior to see revenue up by 109% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that to the industry, which is only predicted to deliver 5.9% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we can see why Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco you should know about.

If these risks are making you reconsider your opinion on Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:BAIN

Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco

Operates in the gaming, hotels, and rental sectors in Monaco.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.