- France

- /

- Hospitality

- /

- ENXTPA:BAIN

Investors Can Find Comfort In Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco's (EPA:BAIN) Earnings Quality

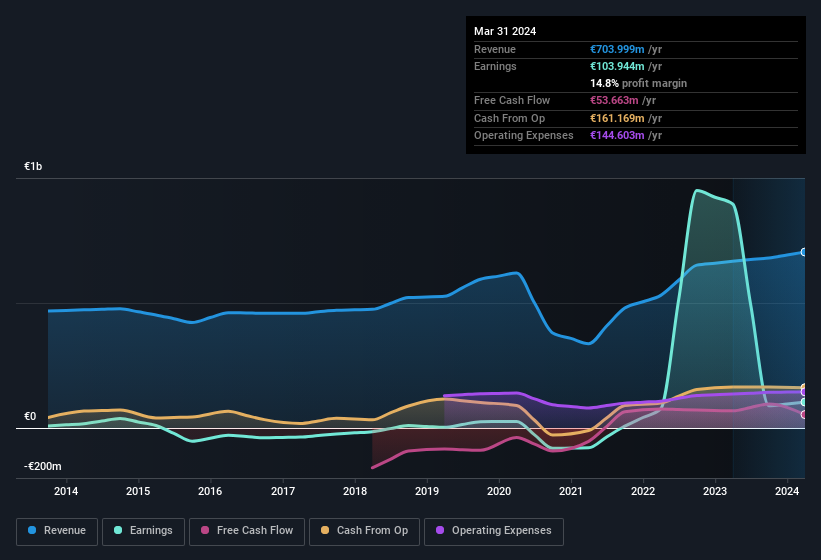

The subdued market reaction suggests that Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco's (EPA:BAIN) recent earnings didn't contain any surprises. Our analysis suggests that along with soft profit numbers, investors should be aware of some other underlying weaknesses in the numbers.

See our latest analysis for Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco

Our Take On Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco's Profit Performance

Because of this, we think that it may be that Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco's statutory profits are better than its underlying earnings power. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. Every company has risks, and we've spotted 1 warning sign for Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco you should know about.

Our examination of Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BAIN

Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco

Operates in the gaming, hotels, and rental sectors in Monaco.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.