- France

- /

- Hospitality

- /

- ENXTPA:ALVDM

Voyageurs du Monde (ENXTPA:ALVDM) Profit Margins Edge Higher, Challenging Growth Concerns

Reviewed by Simply Wall St

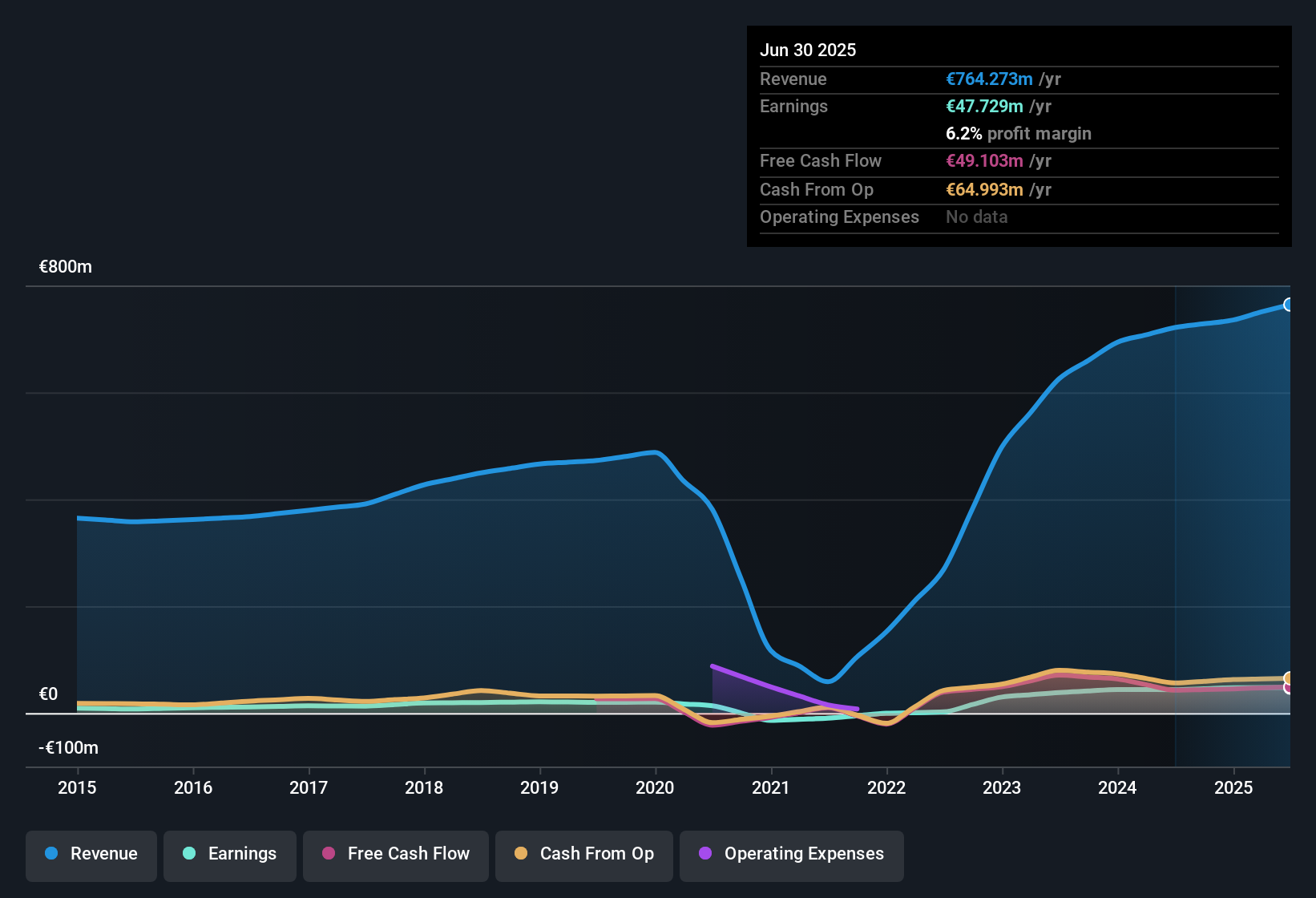

Voyageurs du Monde (ENXTPA:ALVDM) posted annual earnings growth of 9.3%, a pace notably below its five-year average of 53% per year. Net profit margins inched up to 6.2% from 6.1% a year ago, and revenue is now forecast to grow at 4% per year, trailing the French market’s 5.4% average. With earnings expected to expand at 5.3% per year compared to the broader market’s 12.2%, and the stock trading at a 15.9x P/E, investors are watching closely to see if attractive valuation and high-quality earnings can offset a moderate growth outlook.

See our full analysis for Voyageurs du Monde.The next step is to see how these earnings results hold up against the main narratives circulating in the market. Let’s compare the stories investors are telling with the latest numbers on the table.

Curious how numbers become stories that shape markets? Explore Community Narratives

Premium Valuation Versus Peers

- At a Price-To-Earnings ratio of 15.9x, Voyageurs du Monde trades below both its peer group average of 39.3x and the European hospitality industry’s 17.3x. This gives it a relative value discount that stands out in a sector often priced for growth.

- Prevailing market view points to Voyageurs du Monde’s high-quality earnings profile as a key support for valuation. However, the moderate growth forecast of 5.3% per year versus the sector’s 12.2% raises a question:

- While the current share price of €169.50 looks attractive on a comparative basis, the company’s slower revenue and earnings expansion means its valuation upside may depend more on profit durability rather than growth re-acceleration.

- The market’s balanced approach reflects confidence in established profitability, but also a watchful caution about whether these fundamentals can outshine faster-growing alternatives if sector sentiment shifts.

See how the current valuation lines up against analyst narratives and real sector multiples. 📊 Read the full Voyageurs du Monde Consensus Narrative.

Margins Hold Steady Amid Slowdown

- Net profit margins nudged up to 6.2% from 6.1% last year, holding firm even as top-line growth projections cool to 4% per year. This is below the French market’s 5.4% average.

- The prevailing market view emphasizes Voyageurs du Monde’s margin stability as a sign of operational discipline. Yet there is tension, as slower top-line growth underscores the importance of sustaining cost control:

- Investors looking for upside are watching whether this stable profitability can continue as broader sector dynamics become more competitive.

- Margins that show only modest improvement reinforce cautious optimism but also highlight the need for incremental efficiency gains to keep sentiment positive.

Dividend Sustainability in Focus

- The only prominent risk flagged in disclosures is around future dividend sustainability. No new dilution concerns have emerged over the past year, which helps shareholder confidence.

- According to the prevailing market view, the modest payout outlook weighs on bulls’ hopes for total returns:

- With slowing growth and only marginal improvements in profitability, investors may demand clearer evidence that dividends will remain stable or improve even as headwinds persist.

- Absence of fresh dilution signals is positive, but market confidence hinges on ongoing cash flow to support shareholder distributions in future years.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Voyageurs du Monde's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Voyageurs du Monde’s slower growth outlook and concerns about dividend sustainability could limit total returns compared to peers with stronger fundamentals.

If dependable payout streams matter to you, use these 1989 dividend stocks with yields > 3% to target companies offering robust, reliable yields that help offset growth uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALVDM

Voyageurs du Monde

Operates as a travel agency in France and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives