- France

- /

- Hospitality

- /

- ENXTPA:ALVDM

Shareholders Are Thrilled That The Voyageurs du Monde (EPA:ALVDM) Share Price Increased 129%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you can make far more than 100% on a really good stock. One great example is Voyageurs du Monde SA (EPA:ALVDM) which saw its share price drive 129% higher over five years. It's also up 20% in about a month.

Check out our latest analysis for Voyageurs du Monde

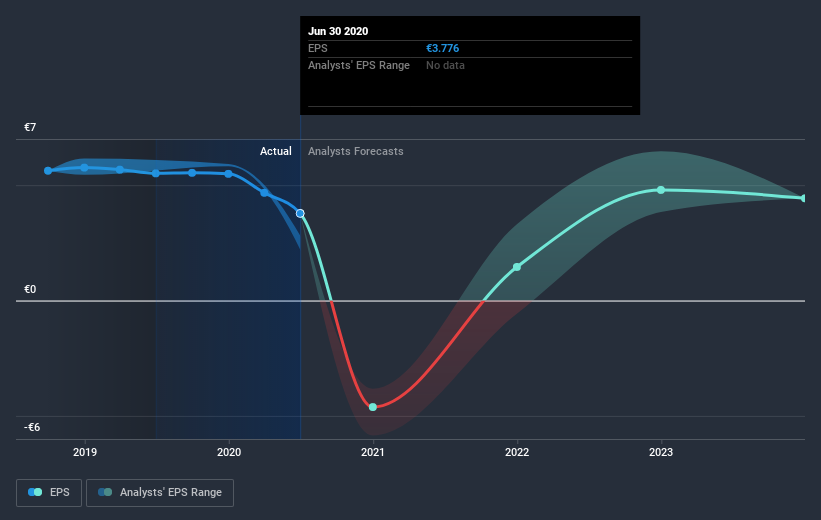

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Voyageurs du Monde moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Voyageurs du Monde's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Voyageurs du Monde's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Voyageurs du Monde's TSR of 146% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

Voyageurs du Monde shareholders are up 13% for the year. But that return falls short of the market. If we look back over five years, the returns are even better, coming in at 20% per year for five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. Before deciding if you like the current share price, check how Voyageurs du Monde scores on these 3 valuation metrics.

Of course Voyageurs du Monde may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you decide to trade Voyageurs du Monde, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ALVDM

Voyageurs du Monde

Operates as a travel agency in France and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives