Exploring 3 Undiscovered European Gems with Promising Potential

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index climbs 2.11% on strong corporate earnings and hopes for a resolution to the Ukraine-Russia conflict, investors are increasingly turning their attention to smaller, less-known companies that may offer unique growth opportunities amid these dynamic market conditions. In this landscape, identifying stocks with solid fundamentals and promising potential can be particularly rewarding, making it essential to explore undiscovered European gems that stand out in today's economic environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Flügger group | 30.11% | 1.55% | -30.01% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Dekpol | 63.20% | 11.99% | 14.08% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Voyageurs du Monde (ENXTPA:ALVDM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Voyageurs du Monde SA is a travel agency that operates both in France and internationally, with a market capitalization of €768.34 million.

Operations: The company generates revenue primarily from Tailor-Made Trips (€414.62 million) and Adventure Tours (€205.99 million), with additional contributions from Bike tours (€113.78 million) and Miscellaneous services (€0.88 million).

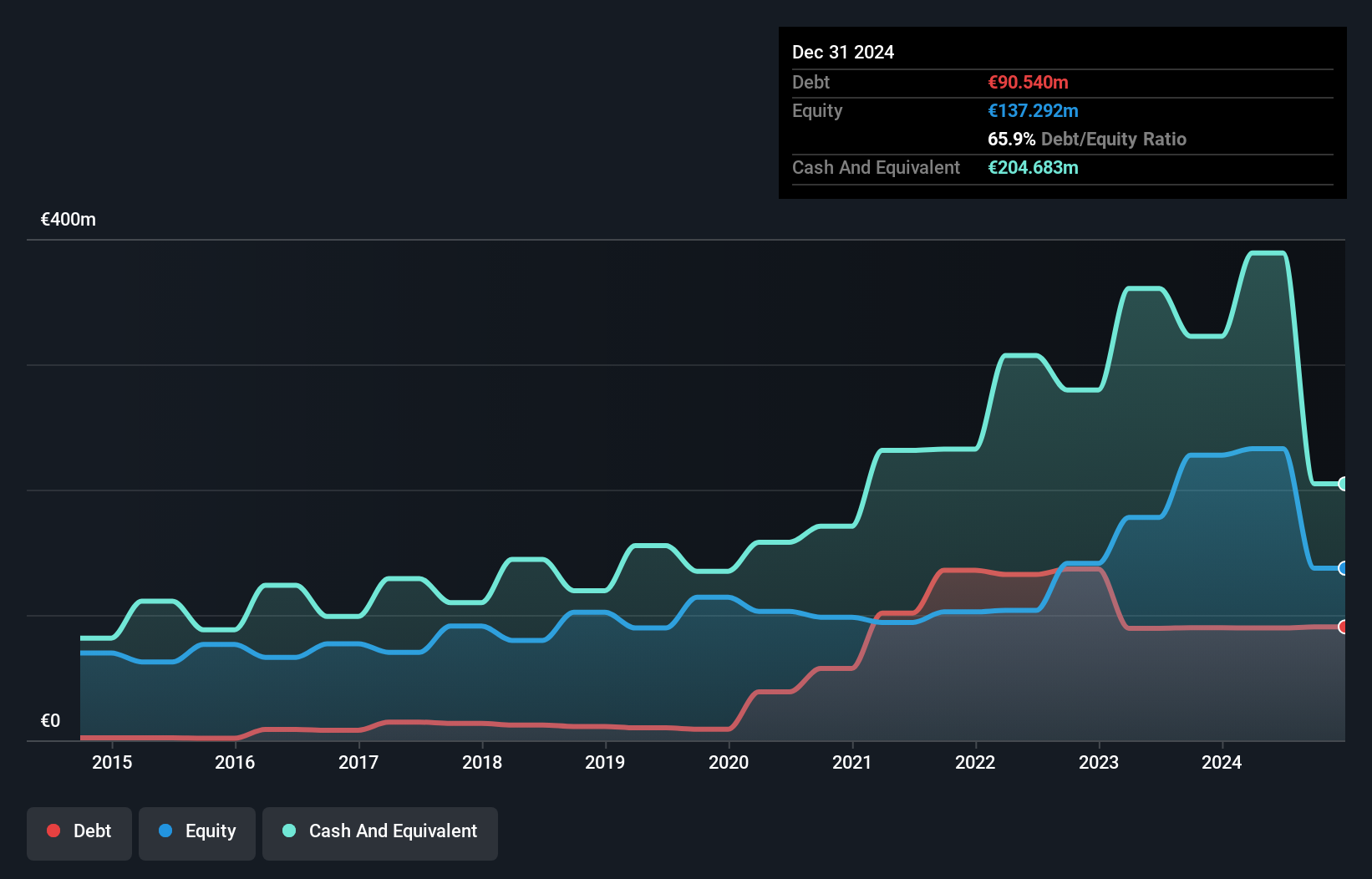

Voyageurs du Monde, a niche player in the travel industry, has shown resilience with a 7.6% earnings growth over the past year, surpassing the hospitality industry's 1.9%. The company trades at 26.5% below its estimated fair value and maintains high-quality earnings despite an increased debt-to-equity ratio from 7.7% to 65.9% over five years. Although shareholders faced substantial dilution recently, Voyageurs du Monde's interest payments are well-covered by EBIT at a multiple of 23.9x, indicating strong financial health amidst its strategic moves like early conversion of convertible bonds completed in May 2025.

- Click here to discover the nuances of Voyageurs du Monde with our detailed analytical health report.

Neurones (ENXTPA:NRO)

Simply Wall St Value Rating: ★★★★★☆

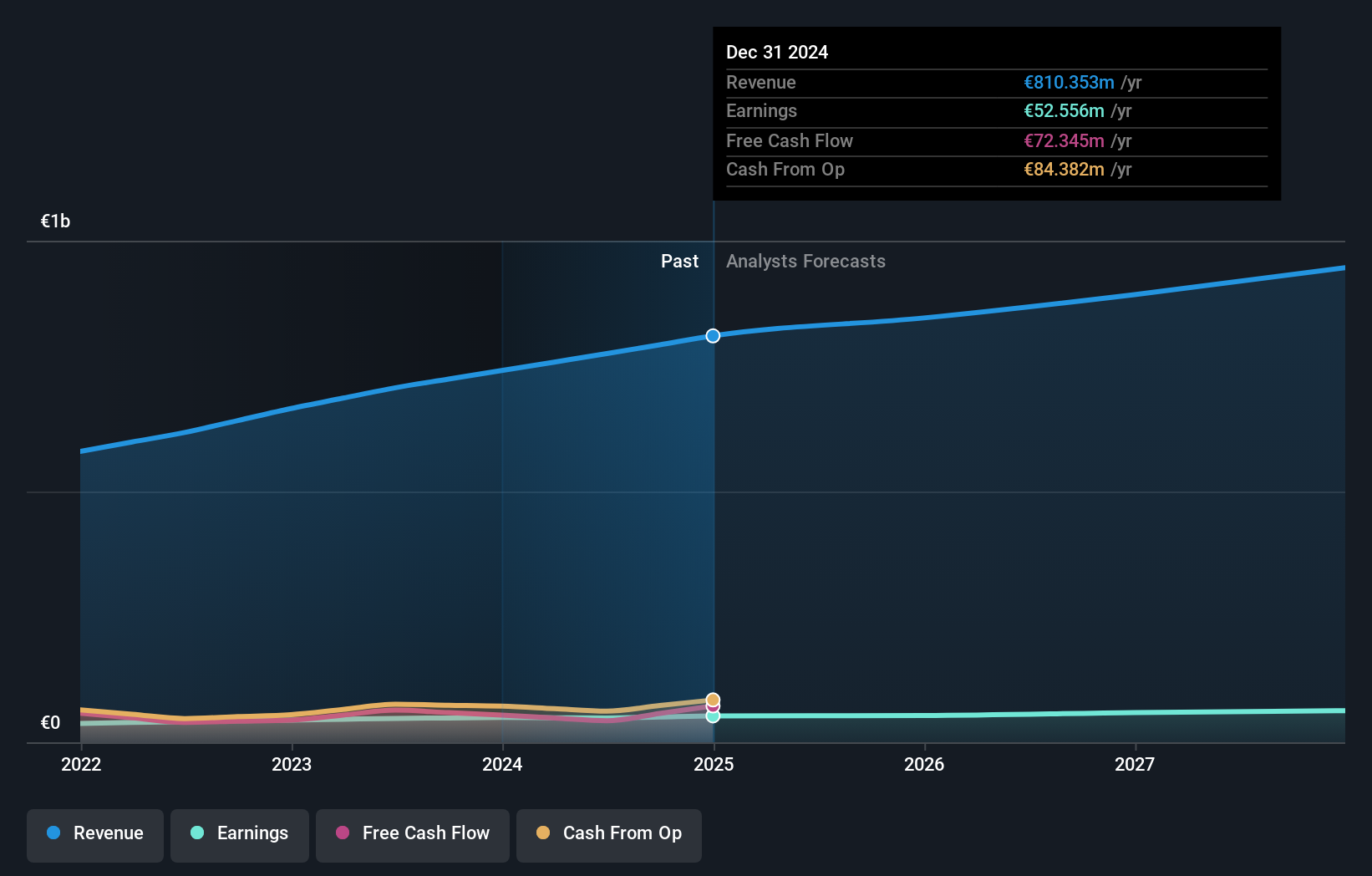

Overview: Neurones S.A. is an IT services company offering infrastructure, application, and consulting services both in France and internationally, with a market cap of €1.04 billion.

Operations: Neurones generates revenue primarily through its infrastructure services (€499.74 million), application services (€257.51 million), and council segment (€53.10 million).

Neurones, a nimble player in the IT sector, has been making waves with its impressive financial performance. The company has been trading at 28.7% below its estimated fair value, highlighting potential undervaluation. Over the past year, earnings growth of 6.4% outpaced the IT industry average of -1.1%, showcasing resilience and strong operational execution. Neurones' debt to equity ratio rose from 0.05% to 1.6% over five years, yet it maintains more cash than total debt, ensuring financial stability. Recent announcements reveal an optimistic revenue forecast for 2025 at €850 million and operating profit adjustments to around 8%.

- Click here and access our complete health analysis report to understand the dynamics of Neurones.

Gain insights into Neurones' past trends and performance with our Past report.

Savencia (ENXTPA:SAVE)

Simply Wall St Value Rating: ★★★★★★

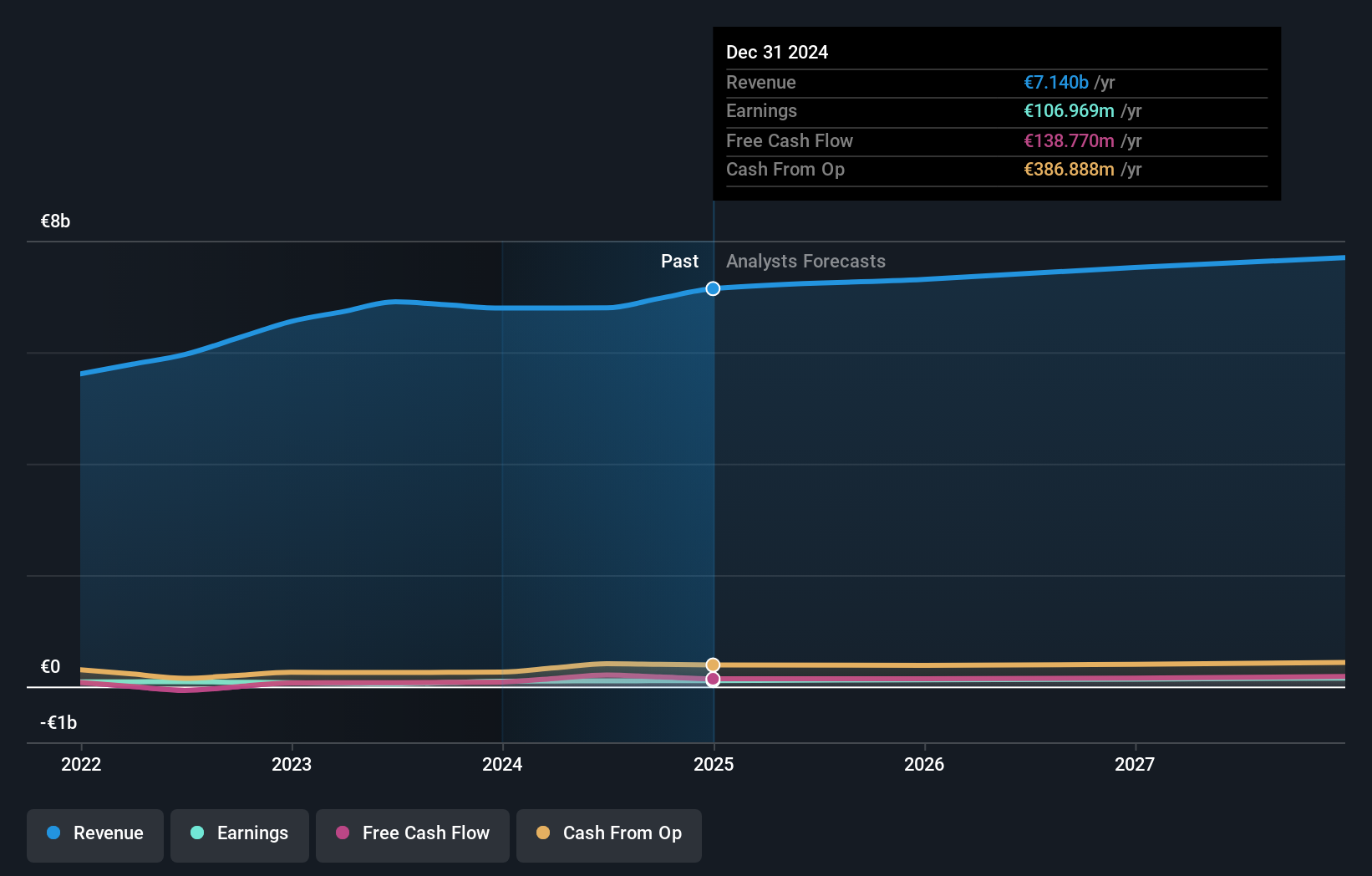

Overview: Savencia SA is a company that produces, distributes, and markets dairy and cheese products in France, the rest of Europe, and internationally with a market capitalization of approximately €828.62 million.

Operations: Savencia's primary revenue streams are derived from Cheese Products and Other Dairy Products, generating approximately €4.06 billion and €3.33 billion, respectively. The company's financial performance is influenced by its net profit margin, which reflects the efficiency of its operations and cost management strategies.

Savencia, a European food company, has shown notable performance with earnings growing by 10.9% over the past year, surpassing the food industry's average of 2.8%. The company's net debt to equity ratio stands at a satisfactory 19.3%, reflecting prudent financial management. Savencia's interest payments are well covered by EBIT at 4.5 times coverage, indicating strong operational efficiency. Over five years, its debt to equity ratio improved from 76.3% to 57.4%, showcasing effective debt reduction strategies. Trading at a significant discount of 78% below estimated fair value suggests potential for future appreciation in value for investors seeking opportunities in smaller markets.

- Navigate through the intricacies of Savencia with our comprehensive health report here.

Assess Savencia's past performance with our detailed historical performance reports.

Next Steps

- Click this link to deep-dive into the 317 companies within our European Undiscovered Gems With Strong Fundamentals screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neurones might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:NRO

Neurones

Provides infrastructure, application, and consulting services in France.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives