- France

- /

- Hospitality

- /

- ENXTPA:AC

Accor (ENXTPA:AC) Valuation: Is the Recent Dip Setting Up a New Opportunity?

Reviewed by Simply Wall St

If you have been watching Accor (ENXTPA:AC) lately, you might be wondering what’s driving the recent moves in its share price. While there hasn’t been one single headline-grabbing event to trigger the shift, the activity is definitely raising questions for anyone weighing the stock, from long-term holders to potential new buyers. Sometimes, the market’s quieter periods can reveal as much about sentiment as the noisier ones. There is no better time than now to check if Accor is quietly setting the stage for something bigger.

Taking a step back, Accor’s shares have delivered a solid 11% return over the past year. The bigger picture is even more impressive, with long-term investors seeing the stock rise over 80% in the past three years. Despite this, momentum has faded recently as the shares slipped about 9% over the past month and are down since the start of the year, following a streak of growth fueled by steady annual revenue and profit gains. In short, the market’s mood on Accor appears to be shifting, even as the company’s financials show resilience.

This brings us straight to the central question: has the recent dip uncovered a genuine buying window, or is the market already wagering that Accor’s future growth is fully accounted for in the price?

Most Popular Narrative: 21% Undervalued

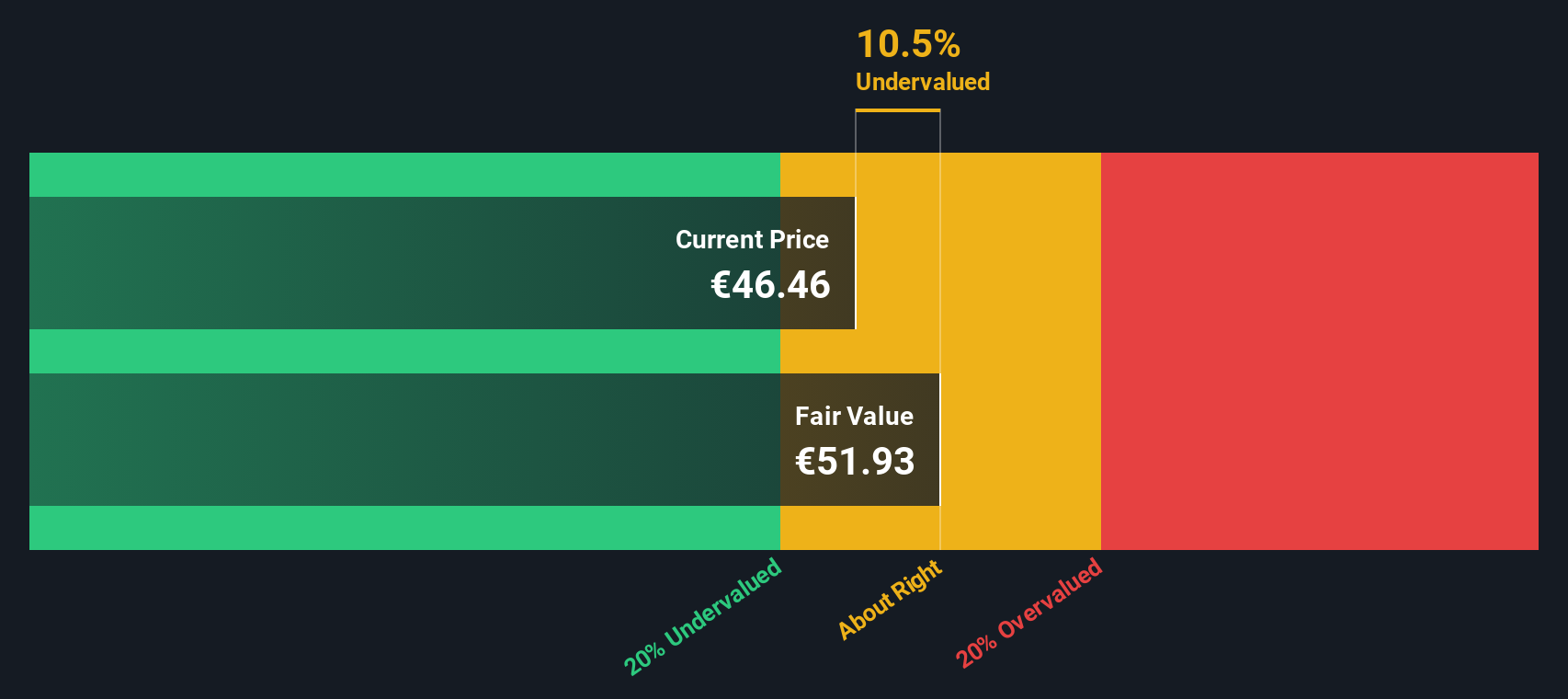

According to the most followed market narrative, Accor shares are currently undervalued by 21% using a discount rate of just over 9%. This view weighs the company’s growth potential and key sector trends against known risks to estimate a fair value far ahead of the current price.

Accor's rapidly expanding pipeline, driven by strong signings in the U.S. and Asia, as well as growth in Luxury & Lifestyle brands, positions the company to benefit from increased global travel demand, urbanization, and the growing global middle class. These factors are expected to support sustained revenue and net unit growth acceleration in coming years.

Curious how this bullish valuation stacks up? There is a thoroughly argued mix of aggressive growth drivers and bold profit margin forecasts under the surface. The analysts are betting on more than just steady growth. Want to know which underlying assumptions push this target sky-high? The details might surprise you.

Result: Fair Value of €52.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent foreign exchange swings or overreliance on Europe could quickly overturn these upbeat forecasts, so the outlook remains far from guaranteed.

Find out about the key risks to this Accor narrative.Another View: Discounted Cash Flow Model

While the analyst consensus points to a strong upside, our DCF model reaches a similar conclusion and suggests Accor’s shares are trading below what long-term cash flows may justify. Are both models being too optimistic, or is there further room to run?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Accor Narrative

If you have a different perspective or want to dig into the numbers yourself, you can shape your own narrative in just a few minutes. Do it your way

A great starting point for your Accor research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let great stocks pass you by. The Simply Wall Street Screener highlights high-potential ideas every investor should see. Unlock strong gains, reliable income, and the industries at the edge of tomorrow.

- Find hidden gems among undervalued companies rising on solid cash flow fundamentals when you jump into our undervalued stocks based on cash flows selection.

- Capture steady income with stocks offering yields over 3 percent by accessing our list of dividend stocks with yields > 3% today.

- Step ahead of the curve with picks in quantum computing. See which companies are powering the next leap forward by checking quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:AC

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives