- France

- /

- Food and Staples Retail

- /

- ENXTPA:CA

Why Investors Shouldn't Be Surprised By Carrefour SA's (EPA:CA) Low P/E

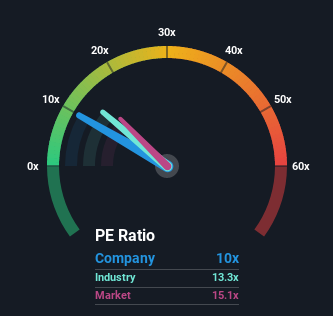

When close to half the companies in France have price-to-earnings ratios (or "P/E's") above 16x, you may consider Carrefour SA (EPA:CA) as an attractive investment with its 10x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Carrefour as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Carrefour

Is There Any Growth For Carrefour?

There's an inherent assumption that a company should underperform the market for P/E ratios like Carrefour's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 45% gain to the company's bottom line. The latest three year period has also seen an excellent 5,009% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the twelve analysts covering the company suggest earnings should grow by 4.7% per year over the next three years. Meanwhile, the rest of the market is forecast to expand by 11% each year, which is noticeably more attractive.

With this information, we can see why Carrefour is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Carrefour maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - Carrefour has 2 warning signs we think you should be aware of.

Of course, you might also be able to find a better stock than Carrefour. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:CA

Carrefour

Engages in the operation of stores that offer food and non-food products in various formats and channels in France, Spain, Italy, Belgium, Poland, Romania, Brazil, and Argentina, as well as in the Middle East, Africa, and Asia.

Established dividend payer and good value.