- France

- /

- Food and Staples Retail

- /

- ENXTPA:CA

If EPS Growth Is Important To You, Carrefour (EPA:CA) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Carrefour (EPA:CA), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Carrefour with the means to add long-term value to shareholders.

See our latest analysis for Carrefour

Carrefour's Improving Profits

In the last three years Carrefour's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Carrefour's EPS skyrocketed from €1.27 to €1.87, in just one year; a result that's bound to bring a smile to shareholders. That's a commendable gain of 47%.

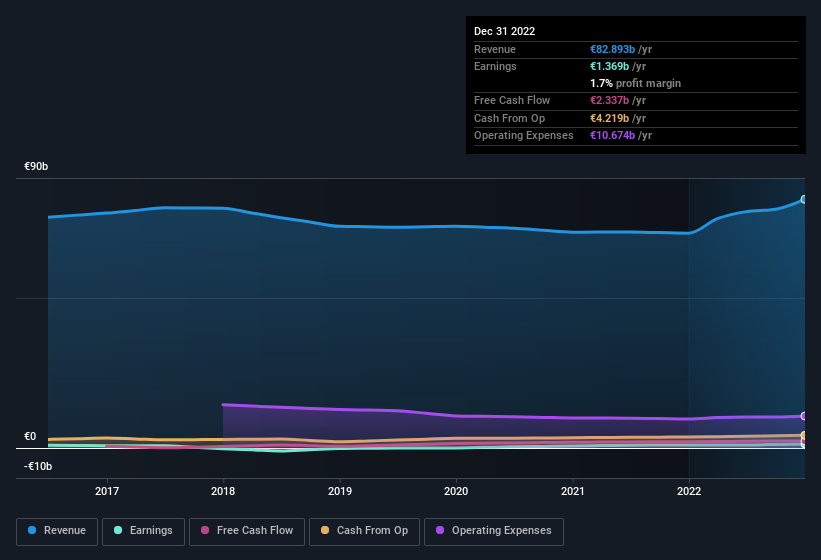

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Carrefour's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. While we note Carrefour achieved similar EBIT margins to last year, revenue grew by a solid 16% to €83b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Carrefour's future profits.

Are Carrefour Insiders Aligned With All Shareholders?

Owing to the size of Carrefour, we wouldn't expect insiders to hold a significant proportion of the company. But we do take comfort from the fact that they are investors in the company. As a matter of fact, their holding is valued at €13m. That's a lot of money, and no small incentive to work hard. Despite being just 0.1% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is Carrefour Worth Keeping An Eye On?

You can't deny that Carrefour has grown its earnings per share at a very impressive rate. That's attractive. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Carrefour that you should be aware of.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:CA

Carrefour

Engages in the operation of stores that offer food and non-food products in various formats and channels in France, Spain, Italy, Belgium, Poland, Romania, Brazil, and Argentina, as well as in the Middle East, Africa, and Asia.

Established dividend payer and good value.