- France

- /

- Food and Staples Retail

- /

- ENXTPA:CA

Carrefour (ENXTPA:CA) Valuation: Is There More Upside After Recent Momentum?

Reviewed by Simply Wall St

Shares of Carrefour (ENXTPA:CA) edged up today, attracting interest after a steady performance over the past month. Investors are taking note of Carrefour’s recent momentum as well as the broader retail environment in Europe.

See our latest analysis for Carrefour.

Carrefour’s 7-day share price return of nearly 3% stands out against its softer performance earlier in the year. Recent momentum suggests renewed investor optimism. While the 1-year total shareholder return remains slightly negative, the stock’s longer-term results indicate it still has potential for patient investors.

If Carrefour’s resilience caught your attention, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares currently trading below analyst targets and modest long-term gains, the key question emerges: Is Carrefour undervalued with room to grow, or is the current price already reflecting expectations for future growth?

Most Popular Narrative: 5.4% Undervalued

Compared to Carrefour’s latest closing price, the most widely followed narrative sets a fair value slightly above market, presenting a measured upside for investors who believe in the growth story underpinning this valuation.

Carrefour's strategic review of its portfolio, including its operational models and real estate assets, aims to optimize resource allocation and focus on high-potential areas. This could lead to more efficient capital deployment and potentially enhance earnings in the future.

Curious what numbers power this optimistic outlook? One key factor is a dramatic swing in profitability projected ahead, with future growth multiples rarely seen in traditional retail. There is also an ambitious transformation plan that is set to shake up margins and market share. Ready to uncover the specifics?

Result: Fair Value of €13.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could quickly change if weakening consumption in France or ongoing currency headwinds in Brazil and Argentina continue to affect Carrefour’s performance.

Find out about the key risks to this Carrefour narrative.

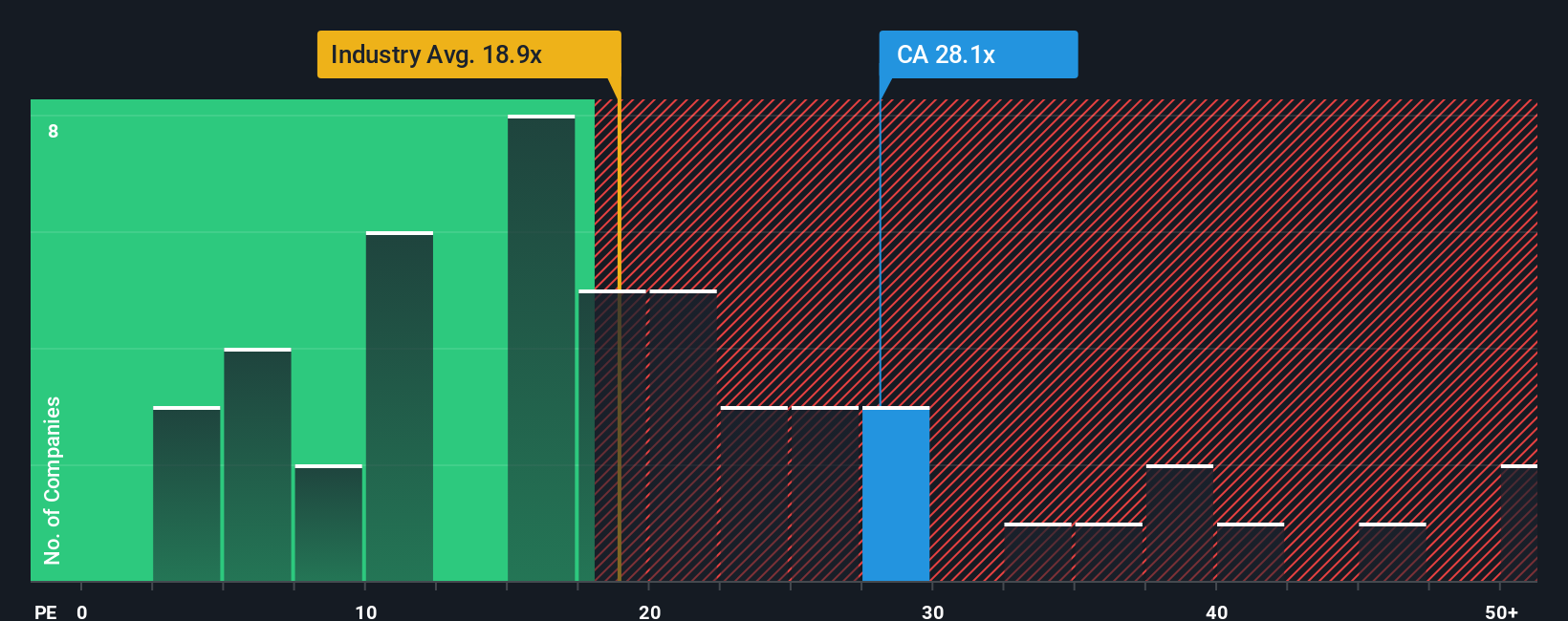

Another View: Gauging Value Through Market Multiples

While our fair value estimate points to Carrefour being undervalued, a closer look at its market multiple presents a more cautious picture. The company's price-to-earnings ratio stands at 28.6x, which is considerably higher than the European retail industry average of 18.2x, but lower than the peer group average of 32x. This means the stock appears expensive compared to much of the market, which could limit upside if sentiment shifts. Does this premium reflect real growth potential, or is the market already pricing in a best-case scenario?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Carrefour Narrative

If you have a different take on Carrefour’s outlook or enjoy digging into the numbers yourself, you can quickly build your own perspective in just a few minutes. Do it your way

A great starting point for your Carrefour research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing is all about spotting opportunities before the crowd. Don’t let the next big winner slip by. These unique stock lists put tomorrow’s standouts within reach.

- Tap into tomorrow’s market leaders by checking out these 931 undervalued stocks based on cash flows, which spotlights stocks that may be poised for growth and are currently priced below their estimated value.

- Capture steady income and long-term stability through these 15 dividend stocks with yields > 3%, featuring companies with attractive yields over 3 percent.

- Ride the technology wave by targeting these 25 AI penny stocks, where artificial intelligence is playing a growing role for forward-thinking investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CA

Carrefour

Operates as a food retailer in France, Spain, Italy, Belgium, Poland, Romania, Brazil, Argentina, the Middle East, Africa, and Asia.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success