- France

- /

- Consumer Durables

- /

- ENXTPA:SK

Introducing SEB (EPA:SK), The Stock That Zoomed 142% In The Last Five Years

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. For example, the SEB SA (EPA:SK) share price has soared 142% in the last half decade. Most would be very happy with that. Meanwhile the share price is 1.9% higher than it was a week ago.

View our latest analysis for SEB

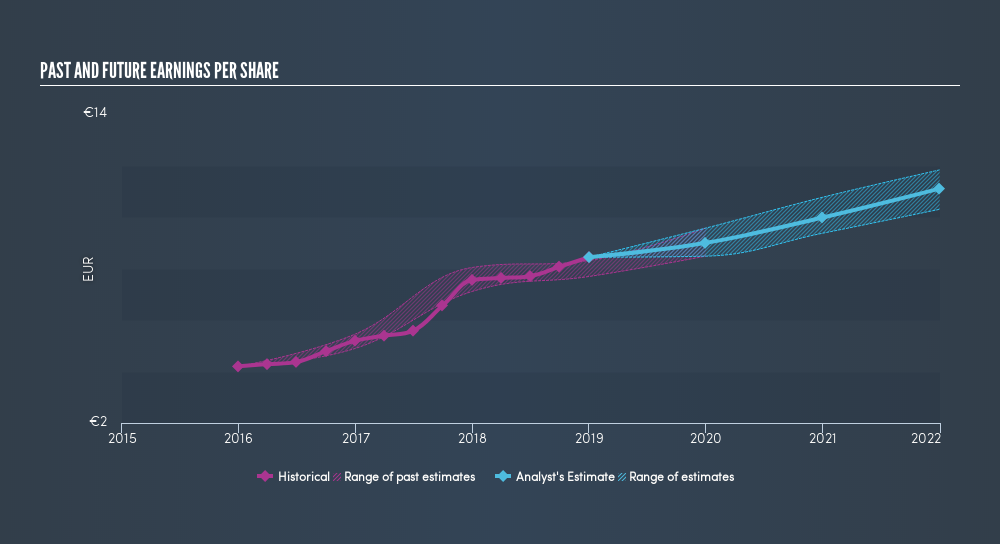

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, SEB achieved compound earnings per share (EPS) growth of 15% per year. This EPS growth is lower than the 19% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

We know that SEB has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of SEB, it has a TSR of 160% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

SEB's TSR for the year was broadly in line with the market average, at 7.2%. We should note here that the five-year TSR is more impressive, at 21% per year. Although the share price growth has slowed, the longer term story points to a business well worth watching. Is SEB cheap compared to other companies? These 3 valuation measures might help you decide.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:SK

SEB

Designs, manufactures, and markets small domestic equipment in Western Europe, rest of Europe, the Middle East, Africa, North and South America, China, and rest of Asia.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives