How Hermès’ Sustained Revenue Growth in Q3 (ENXTPA:RMS) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Hermès International Société en commandite par actions recently reported that third quarter 2025 consolidated revenue reached €3.88 billion, up from €3.70 billion the previous year, with year-to-date revenue rising to €11.92 billion compared to €11.21 billion last year.

- This ongoing revenue growth signals continued resilience and demand for Hermès’ products in the global luxury market.

- Let's consider how Hermès’ solid third quarter revenue performance could shape its long-term investment narrative and future prospects.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Hermès International Société en commandite par actions Investment Narrative Recap

To be a shareholder in Hermès International, you need to believe in the enduring power of its globally recognized brand, robust pricing power, and disciplined supply strategy in the ultra-luxury segment. The recent uptick in third quarter revenue reinforces the most important short-term catalyst, resilient global demand for luxury goods, even as questions around consumer sentiment in China and margin pressure linger. Based on these results, the impact on the primary risks appears limited for now.

The July 2025 announcement, highlighting strong sales growth but a dip in net income for the half year, is especially relevant here. Despite ongoing revenue gains, investors saw net profit margins shrink in the first half, a reminder that higher raw material and operating costs could offset top-line momentum and test the business’s ability to sustain record earnings growth.

Yet, despite solid revenue trends, rising cost pressures present a challenge that every investor should be aware of, especially if...

Read the full narrative on Hermès International Société en commandite par actions (it's free!)

Hermès International Société en commandite par actions is projected to reach €20.3 billion in revenue and €6.3 billion in earnings by 2028. This outlook is based on annual revenue growth of 9.0% and an increase in earnings of €1.8 billion from the current level of €4.5 billion.

Uncover how Hermès International Société en commandite par actions' forecasts yield a €2398 fair value, a 10% upside to its current price.

Exploring Other Perspectives

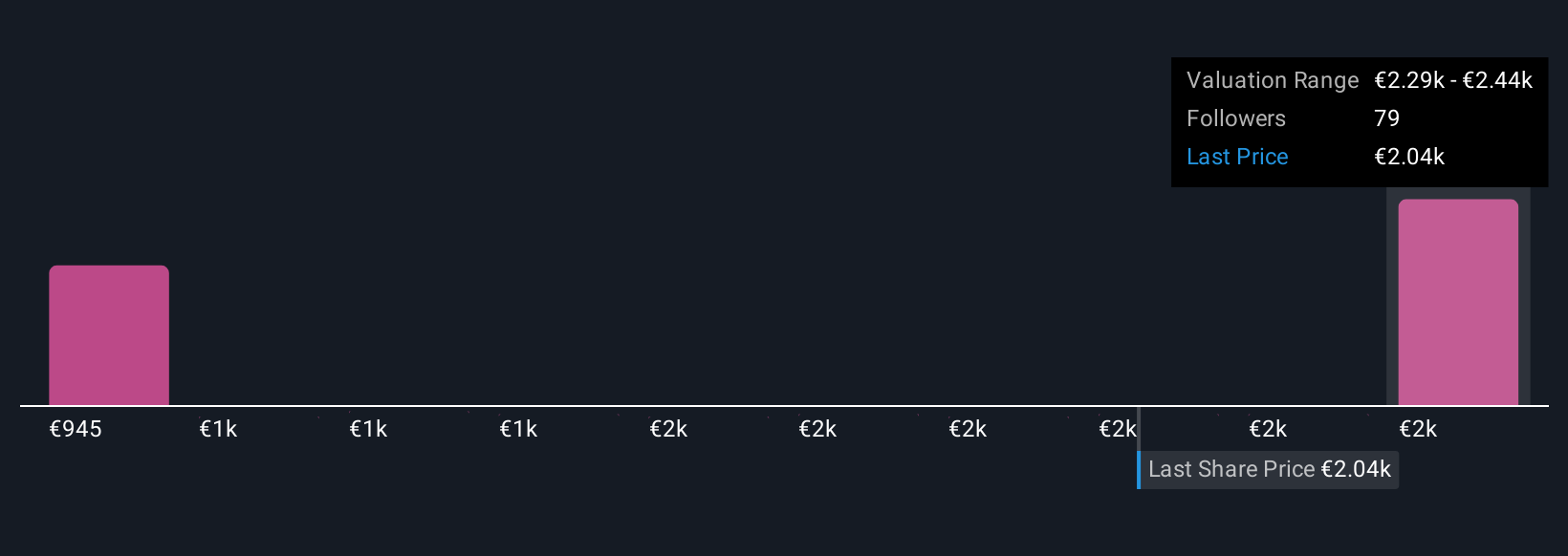

Simply Wall St Community members provided nine individual fair value estimates for Hermès International, ranging widely from €938 to €2,436 per share. This broad spread comes as some market participants focus on the company’s ability to maintain industry-leading margins amid rising cost pressures, inviting you to compare several distinct viewpoints about Hermès’ future.

Explore 9 other fair value estimates on Hermès International Société en commandite par actions - why the stock might be worth as much as 12% more than the current price!

Build Your Own Hermès International Société en commandite par actions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hermès International Société en commandite par actions research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Hermès International Société en commandite par actions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hermès International Société en commandite par actions' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hermès International Société en commandite par actions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:RMS

Hermès International Société en commandite par actions

Engages in the production, wholesale, and retail of various goods.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion