Does Cooling Birkin Premiums And New Handbag Funds Subtly Recast Hermès' (ENXTPA:RMS) Luxury Moat?

Reviewed by Sasha Jovanovic

- Recent reports show that resale premiums for Hermès Birkin and Kelly bags have cooled from very large multiples of original prices to lower levels, even as luxury asset manager LUXUS, backed by Christie’s, launches new handbag investment funds focused on these models.

- This mix of softer secondary-market pricing and financialization of Hermès icons highlights how the brand now sits at the intersection of consumer demand, collectibles culture, and alternative investments.

- We’ll now examine how the cooling Birkin resale premiums and emerging handbag funds could influence Hermès’ long-term investment narrative.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Hermès International Société en commandite par actions Investment Narrative Recap

To own Hermès, you really have to believe that its tightly controlled scarcity, brand heritage, and pricing power can keep attracting true luxury clients even as the broader sector cools. The recent pullback in Birkin and Kelly resale premiums looks more like a sentiment check than a direct hit to near term results, while the biggest current risk still sits with softer demand from aspirational and China based customers rather than secondary market price moves.

Against this backdrop, Hermès’ half year 2025 results, with sales of €8,034 million and net income of €2,246 million, underline how the core business remains driven by primary demand rather than speculative resale activity. For investors watching Birkin funds and cooler premiums, these figures help anchor the investment story in underlying earnings power instead of headlines about handbags as financial assets.

Yet for all the talk of exclusivity, investors should be aware that growing luxury resale markets could still...

Read the full narrative on Hermès International Société en commandite par actions (it's free!)

Hermès International Société en commandite par actions' narrative projects €20.3 billion revenue and €6.3 billion earnings by 2028.

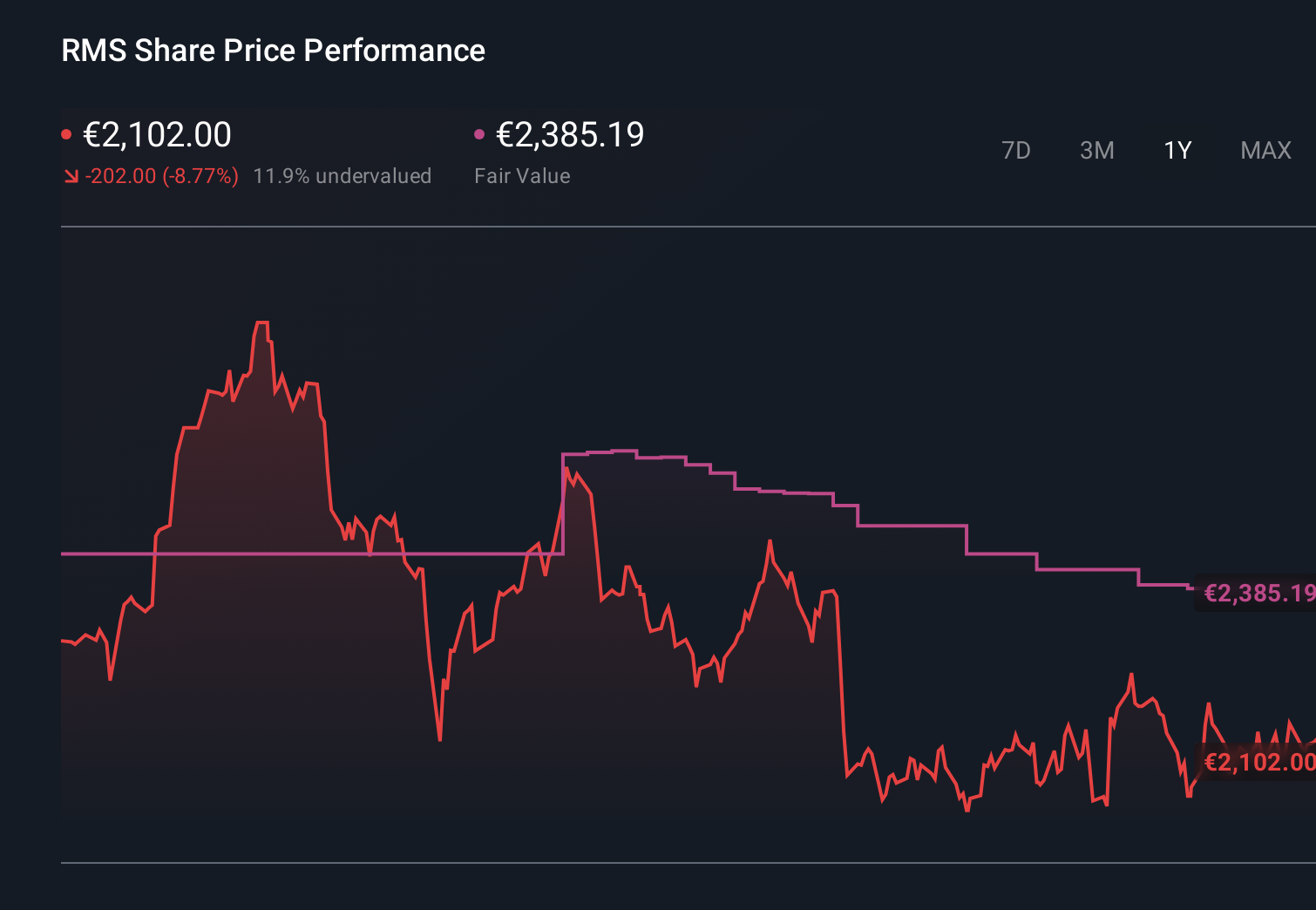

Uncover how Hermès International Société en commandite par actions' forecasts yield a €2385 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members see Hermès’ fair value anywhere between €873 and €2,436 across 11 separate models, highlighting a wide dispersion of views. Against this, questions around demand from first time and aspirational buyers in a softer luxury market could materially shape how the business performs over time, so it is worth exploring several of these perspectives in detail.

Explore 11 other fair value estimates on Hermès International Société en commandite par actions - why the stock might be worth less than half the current price!

Build Your Own Hermès International Société en commandite par actions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hermès International Société en commandite par actions research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Hermès International Société en commandite par actions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hermès International Société en commandite par actions' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hermès International Société en commandite par actions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:RMS

Hermès International Société en commandite par actions

Engages in the production, wholesale, and retail of various goods.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion