LVMH (ENXTPA:MC) Valuation Check as Bulgari Welcomes New CEO Laura Burdese

Reviewed by Simply Wall St

LVMH Moët Hennessy - Louis Vuitton Société Européenne (ENXTPA:MC) is back in focus after announcing that Laura Burdese will take over as Bulgari CEO in July, succeeding long serving leader Jean Christophe Babin.

See our latest analysis for LVMH Moët Hennessy - Louis Vuitton Société Européenne.

The leadership shuffle at Bulgari lands at an interesting moment for LVMH, with the share price at $631.7 and a strong 90 day share price return of 22.04 percent contrasting with a modest 1 year total shareholder return of 1.63 percent. This suggests near term momentum is picking up while longer term gains remain more measured.

If this kind of high end brand story has your attention, it could be a good time to see what else is moving in luxury and consumer names via fast growing stocks with high insider ownership

Yet with the shares now trading close to analyst targets and only modest gains over the past year, investors face a key question: is LVMH still undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 3.2% Overvalued

With LVMH shares closing at €631.7 against a most-followed fair value of €612.4, the narrative frames today’s price as slightly ahead of fundamentals.

Analysts expect earnings to reach €16.4 billion (and earnings per share of €30.93) by about September 2028, up from €11.0 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €11.1 billion.

Curious how steady growth assumptions, rising margins and a richer earnings multiple can still point to only a mild premium today? The full narrative explains the earnings climb, revenue trajectory and valuation bridge that underpin this fair value and the modest overvaluation signal.

Result: Fair Value of $612.4 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weakness in key Asian luxury demand, or a sharper squeeze on margins from inflation and FX, could quickly challenge that mildly overvalued narrative.

Another Angle On Value

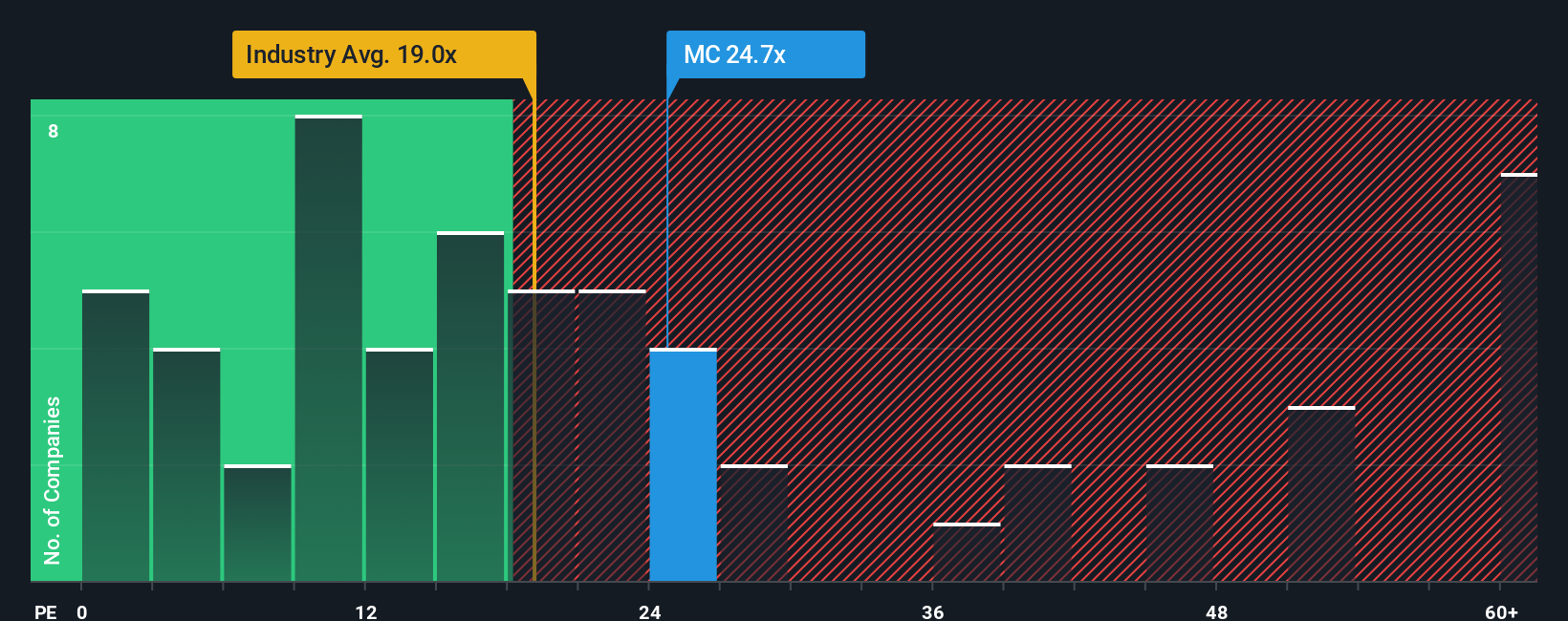

While the narrative points to only a slight 3.2 percent premium to fair value, today’s price tells a sharper story when you look at earnings. LVMH trades at 28.6 times earnings versus a 19.7 times average for European luxury, though still below a 31.1 times fair ratio and 38.2 times peer average. That gap hints at real valuation risk if sentiment turns, but also some protection if quality brands keep their premium.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LVMH Moët Hennessy - Louis Vuitton Société Européenne Narrative

If you see the story differently and want to dig into the numbers yourself, you can build a fresh view in just a few minutes: Do it your way

A great starting point for your LVMH Moët Hennessy - Louis Vuitton Société Européenne research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider scanning targeted stock ideas that match different strategies, so you never rely on one company’s story alone.

- Strengthen your core portfolio by targeting resilient businesses trading below intrinsic value with these 907 undervalued stocks based on cash flows that put cash flows front and center.

- Explore the next wave of innovation by focusing on smaller names using these 25 AI penny stocks that already pair AI momentum with early growth potential.

- Turn income into a strategic edge by zeroing in on companies offering reliable payouts via these 13 dividend stocks with yields > 3% that can support long term compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MC

LVMH Moët Hennessy - Louis Vuitton Société Européenne

Operates as a luxury goods company worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion