Evaluating LVMH Shares After an 18.7% Surge and Sustainability Initiative in 2025

Reviewed by Bailey Pemberton

If you’re sizing up what to do with LVMH Moët Hennessy - Louis Vuitton Société Européenne stock right now, you’re hardly alone. After a bumpy start to the year, shares have staged a surprising comeback, rising 18.7% over the past month alone and notching a 3.1% gain this past week. But has this upward swing unlocked more opportunity, or does it reflect a shift in how investors are evaluating risk and reward?

It’s hard to talk about a luxury house like LVMH without considering what’s fueling sentiment. Recently, the company’s ongoing focus on digital transformation and a high-profile sustainability initiative have kept LVMH in the headlines. Even if their impact on the bottom line will play out over the long term, these moves have reminded investors that LVMH is intent on shaping the future of luxury, not just maintaining its legacy.

Still, with a value score of 2, based on six standard valuation checks, the numbers tell us LVMH is undervalued in just two areas. That score suggests there’s some cause for optimism, but also reason for caution. So, let’s dive into this score by looking at the individual valuation checks commonly used by analysts and see what they can tell us. And, as you’ll discover, there might be a better way to cut through the noise than what standard metrics reveal.

LVMH Moët Hennessy - Louis Vuitton Société Européenne scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: LVMH Moët Hennessy Louis Vuitton Société Européenne Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future free cash flows and discounting them back to present value. For LVMH, the DCF approach involves looking at expected Free Cash Flow (FCF) in the coming years and working backwards to see how much those future earnings are worth right now, adjusted for risk and time.

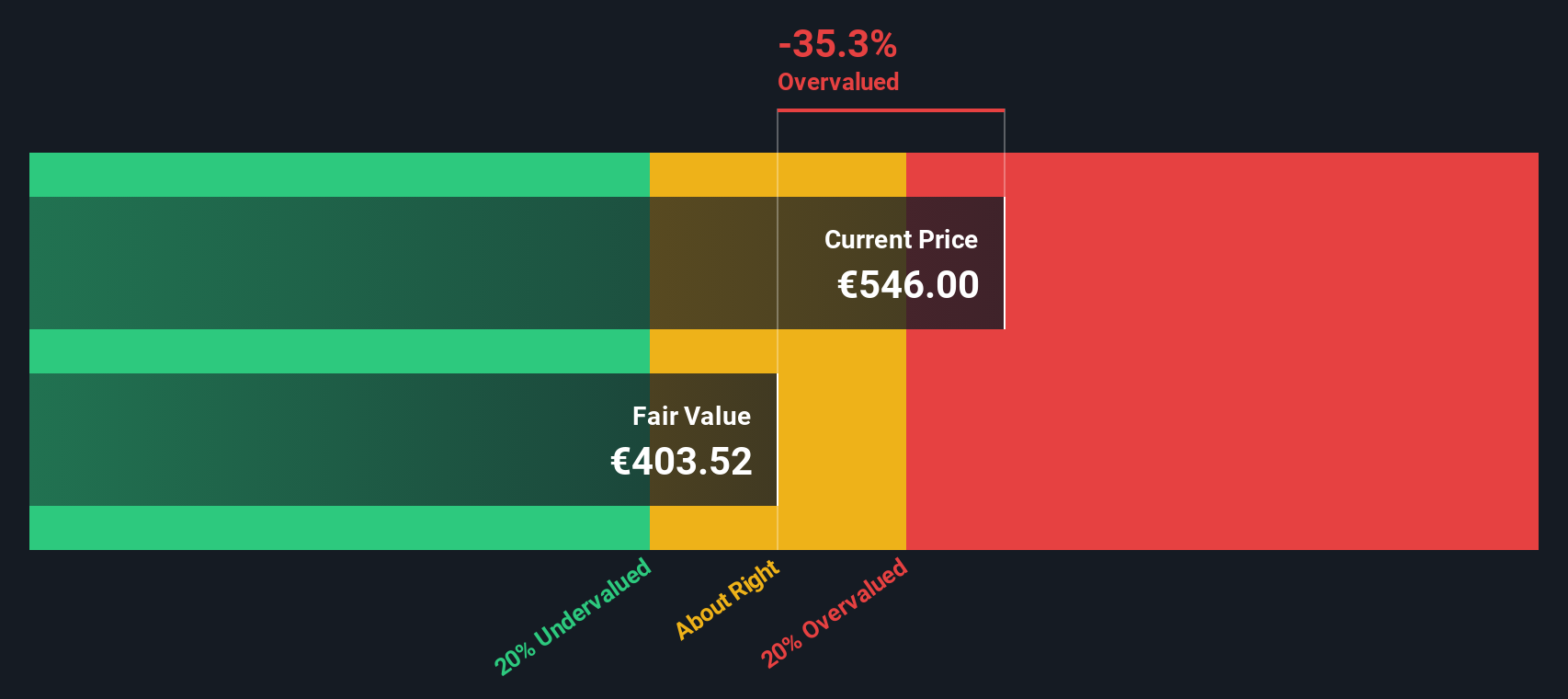

LVMH generated €13.33 billion in Free Cash Flow over the last twelve months. Looking ahead, analysts project FCF to reach approximately €12.79 billion by 2029. In total, the model incorporates forecasts from analysts for the next five years, then extends these projections further out to 2035 with reasonable assumptions to gauge the company’s potential over a decade.

Based on this methodology, the estimated intrinsic value for LVMH stock is €365.47 per share. However, this figure is 69.9% below the current share price, implying that the stock is heavily overvalued according to the DCF model. This large gap suggests investors are paying a significant premium, betting on factors like brand strength and future growth that may not be fully captured by cash flow projections alone.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests LVMH Moët Hennessy - Louis Vuitton Société Européenne may be overvalued by 69.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: LVMH Moët Hennessy Louis Vuitton Société Européenne Price vs Earnings (PE)

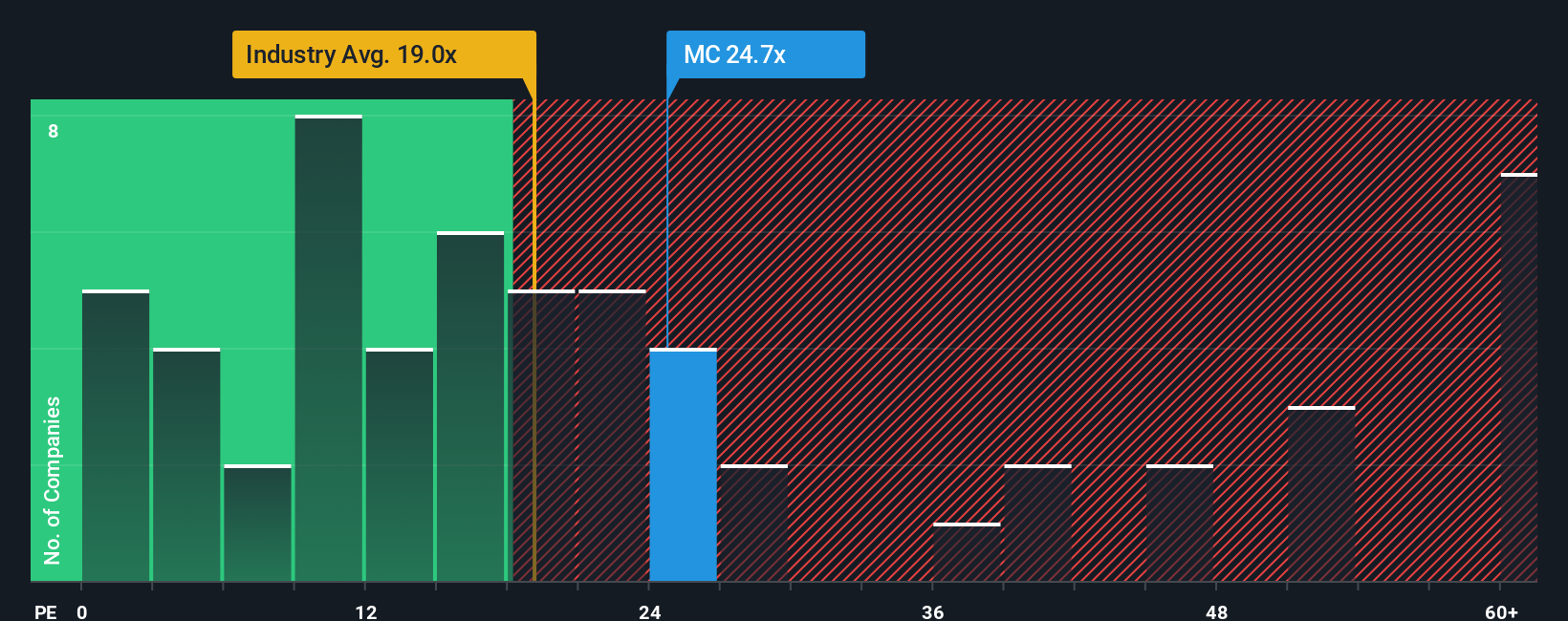

The Price-to-Earnings (PE) ratio is widely regarded as the go-to valuation measure for profitable companies, as it reflects how much investors are willing to pay for each euro of current earnings. Since LVMH has solid profits and a long record of earnings growth, the PE ratio provides a meaningful benchmark for understanding how the market values its future prospects.

Typically, higher growth expectations and lower risk support a higher PE ratio. If a company can reliably grow its earnings or faces less uncertainty, investors are usually willing to pay a greater premium, driving up the multiple. Conversely, industries with slower growth or greater risk will often see lower “normal” PE ratios.

LVMH currently trades on a PE ratio of 28.1x. Compared to the broader luxury industry average of 18.2x, and a peer average of 39.9x, LVMH’s multiple stands somewhere in the middle. What matters more, though, is the “Fair Ratio,” which is Simply Wall St’s proprietary estimate of the PE multiple LVMH deserves based on its growth potential, profitability, risk profile, and size. This tailored benchmark goes further than a simple peer or industry comparison by adjusting for the unique strengths and challenges LVMH faces in the market.

According to Simply Wall St, LVMH’s Fair Ratio is 32.1x. Since the company’s current PE is a bit below this, the numbers suggest LVMH may be somewhat undervalued at current levels when considering its growth outlook and profitability.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your LVMH Moët Hennessy Louis Vuitton Société Européenne Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful investment tool that lets you articulate your view of a company by combining your personal story about LVMH, your assumptions for future revenue, profit margins, and fair value. Narratives connect a company's real-world developments to specific financial forecasts and finally to an estimated fair price, giving every investor a way to “see the story behind the numbers.”

On Simply Wall St’s Community page, used by millions of investors globally, anyone can access and create Narratives for LVMH with just a few clicks. Narratives empower you to make informed buy or sell decisions by directly comparing your estimated Fair Value against today’s market Price, so you can act when the gap is compelling. Better still, Narratives update automatically whenever new information like earnings reports or news emerges, helping you stay in sync with shifting realities.

For example, at this moment, some investors believe LVMH is worth as much as €720.0 per share, seeing strength in luxury innovation and Asia-Pacific growth, while others set their fair value at €434.6, focusing on macro risks and margin pressures. With Narratives, you can explore these perspectives, adjust the assumptions to fit your outlook, and decide for yourself where opportunity exists.

Do you think there's more to the story for LVMH Moët Hennessy - Louis Vuitton Société Européenne? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MC

LVMH Moët Hennessy - Louis Vuitton Société Européenne

Operates as a luxury goods company worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives