Assessing LVMH’s Valuation After 19.5% Share Price Surge and Strong Asia Sales in 2025

Reviewed by Bailey Pemberton

- Wondering if LVMH Moët Hennessy Louis Vuitton Société Européenne is still a smart buy, or if the luxury giant’s share price has outrun its value? You are not alone. Many investors want to know if it’s the right time to add a prestige name to their portfolio.

- The stock has grabbed attention recently, rising 6.1% over the past week and climbing an impressive 19.5% over the last month. However, it is up only 0.2% year-to-date.

- Recent headlines have highlighted renewed consumer enthusiasm for luxury goods in critical markets, which has helped drive LVMH shares higher. Strong sales in Asia and major acquisitions in the fashion space have also been featured in the news, providing optimism for continued growth but also increasing expectations.

- Our starting point for valuation is the Simply Wall St score, which rates LVMH at 2 out of 6 for undervaluation checks. Next, we will break down several valuation methods to see if market optimism is justified. Stay tuned as we introduce an even more insightful way to assess whether the price truly matches the business.

LVMH Moët Hennessy - Louis Vuitton Société Européenne scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

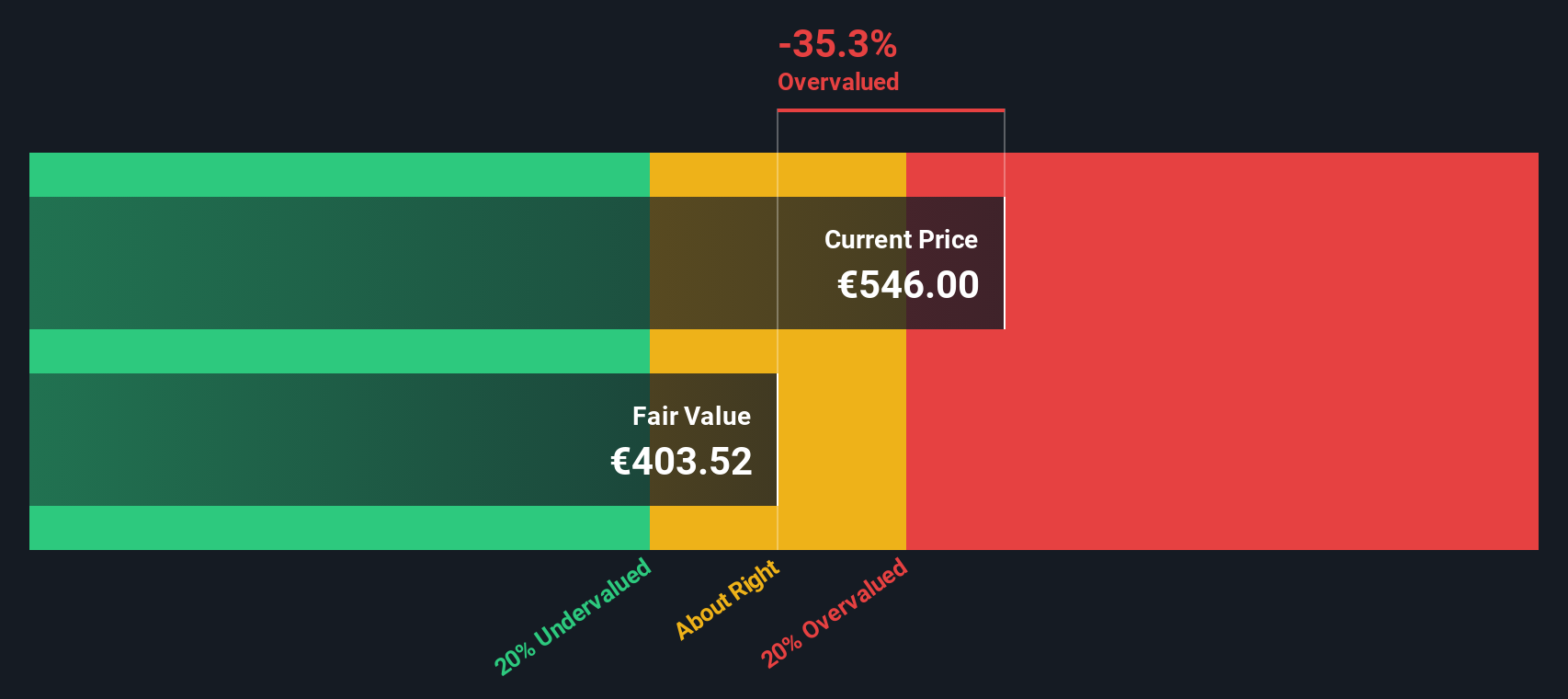

Approach 1: LVMH Moët Hennessy Louis Vuitton Société Européenne Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a stock’s fair value by forecasting the company’s future cash flows and then discounting them to today’s value. This approach aims to determine what the business is truly worth based on its ability to generate cash in the future.

For LVMH Moët Hennessy Louis Vuitton Société Européenne, the latest reported Free Cash Flow stands at €13.33 billion. Analysts provide forecasts up to 2029, projecting Free Cash Flow in that year at €12.79 billion. Beyond that, projections are extrapolated to account for longer-term trends. Over the next decade, cash flows are expected to remain robust, with some variations reflecting market and business dynamics. All cash flows are presented in Euros, LVMH’s reporting currency.

According to the DCF calculation, LVMH’s estimated intrinsic fair value is €365.46 per share. However, this represents a 74.2% premium to the current share price, indicating that the stock is significantly overvalued at current levels.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests LVMH Moët Hennessy - Louis Vuitton Société Européenne may be overvalued by 74.2%. Discover 885 undervalued stocks or create your own screener to find better value opportunities.

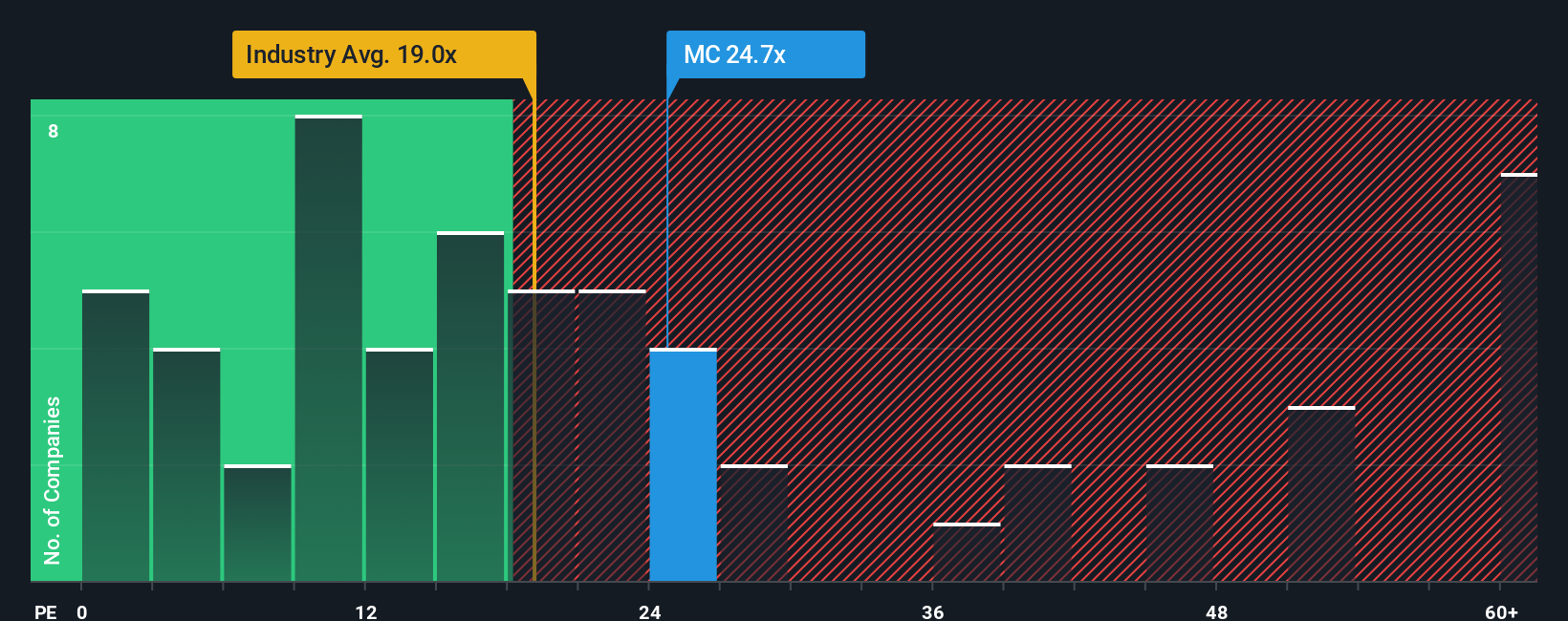

Approach 2: LVMH Moët Hennessy Louis Vuitton Société Européenne Price vs Earnings

The Price-to-Earnings (PE) ratio is widely considered the go-to valuation yardstick for profitable companies like LVMH Moët Hennessy Louis Vuitton Société Européenne. This is because it directly links a company’s share price to its ability to generate profits, making it especially relevant when earnings are robust and predictable.

A company’s growth outlook and perceived risk can push its “normal” or “fair” PE ratio higher or lower. Fast-growing businesses generally command higher PE multiples, whereas greater uncertainty or risk means investors require a lower multiple as compensation.

LVMH currently trades at a PE ratio of 28.8x. This is above the luxury industry average of 18.43x, but falls below its peer group average of 38.94x. These numbers show that while LVMH shares are more expensive than the broader sector, they are not unusually expensive compared to a group of similar leading companies.

Simply Wall St’s proprietary “Fair Ratio” offers an even sharper lens for valuation. This metric weighs the company’s earnings growth, profit margins, risk profile, industry, and market capitalization all at once, rather than relying on blunt averages. For LVMH, the Fair Ratio is calculated to be 33.42x, which is higher than the current PE.

This means that based on LVMH’s fundamentals and outlook, its actual market valuation is not only reasonable but also sits slightly below what Simply Wall St considers fair for this business.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your LVMH Moët Hennessy - Louis Vuitton Société Européenne Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your own story about a company; it links your perspective of LVMH Moët Hennessy - Louis Vuitton Société Européenne’s future with specific forecasts for things like revenue, earnings, and margins, and then calculates a Fair Value based on your expectations.

Narratives empower you to go beyond simple numbers by connecting your investment thesis to real financial outcomes. You create a Narrative on Simply Wall St’s Community page by adjusting key assumptions. The platform instantly shows you what that implies about Fair Value and how it compares to the current price, helping you clearly see if now is the right moment to buy or sell.

Unlike static models, Narratives are dynamically updated when fresh information, such as earnings reports or breaking news, hits the market. This keeps your investment reasoning and fair value up to date without the need for extensive manual recalculations.

For example, some investors interpret LVMH’s expanding Asia-Pacific presence and operational improvements as catalysts for double-digit earnings growth and set Fair Values as high as €720.0 per share. Others, concerned about economic risks and currency fluctuations, land as low as €434.6. Narratives let you compare these viewpoints and anchor your decisions in a clear, personalized framework.

Do you think there's more to the story for LVMH Moët Hennessy - Louis Vuitton Société Européenne? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MC

LVMH Moët Hennessy - Louis Vuitton Société Européenne

Operates as a luxury goods company worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives