Assessing LVMH Shares After an 18.6% Surge on Renewed Luxury Demand Optimism

Reviewed by Bailey Pemberton

Thinking of what to do next with LVMH Moët Hennessy - Louis Vuitton Société Européenne stock? You are not alone. This luxury giant has always attracted attention from investors looking for resilient brands, and lately, its price moves are sparking conversation. Over the last month, LVMH’s stock climbed an impressive 18.6%, and it is up 7.7% just in the past week. That is a lively turnaround from where it started the year, with a -5.2% return year-to-date. It also puts the past twelve months’ modest 1.3% gain in a new light. Over five years, the 53.1% rise is a strong marker of long-term value creation, even as the last three years have been essentially flat at 0.5%.

So what is powering the recent momentum? Much of it comes as markets reassess the sector’s prospects. Recent news about improving sentiment in global luxury demand and signs of recovery in key markets have propelled optimism for LVMH’s powerhouse portfolio. Investors may also be reducing risk perceptions as the company continually demonstrates its ability to weather macroeconomic uncertainty without losing its sheen.

With all this movement, the question is not just what LVMH has done, but whether it represents good value right now. On our six-point valuation checklist, LVMH scores a 2, meaning it shows signs of being undervalued on two out of six major measures. This is a point that deserves a closer look. Next, let us break down some of the classic ways analysts weigh valuation. And if you are looking for a different perspective that could change how you think about “fair value,” stay tuned for the end of the article.

LVMH Moët Hennessy - Louis Vuitton Société Européenne scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: LVMH Moët Hennessy Louis Vuitton Société Européenne Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and discounting them back to the present using a required rate of return. This method attempts to capture what the business is truly worth based on its ability to generate cash over time.

For LVMH, the company reported Last Twelve Months Free Cash Flow (FCF) of €13.3 billion. Forecasts suggest FCF will remain strong, with analyst estimates reaching €12.8 billion by 2029. Only the next five years involve direct analyst inputs, with subsequent years extrapolated to reflect likely business trends. This multi-year projection underscores both stability and resilience in LVMH’s cash-generating capabilities.

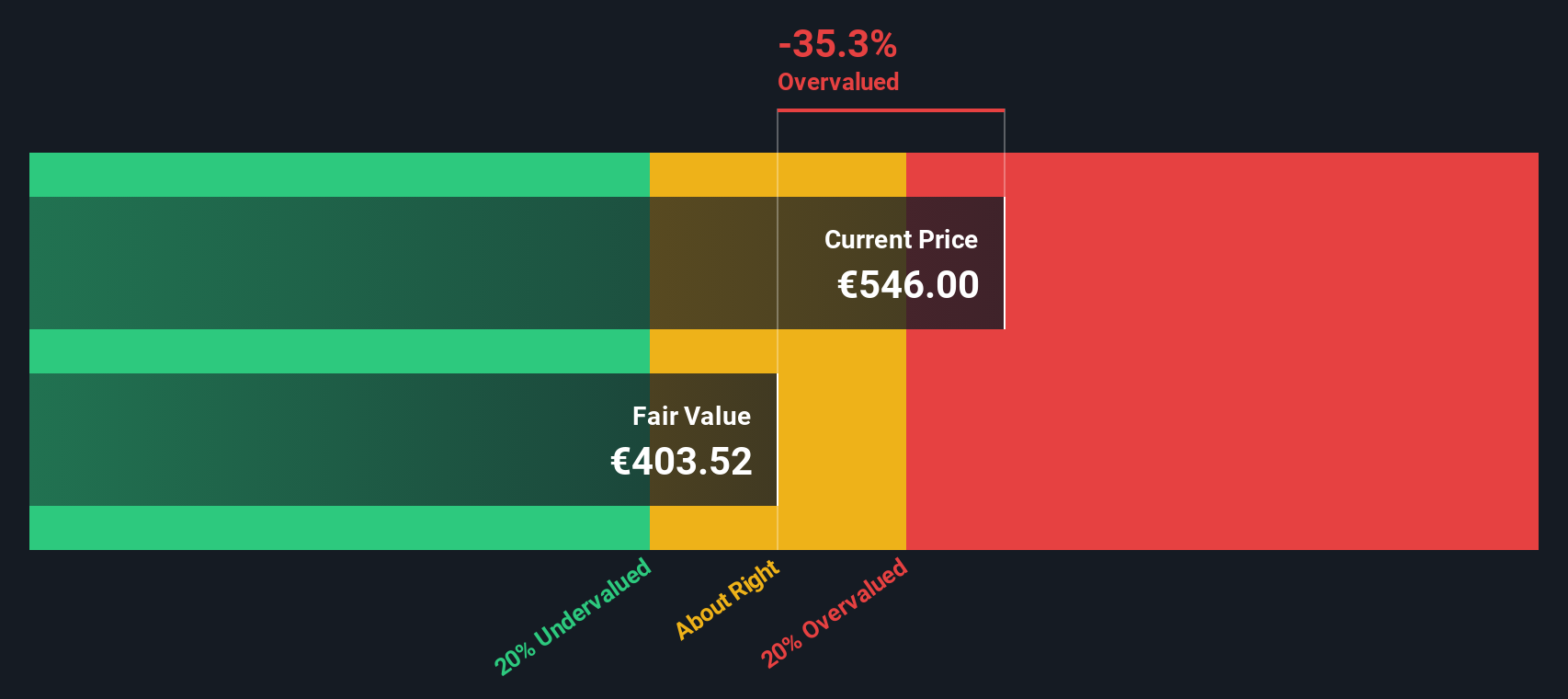

The DCF model for LVMH, using the 2 Stage Free Cash Flow to Equity approach, produces an intrinsic value of €365.07 per share. Compared to the current market price, this figure implies the stock is roughly 65% overvalued. In other words, the present share price is well above what the DCF suggests is fair based on anticipated cash flows.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests LVMH Moët Hennessy - Louis Vuitton Société Européenne may be overvalued by 65.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: LVMH Moët Hennessy Louis Vuitton Société Européenne Price vs Earnings

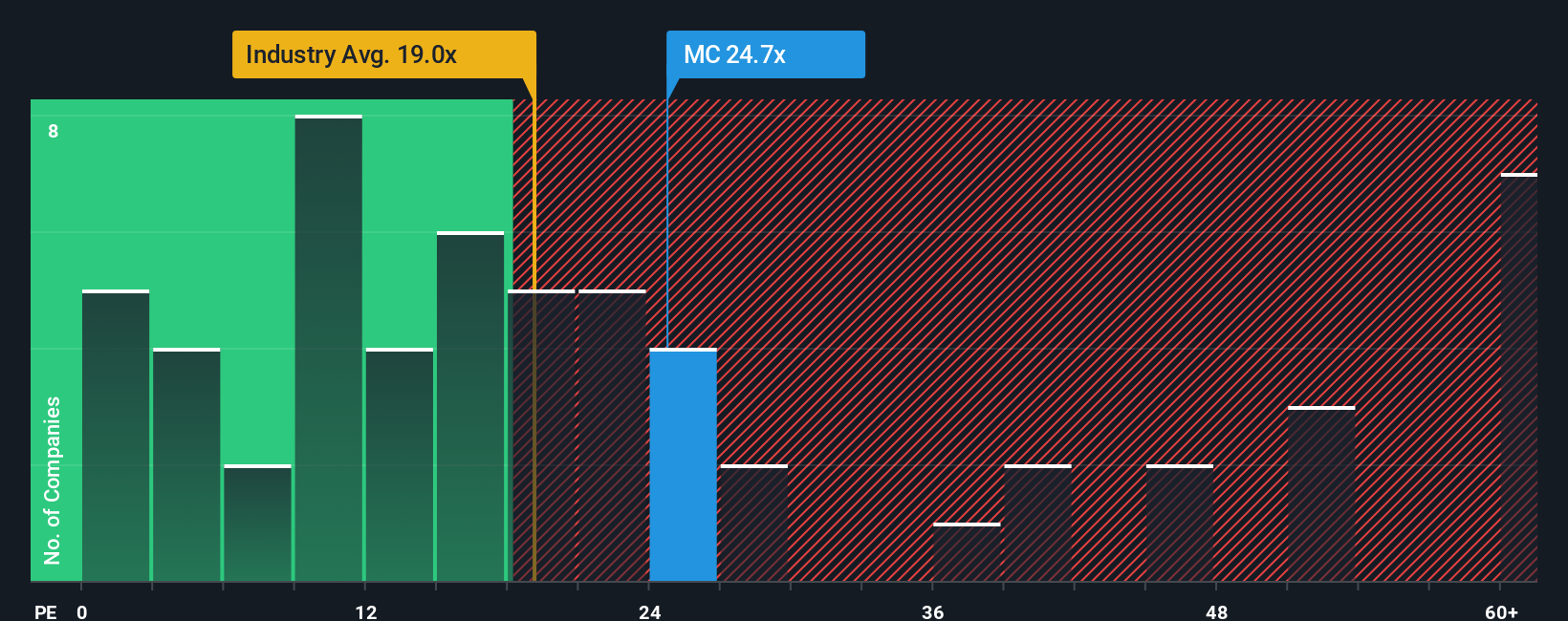

The Price-to-Earnings (PE) ratio is widely used to value profitable companies because it directly connects the share price to how much the company earns. For established companies with steady profits like LVMH, the PE ratio gives investors a practical gauge for comparing value and gauging how much optimism is priced in for future growth.

Growth expectations and risk play a key role in deciding what counts as a “normal” or “fair” PE ratio. Higher growth companies typically trade at a premium, while stable or lower-growth businesses warrant lower multiples. Likewise, companies facing greater risks or more volatile earnings usually see a discount in their ratios. For reference, LVMH currently trades on a PE ratio of 27.26x, which is noticeably higher than the broader luxury industry average of 18.23x, but below the average of its direct peers at 37.96x.

Simply Wall St introduces a tailored “Fair Ratio” to refine this comparison, pegging LVMH’s fair PE at 32.08x. Unlike a plain comparison against sector or peer averages, this Fair Ratio factors in LVMH’s expected earnings growth, profit margins, company size and industry risks to give a more accurate sense of value. Because this metric is grounded in company-specific fundamentals, it offers a more insightful benchmark for whether the stock price is justified.

With LVMH’s current PE ratio of 27.26x sitting below its Fair Ratio of 32.08x, the shares look slightly undervalued on this basis, suggesting room for appreciation if the company delivers on its growth prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your LVMH Moët Hennessy Louis Vuitton Société Européenne Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your own investment story that connects what you believe about a company’s business, such as its strengths, challenges, and future outlook, to actual numbers such as future revenues, profit margins, and ultimately your fair value estimate.

This approach moves beyond static ratios and models, allowing users to anchor their decisions in a dynamic, evolving view of what really drives a company’s worth. Narratives link your perspective on LVMH’s brand power or risks to a financial forecast and a fair value, making your judgment clear, actionable, and personal.

Narratives are easy to create and compare on Simply Wall St’s Community page, used by millions of investors. When you set up a Narrative, the platform will track current price versus your fair value, highlight buy or sell opportunities, and update your Narrative every time new news, earnings, or business events happen.

For example, on LVMH, some investors expect margin expansion and robust growth from experiential retail in Asia-Pacific and value the shares as high as €720, while more cautious views, worried about profit pressures and regulatory risk, see fair value closer to €435. Narratives help you clearly see which story you believe, why, and what it means for your next move.

Do you think there's more to the story for LVMH Moët Hennessy - Louis Vuitton Société Européenne? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MC

LVMH Moët Hennessy - Louis Vuitton Société Européenne

Operates as a luxury goods company worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives