Will Kering's (ENXTPA:KER) Leadership Shuffle Reinvent Gucci's Competitive Edge?

Reviewed by Simply Wall St

- Kering announced the appointment of Francesca Bellettini as President and CEO of Gucci, reporting to Group CEO Luca de Meo, with Jean-Marc Duplaix continuing as Group Chief Operating Officer and the Deputy CEO role being eliminated.

- Bellettini’s extensive history within Kering and track record at Saint Laurent highlight her experience in brand revitalization as she takes the helm at Gucci during a time of creative transition with designer Demna’s upcoming debut collection.

- Now, we’ll examine how Bellettini’s leadership at Gucci could influence Kering’s investment narrative and future brand positioning.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Kering Investment Narrative Recap

To invest in Kering today, one needs conviction that the group can reignite growth at Gucci and reverse weakening demand seen across its flagship labels. Francesca Bellettini’s appointment as President and CEO of Gucci could be a pivotal step, aligning proven luxury brand stewardship with Gucci’s upcoming creative overhaul, yet execution remains the key short-term catalyst, while the biggest risk is a continued slide in consumer demand and brand relevance if the turnaround stalls.

Among recent announcements, the July 2025 earnings release is particularly relevant: Kering reported a sharp year-over-year decline in both sales and net income for the first half, highlighting the urgency for an effective Gucci recovery as Bellettini steps in. This context underscores why leadership shifts and the roll-out of new creative strategies are drawing such attention from the market.

However, against new leadership optimism, investors should also be mindful of the persistent risk that...

Read the full narrative on Kering (it's free!)

Kering's outlook suggests €17.5 billion in revenue and €1.4 billion in earnings by 2028. This is based on 3.5% annual revenue growth and a €671 million increase in earnings from the current €729 million.

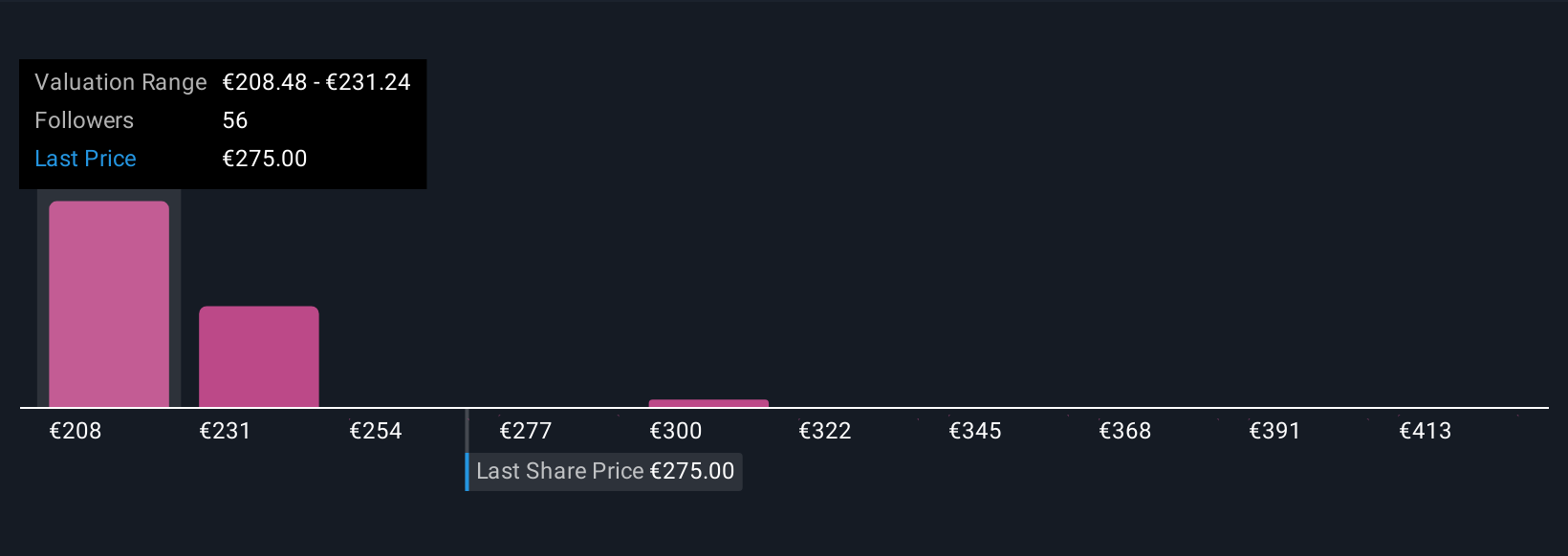

Uncover how Kering's forecasts yield a €208.48 fair value, a 22% downside to its current price.

Exploring Other Perspectives

Nine fair value estimates from the Simply Wall St Community range from €208.48 to €436.12, signaling broad conviction splits. With ongoing brand revitalization still a work in progress, you can find sharply different takes on where Kering may go next and should compare several viewpoints before forming your own view.

Explore 9 other fair value estimates on Kering - why the stock might be worth 22% less than the current price!

Build Your Own Kering Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kering research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Kering research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kering's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:KER

Kering

Manages the development of a collection of renowned houses in fashion, leather goods, and jewelry in the Asia Pacific, Western Europe, North America, Japan, and internationally.

Average dividend payer with moderate growth potential.

Market Insights

Community Narratives