- France

- /

- Consumer Durables

- /

- ENXTPA:ALMLB

Market Might Still Lack Some Conviction On Miliboo Société anonyme (EPA:ALMLB) Even After 26% Share Price Boost

Miliboo Société anonyme (EPA:ALMLB) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 37% in the last twelve months.

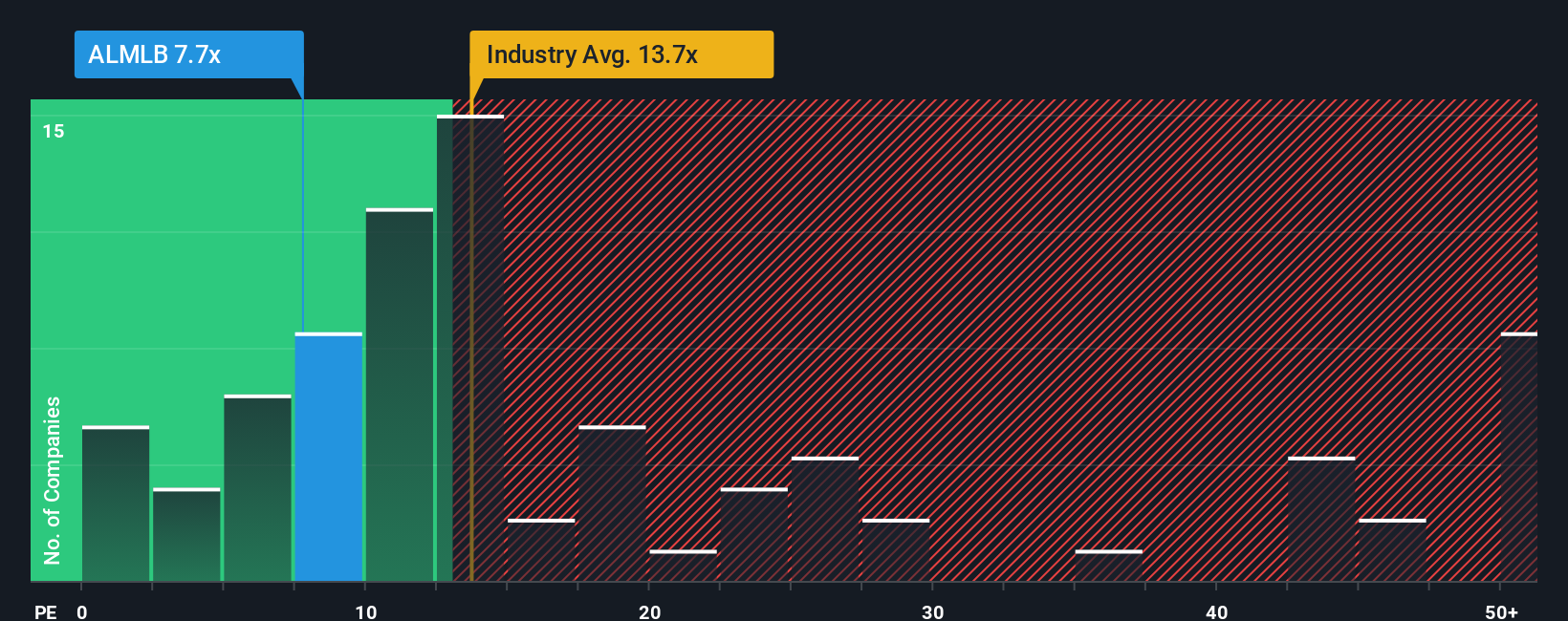

In spite of the firm bounce in price, Miliboo Société anonyme may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 7.7x, since almost half of all companies in France have P/E ratios greater than 17x and even P/E's higher than 32x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Miliboo Société anonyme hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Miliboo Société anonyme

Is There Any Growth For Miliboo Société anonyme?

In order to justify its P/E ratio, Miliboo Société anonyme would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 23%. As a result, earnings from three years ago have also fallen 46% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

The Bottom Line On Miliboo Société anonyme's P/E

Miliboo Société anonyme's recent share price jump still sees its P/E sitting firmly flat on the ground. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Before you take the next step, you should know about the 4 warning signs for Miliboo Société anonyme (2 shouldn't be ignored!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALMLB

Miliboo Société anonyme

Engages in the design and sale of modular and customizable furniture in Paris and internationally.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives