- France

- /

- Consumer Durables

- /

- ENXTPA:ALHEX

These 4 Measures Indicate That Hexaom (EPA:ALHEX) Is Using Debt Extensively

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Hexaom S.A. (EPA:ALHEX) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Hexaom

How Much Debt Does Hexaom Carry?

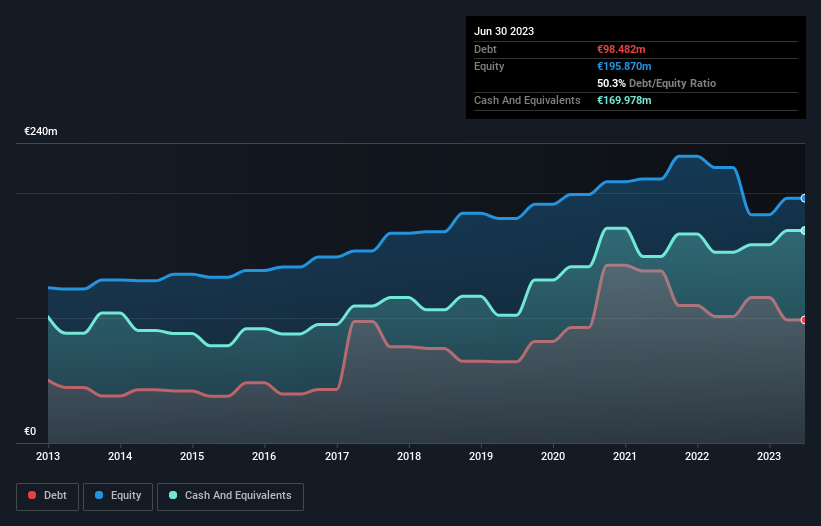

The chart below, which you can click on for greater detail, shows that Hexaom had €98.5m in debt in June 2023; about the same as the year before. But on the other hand it also has €170.0m in cash, leading to a €71.5m net cash position.

A Look At Hexaom's Liabilities

We can see from the most recent balance sheet that Hexaom had liabilities of €434.7m falling due within a year, and liabilities of €57.3m due beyond that. On the other hand, it had cash of €170.0m and €223.8m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €98.2m.

This is a mountain of leverage relative to its market capitalization of €110.3m. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. Despite its noteworthy liabilities, Hexaom boasts net cash, so it's fair to say it does not have a heavy debt load!

It is just as well that Hexaom's load is not too heavy, because its EBIT was down 77% over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Hexaom's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Hexaom may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last three years, Hexaom generated free cash flow amounting to a very robust 85% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Summing Up

Although Hexaom's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of €71.5m. The cherry on top was that in converted 85% of that EBIT to free cash flow, bringing in €29m. So while Hexaom does not have a great balance sheet, it's certainly not too bad. Even though Hexaom lost money on the bottom line, its positive EBIT suggests the business itself has potential. So you might want to check out how earnings have been trending over the last few years.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you're looking to trade Hexaom, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hexaom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALHEX

Flawless balance sheet and good value.

Market Insights

Community Narratives