Revenues Working Against Cybergun S.A.'s (EPA:ALCYB) Share Price Following 32% Dive

Cybergun S.A. (EPA:ALCYB) shareholders won't be pleased to see that the share price has had a very rough month, dropping 32% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 79% loss during that time.

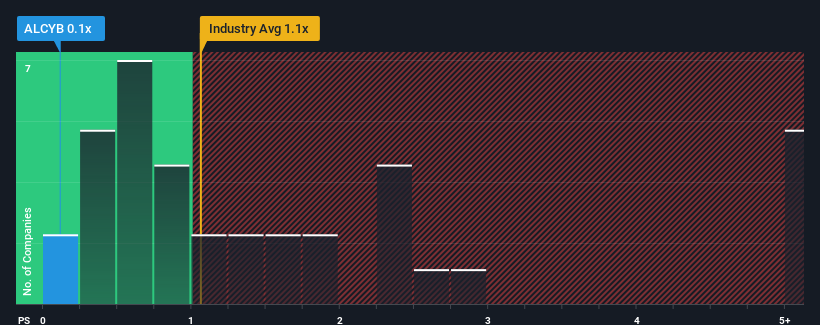

Following the heavy fall in price, when close to half the companies operating in France's Leisure industry have price-to-sales ratios (or "P/S") above 0.6x, you may consider Cybergun as an enticing stock to check out with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Cybergun

How Has Cybergun Performed Recently?

With revenue growth that's exceedingly strong of late, Cybergun has been doing very well. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Cybergun will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Cybergun would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 50%. The latest three year period has also seen an excellent 53% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 80% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Cybergun is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Bottom Line On Cybergun's P/S

Cybergun's recently weak share price has pulled its P/S back below other Leisure companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

In line with expectations, Cybergun maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

You always need to take note of risks, for example - Cybergun has 2 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALIBR

Calibre

Manufactures and distributes replica weapons, light machine guns, and associated accessories worldwide.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives