- France

- /

- Professional Services

- /

- ENXTPA:TEP

Can Teleperformance’s (ENXTPA:TEP) Public Sector Wins Signal Durable Contract-Driven Growth Ahead?

Reviewed by Sasha Jovanovic

- On October 27, 2025, Teleperformance announced it has secured positions on both Lot 1 (Citizen Experience) and Lot 2 (Business Services) of the UK Crown Commercial Services MYR 6,295 framework, further strengthening its government and public sector footprint.

- This dual appointment highlights Teleperformance's expanding influence in public sector digital and back-office services, underlining its progress in scaling contract wins and broadening client relationships across government organizations.

- We'll explore how Teleperformance's expanded public sector service mandate shapes its investment narrative and outlook for contract-driven growth.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Teleperformance Investment Narrative Recap

Investors in Teleperformance must weigh the company’s ability to capitalize on increased demand for digitized business services while managing the revenue pressure from mature and volatile markets. The recent win of both lots on the UK Crown Commercial Services framework could help shore up its public sector position; however, this development does not fully offset the company’s biggest short-term challenge: persistent revenue softness in Specialized Services and market volatility, especially in the U.S., which remains the primary near-term risk. A recent, closely connected announcement is Teleperformance’s “Future Forward” plan, unveiled in June 2025, which seeks to accelerate the integration of AI across operational functions. This initiative ties directly to the catalyst of enterprise digitization and process automation, factors that Teleperformance hopes will support contract expansion, margin recovery, and a more resilient top-line, especially as public sector mandates grow in scope. Yet, unlike the optimism around public sector growth, investors should be aware that ongoing demand uncertainty in the U.S. Specialized Services business...

Read the full narrative on Teleperformance (it's free!)

Teleperformance's narrative projects €11.1 billion revenue and €766.6 million earnings by 2028. This requires 2.4% yearly revenue growth and a €285.6 million earnings increase from €481.0 million today.

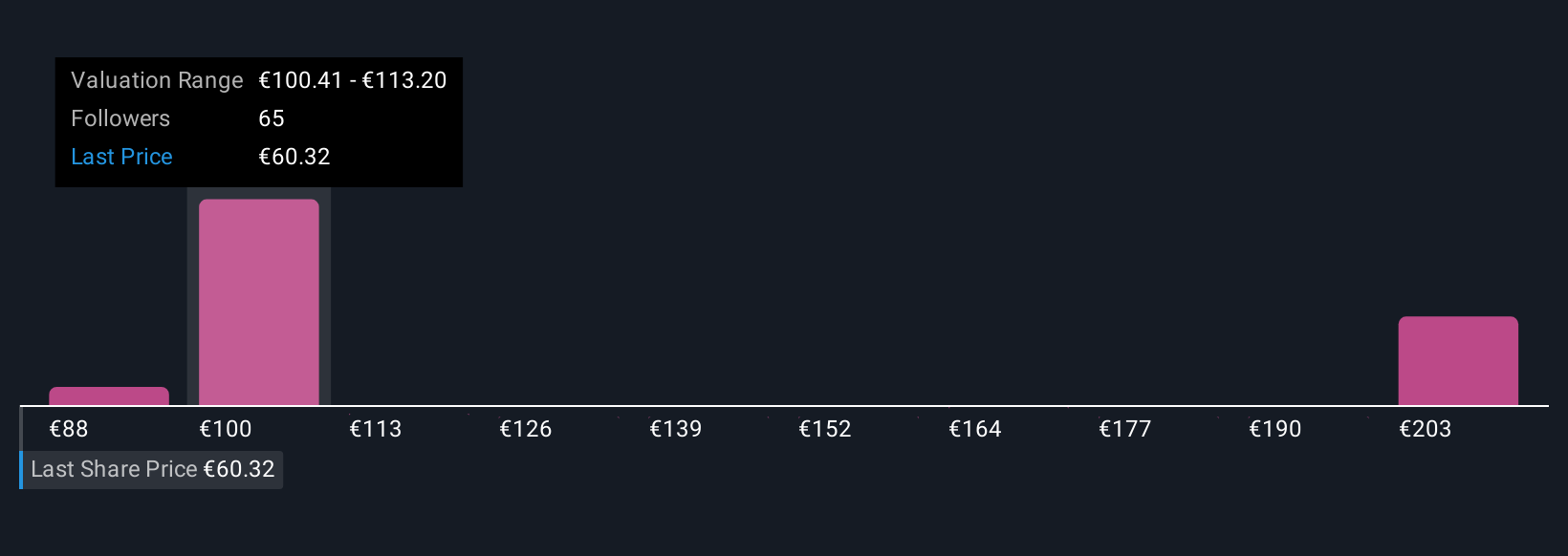

Uncover how Teleperformance's forecasts yield a €112.13 fair value, a 81% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have issued 11 fair value estimates for Teleperformance, ranging widely from €87.63 to €248.66. Despite this breadth of opinion, the key risk remains exposure to unstable revenue streams and the effects of contract loss, inviting you to consider several sharply different outlooks when assessing Teleperformance’s future.

Explore 11 other fair value estimates on Teleperformance - why the stock might be worth just €87.63!

Build Your Own Teleperformance Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teleperformance research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Teleperformance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teleperformance's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Teleperformance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TEP

Teleperformance

Operates as a digital business services company in France and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion