- France

- /

- Professional Services

- /

- ENXTPA:SDG

Synergie (EPA:SDG) shareholders notch a 81% return over 1 year, yet earnings have been shrinking

The simplest way to invest in stocks is to buy exchange traded funds. But investors can boost returns by picking market-beating companies to own shares in. To wit, the Synergie SE (EPA:SDG) share price is 76% higher than it was a year ago, much better than the market return of around 36% (not including dividends) in the same period. That's a solid performance by our standards! The longer term returns have not been as good, with the stock price only 1.8% higher than it was three years ago.

Since it's been a strong week for Synergie shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for Synergie

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the last twelve months, Synergie actually shrank its EPS by 36%.

Given the share price gain, we doubt the market is measuring progress with EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Synergie's revenue actually dropped 17% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

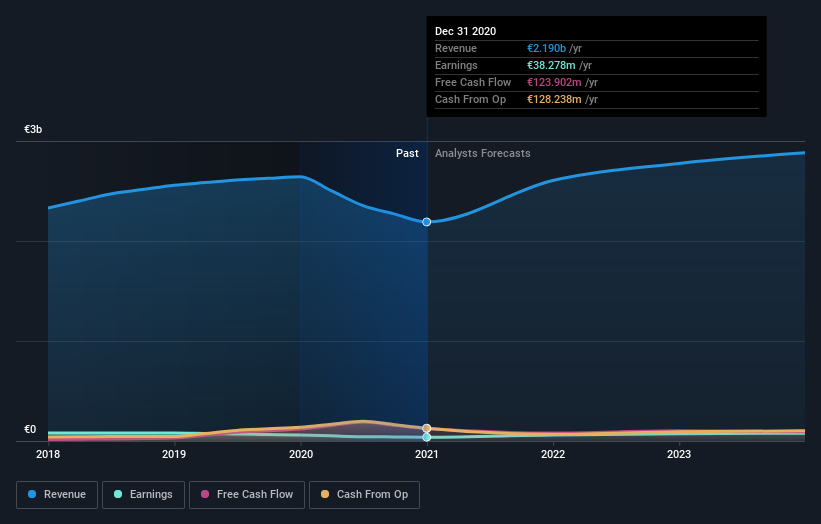

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Synergie in this interactive graph of future profit estimates.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Synergie's TSR for the last 1 year was 81%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Synergie shareholders have received a total shareholder return of 81% over the last year. And that does include the dividend. That gain is better than the annual TSR over five years, which is 6%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Synergie is showing 1 warning sign in our investment analysis , you should know about...

Of course Synergie may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you’re looking to trade Synergie, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:SDG

Synergie

Provides human resources management and development services for companies and institutions in France, Belgium, Other Northern and Eastern Europe, Italy, Spain, Portugal, Canada, and Australia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives