- France

- /

- Professional Services

- /

- ENXTPA:SDG

Pulling back 6.3% this week, Synergie's EPA:SDG) one-year decline in earnings may be coming into investors focus

One way to deal with stock volatility is to ensure you have a properly diverse portfolio. Of course, the aim of the game is to pick stocks that do better than an index fund. One such company is Synergie SE (EPA:SDG), which saw its share price increase 14% in the last year, slightly above the market return of around 12% (not including dividends). The longer term returns have not been as good, with the stock price only 1.6% higher than it was three years ago.

Although Synergie has shed €48m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year, Synergie actually saw its earnings per share drop 5.6%.

Given the share price gain, we doubt the market is measuring progress with EPS. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

We doubt the modest 1.6% dividend yield is doing much to support the share price. Revenue was pretty flat year on year, but maybe a closer look at the data can explain the market optimism.

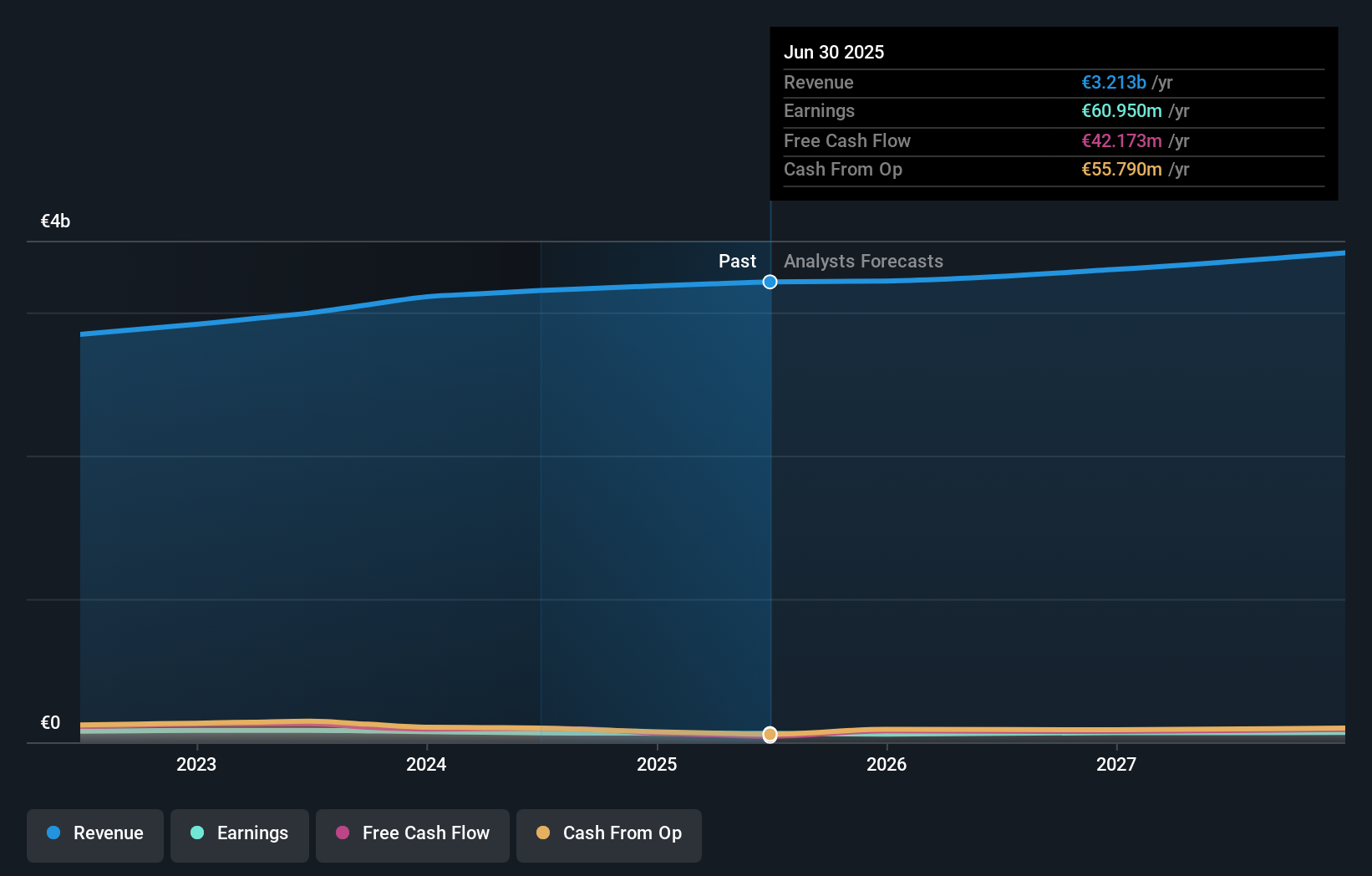

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Synergie shareholders have received returns of 16% over twelve months (even including dividends), which isn't far from the general market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 4%. It is possible that management foresight will bring growth well into the future, even if the share price slows down. Before forming an opinion on Synergie you might want to consider these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:SDG

Synergie

Provides human resources management and development services for companies and institutions in France, Belgium, Other Northern and Eastern Europe, Italy, Spain, Portugal, Canada, and Australia.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success