Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Edenred SA (EPA:EDEN) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Edenred

What Is Edenred's Debt?

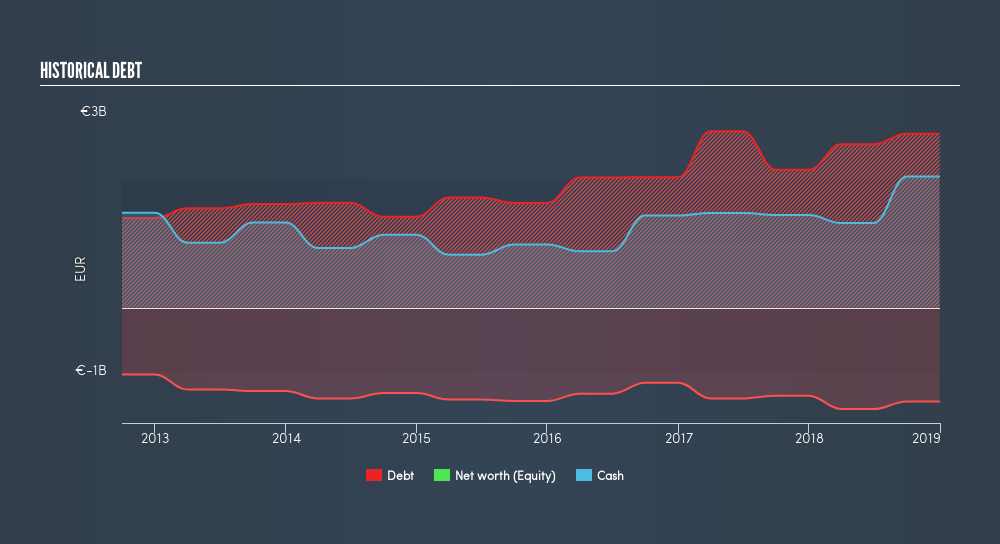

The image below, which you can click on for greater detail, shows that at December 2018 Edenred had debt of €2.70b, up from €2.14b in one year. On the flip side, it has €2.03b in cash leading to net debt of about €662.0m.

A Look At Edenred's Liabilities

We can see from the most recent balance sheet that Edenred had liabilities of €6.27b falling due within a year, and liabilities of €2.45b due beyond that. Offsetting this, it had €2.03b in cash and €2.09b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €4.60b.

While this might seem like a lot, it is not so bad since Edenred has a huge market capitalization of €10.8b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. Because it carries more debt than cash, we think it's worth watching Edenred's balance sheet over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Edenred has net debt of just 1.36 times EBITDA, suggesting it could ramp leverage without breaking a sweat. But the really cool thing is that it actually managed to receive more interest than it paid, over the last year. So it's fair to say it can handle debt like a hot shot teppanyaki chef handles cooking. Also good is that Edenred grew its EBIT at 14% over the last year, further increasing its ability to manage debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Edenred's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Edenred actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

The good news is that Edenred's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. And that's just the beginning of the good news since its conversion of EBIT to free cash flow is also very heartening. When we consider the range of factors above, it looks like Edenred is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. Over time, share prices tend to follow earnings per share, so if you're interested in Edenred, you may well want to click here to check an interactive graph of its earnings per share history.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:EDEN

Edenred

Provides digital platform for services and payments for companies, employees, and merchants worldwide.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives