- France

- /

- Commercial Services

- /

- ENXTPA:DBG

Is There Now an Opportunity in Derichebourg After Strong Five Year Stock Gains?

Reviewed by Bailey Pemberton

If you are thinking about what to do with Derichebourg stock, you are not alone. With so many market voices out there, it can be tough to interpret all the signals, especially after a string of solid performances as seen lately. Derichebourg has just closed at €5.68, and it has notched up a 7.2% gain in the last week alone. In fact, over the last year, shares are up a solid 13.2%, with a truly impressive 149.8% gain over five years. Clearly, this is not simply a fluke or a one-off rally. These numbers point to a pattern that deserves a closer look.

These recent price moves are coming at a time of renewed investor focus on sectors where Derichebourg is active, with overall market developments making investors revisit names that combine resilience with growth. A strong three-year return of 55.4% highlights how much long-term holders have been rewarded. But with all this upward momentum, the next logical question is whether Derichebourg is still undervalued, or if the stock is getting ahead of itself.

That is exactly where a valuation-focused strategy comes in, and right now Derichebourg sports a value score of 5 out of a possible 6. This means it passes the undervalue test in 5 different ways. In the sections ahead, we will dig into what is driving that score and examine the main valuation measures. We will also wrap up with an approach to judging valuation that goes beyond the usual numbers, so you have the full picture before making your call.

Why Derichebourg is lagging behind its peers

Approach 1: Derichebourg Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future cash flows and discounting them back to their present value. This approach aims to reflect what those future streams of cash are worth in today's euros, offering a comprehensive view of the company's underlying worth.

For Derichebourg, the most recent Free Cash Flow was €127.03 million. Analysts forecast annual figures for the next several years, with projections suggesting free cash flow will reach around €141.9 million in 2026 and €115.1 million by 2027. Beyond that, estimates are extrapolated, pointing to a gradual, modest decline followed by a return to slow growth in free cash flows through 2035.

- 2026 projected FCF: €141.9 million (analyst estimate)

- 2027 projected FCF: €115.1 million (analyst estimate)

- 2035 projected FCF: €120.7 million (extrapolated)

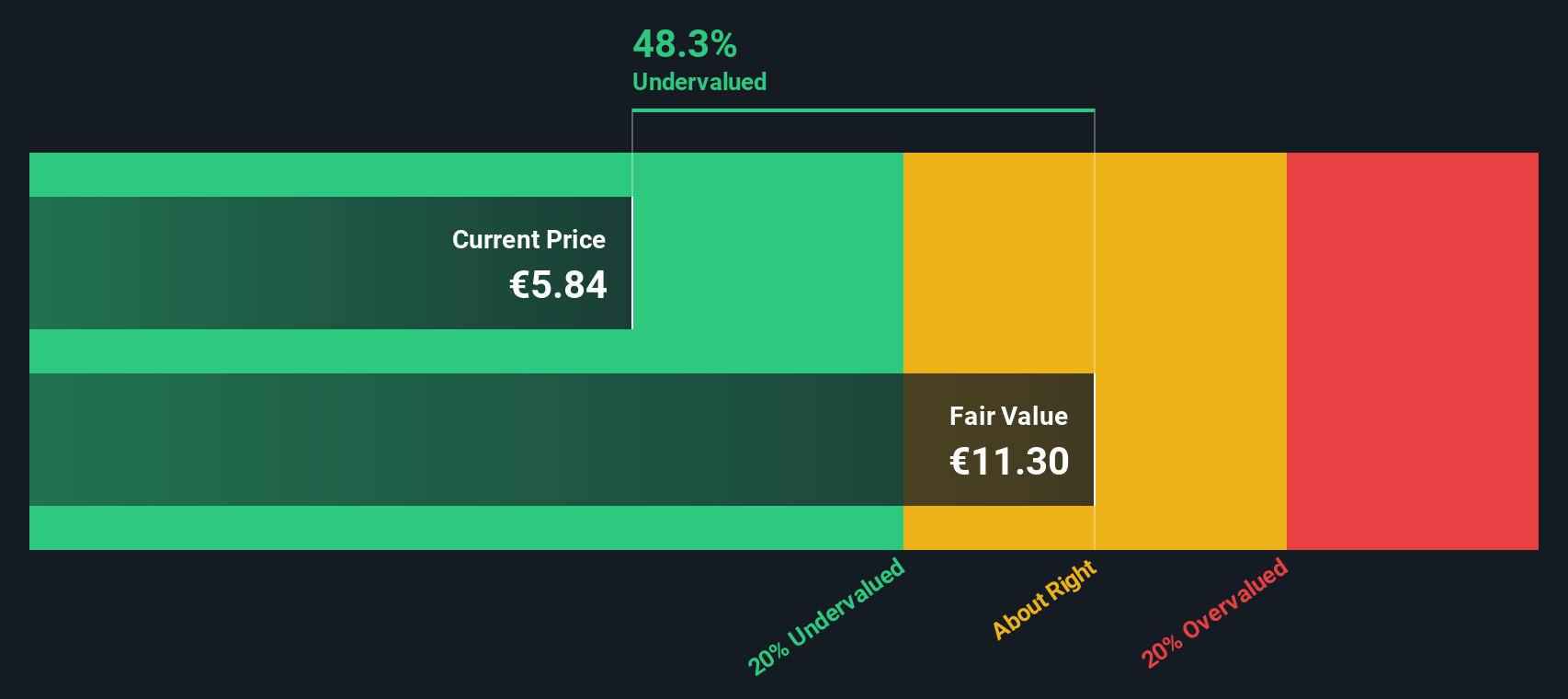

With these inputs, the DCF model calculates Derichebourg’s intrinsic fair value at €10.96 per share. Compared to the current share price of €5.68, this implies the stock is 48.2% undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Derichebourg is undervalued by 48.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Derichebourg Price vs Earnings

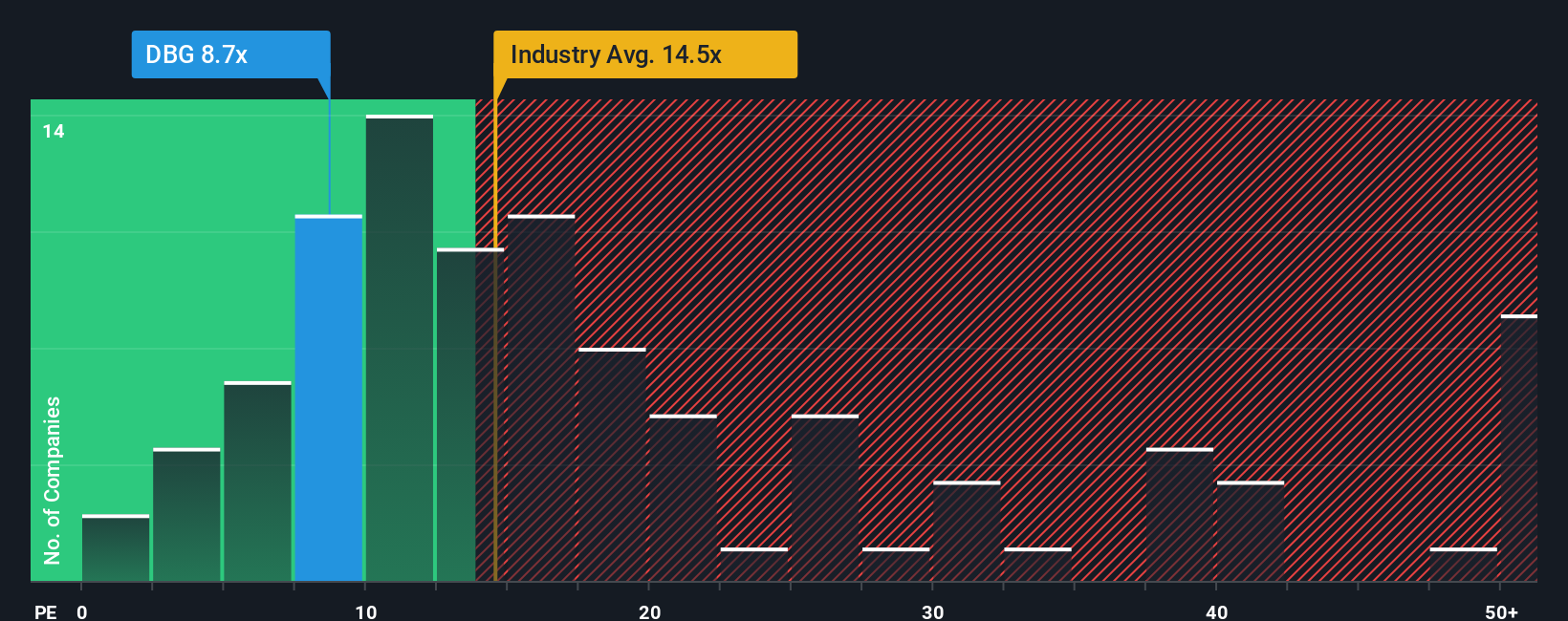

For profitable companies like Derichebourg, the Price-to-Earnings (PE) ratio is a time-tested metric for comparing market value to actual earnings. It helps investors understand how much they are paying for each euro of profit the business generates. While a low PE can signal undervaluation, what qualifies as “low” depends heavily on the company’s growth prospects and risk profile. High growth or lower risk tends to justify higher PE ratios.

Derichebourg currently trades at a PE ratio of 8.45x, which is significantly below the Commercial Services industry average of 16.79x, as well as the peer group average of 18.77x. At first glance, this suggests the market is pricing in far less optimism for Derichebourg than for its rivals. However, raw numbers do not always tell the full story.

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio is a proprietary measure that does not just benchmark against industry or peers, but also factors in Derichebourg’s own earnings growth outlook, profit margins, size, and specific risks. This holistic approach aims to pinpoint a more accurate “fair” valuation multiple for the company. For Derichebourg, the Fair Ratio is calculated at 13.40x. That is notably higher than the current market multiple, indicating the shares are being valued at a discount.

With the current PE ratio of 8.45x sitting well below the Fair Ratio of 13.40x, the numbers make a strong case that Derichebourg appears undervalued on this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Derichebourg Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple but powerful tool that helps you connect your view of Derichebourg’s story with the financial forecasts that matter, including your assumptions about things like future revenue, earnings, and profit margins, and ultimately, your estimate of fair value.

On Simply Wall St’s Community page, you can easily create or follow these Narratives. This allows you to anchor your investment choices in a clear, numbers-backed story. Narratives help you decide when to buy or sell by showing how your fair value compares with the live share price, and they automatically update as new company news or earnings come in, so your perspective always stays relevant.

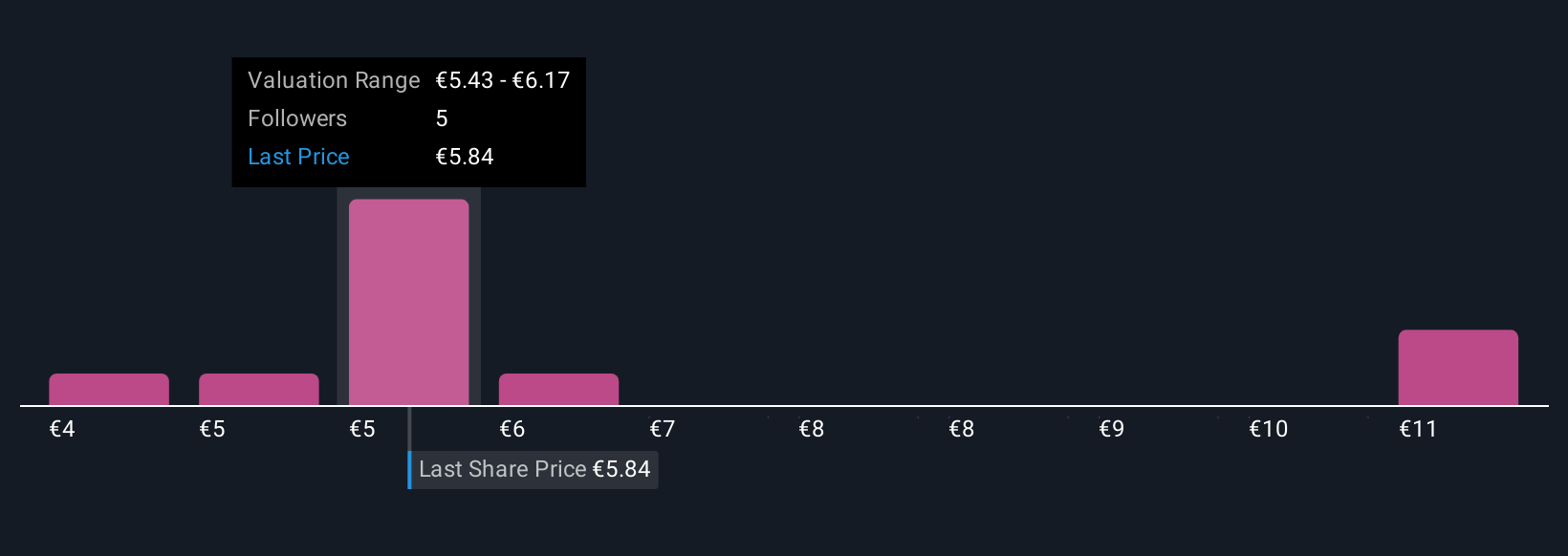

For example, you might see the most optimistic Narrative valuing Derichebourg shares as high as €15 per share based on strong growth expectations, while the most cautious view puts fair value nearer to €7 per share using more modest assumptions. Narratives make it easy for you to see the real drivers behind these views, so you can invest with confidence and clarity.

Do you think there's more to the story for Derichebourg? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:DBG

Derichebourg

Provides environmental services to businesses, and local and municipal authorities.

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026