- France

- /

- Professional Services

- /

- ENXTPA:BVI

How Bureau Veritas’s Stock Measures Up After Recent Regulatory Tailwinds in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with your Bureau Veritas stock? You are not alone. With the shares closing at €27.3 recently, investors have been watching a subtle shift in the stock's momentum. Over the past week, Bureau Veritas gained 3.7%, extending a modest 3.4% rise over the last 30 days. While that does not seem earth-shattering, it is a sign that confidence is quietly building after a turbulent start to the year, when the stock slipped 6.1% year-to-date. If you zoom out even further, the bigger picture is hard to ignore. Bureau Veritas has delivered a substantial 54.7% return over five years and 29.2% over three years, making it a name that long-term holders know well.

Much of this performance has been influenced by global shifts in compliance and quality controls, areas where Bureau Veritas is a market leader. News of increasing regulation across industries has supported the company’s core business, gradually shaping perceptions of its risk and growth potential.

But with the latest value score sitting at just 3 out of 6, is Bureau Veritas really undervalued, or is the recent optimism already priced in? Up next, we will break down the different ways investors assess Bureau Veritas’s valuation, and why digging deeper than just these numbers could reveal an even more complete picture.

Approach 1: Bureau Veritas Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. By focusing on the company’s ability to generate cash over time, DCF seeks to answer what Bureau Veritas might truly be worth, regardless of current market sentiment.

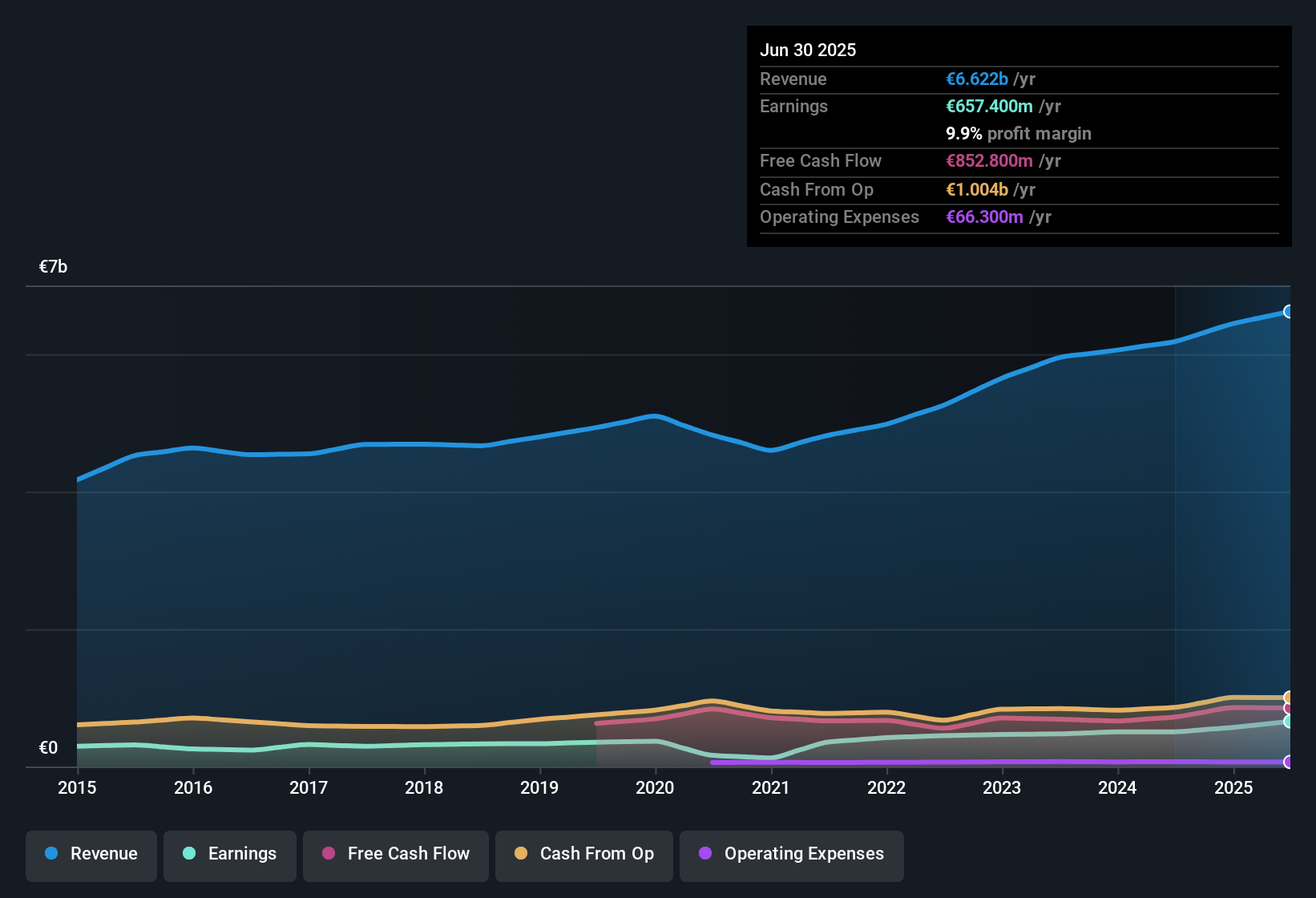

Bureau Veritas reported a Last Twelve Months Free Cash Flow (FCF) of €846 million, reflecting the core profitability and financial health of its operations. Analyst forecasts extend only a few years, but by combining these with longer-term projections, Simply Wall St estimates the company’s FCF could reach approximately €594 million in 2035. Notably, FCF estimates show some fluctuations, but the overall trajectory stays robust over the next decade.

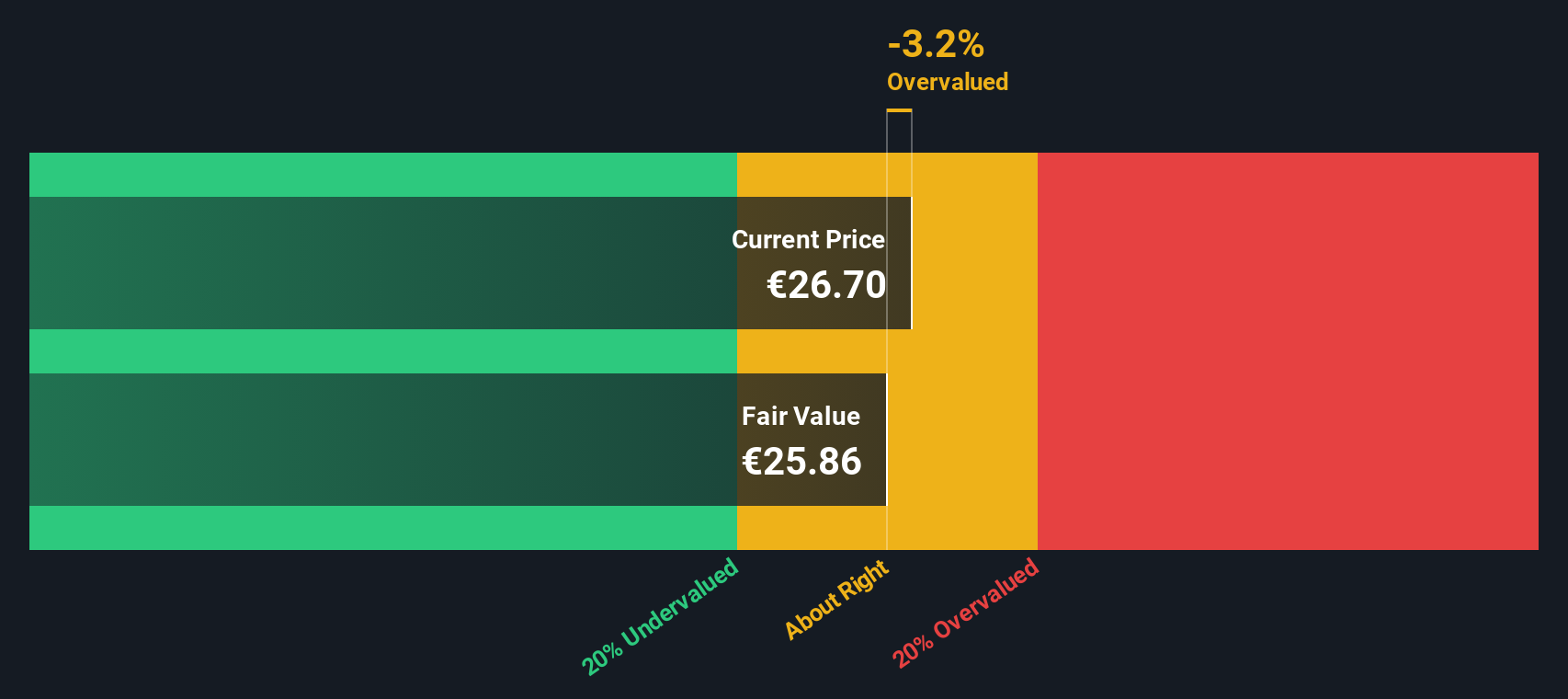

Using the DCF model, the fair value per share is calculated at €25.83. Compared with the recent share price of €27.30, this implies Bureau Veritas is trading about 5.7% higher than its intrinsic worth. In other words, the current optimism in the market has nudged the price marginally above what future cash flows might justify.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Bureau Veritas's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Bureau Veritas Price vs Earnings

The price-to-earnings (PE) ratio is a widely used valuation tool for profitable companies like Bureau Veritas, as it directly compares the company's current share price to its earnings per share. For businesses with steady profitability, the PE can provide investors with a quick sense of whether the market is optimistic or cautious about future prospects.

Growth expectations and perceived risk play a big role in determining what a "fair" PE ratio should be. Companies expected to grow faster or with lower risk profiles generally command higher PE multiples, while those facing headwinds tend to trade at a discount.

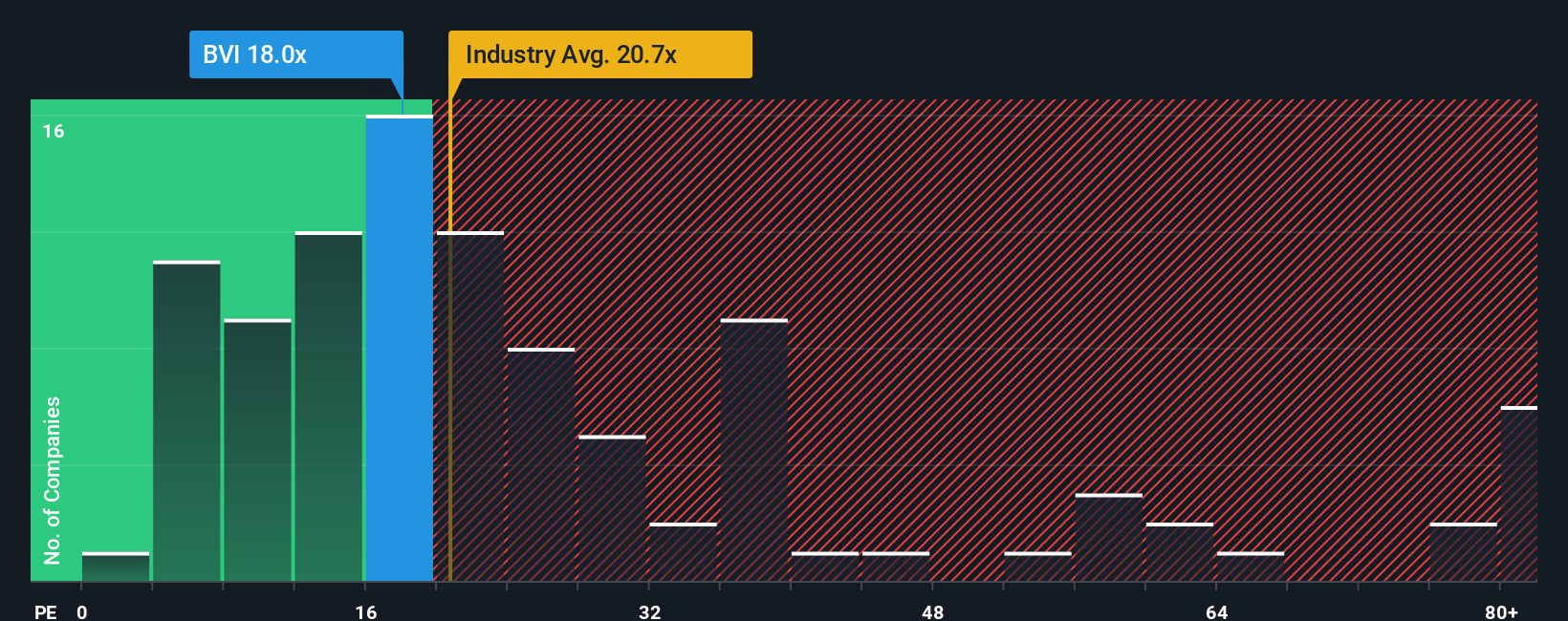

Currently, Bureau Veritas trades at a PE of 18.4x. This sits just below the Professional Services industry average of 19.9x and is notably lower than the peer group average at 35.1x. Instead of comparing only these benchmarks, Simply Wall St calculates a "Fair Ratio" of 16.2x for Bureau Veritas. This proprietary metric factors in the company’s individual growth outlook, profit margins, market cap, risks, and its place in the industry. This offers a more tailored sense of what is reasonable than a simple side-by-side with peers or sector averages.

With Bureau Veritas’s actual PE multiple just 2.2x above its Fair Ratio, the share price appears only marginally higher than justified by fundamentals when all risk and growth expectations are considered. The gap is small enough to conclude that the stock’s valuation is about right at current levels.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bureau Veritas Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your opportunity to give the story and perspective behind the numbers, combining your assumptions about future revenue, earnings, and profit margins with a fair value that matches your view of Bureau Veritas.

Instead of relying only on ratios or historical trends, Narratives link a company’s story with its financial forecast and show you how those beliefs translate into a fair value. They make complex investment thinking accessible to everyone, and you can easily create or explore Narratives from millions of investors on Simply Wall St’s Community page.

Narratives update dynamically when new information, news or earnings are released, so you always have the freshest analysis matched to your investing view. This helps you compare fair value with the current share price to decide if it is the right time to buy or sell for your strategy.

For example, some investors see Bureau Veritas benefitting from global regulations and digital transformation, projecting a fair value as high as €40. Others, focused on risks like integration and currency impacts, see a more cautious outlook with a fair value closer to €28.5.

Do you think there's more to the story for Bureau Veritas? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bureau Veritas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BVI

Bureau Veritas

Provides laboratory testing, inspection, and certification services.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives