- France

- /

- Commercial Services

- /

- ENXTPA:BB

Assessing Société BIC (ENXTPA:BB) Valuation Following Recent Momentum Shift

Reviewed by Kshitija Bhandaru

Société BIC (ENXTPA:BB) shares have shown a slight move this week, prompting some investors to take a closer look at recent performance. With numbers in focus, it is a good time to review how the stock stacks up.

See our latest analysis for Société BIC.

Looking at the bigger picture, Société BIC’s share price has edged lower year-to-date, and while the 1-year total shareholder return remains slightly negative, the much stronger five-year total return points to a company that has rewarded patient holders in the long run. Momentum has softened recently, but those long-term gains highlight resilience as market perceptions shift between growth and risk.

If you’re watching for signals of long-term strength, now is a smart moment to expand your search and discover fast growing stocks with high insider ownership

With shares trading below analyst targets and a strong five-year return, the lingering question is whether Société BIC is undervalued at current levels or if the market has already factored in future growth prospects.

Most Popular Narrative: 14.5% Undervalued

With Société BIC’s consensus fair value set above the recent close, this most popular market narrative is calling attention to untapped upside. The valuation hinges on both geographic expansion and operational transformation, which could be a significant driver of the outlook.

The company's ongoing focus on supply chain optimization (for example, relocation of production closer to key markets) and realization of Horizon plan efficiencies are leading to lower operating expenses and enhanced supply chain agility. This should help improve net margins and bolster earnings resilience, especially in volatile macro environments.

Want to know the secret behind this bullish price target? This narrative is built on expectations of fatter margins, nimble operations, and a strategic shift in markets. The full story, complete with the precise growth forecasts and bold profit assumptions, may surprise you.

Result: Fair Value of €62.6 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating digitalization and sustained cost pressures could erode earnings and challenge the optimistic outlook on Société BIC’s long-term margin growth.

Find out about the key risks to this Société BIC narrative.

Another View: Looking at Price-to-Earnings

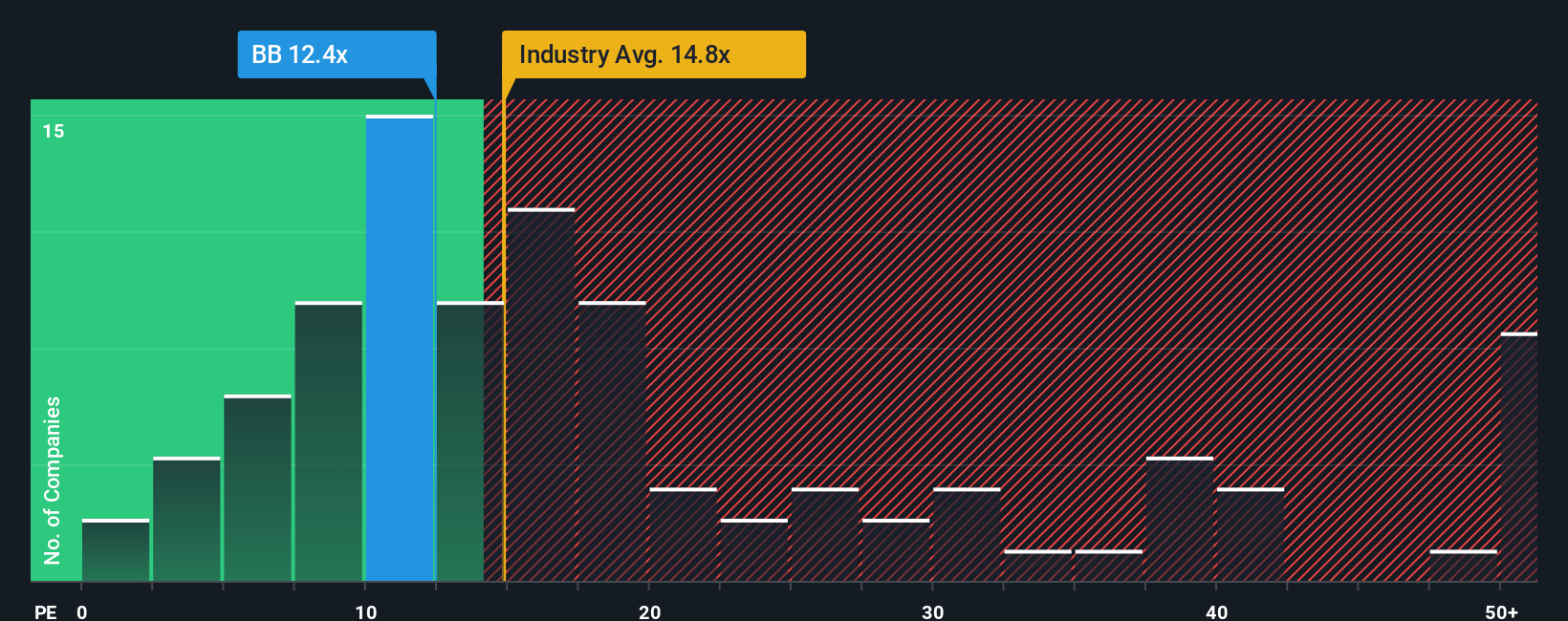

While the headline valuation suggests Société BIC is undervalued, looking at the price-to-earnings ratio presents a slightly different picture. BIC currently trades at 12.5x earnings, which is higher than the peer average of 11.4x but remains below the European industry average of 14.7x. Compared to the fair ratio of 14.4x, the market could still re-rate the stock higher. This raises the question: is this a sign of lingering caution or an overlooked value opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Société BIC Narrative

If you see the story differently, or want to dig into the numbers yourself, you can shape your own perspective with ease. Do it your way

A great starting point for your Société BIC research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Ideas?

Don’t let your search end here. Expand your opportunities by targeting stocks that align with your interests, strategy, and growth goals. Fresh ideas await you.

- Cement income stability by zeroing in on companies offering reliable yields. Check out these 19 dividend stocks with yields > 3% for top picks with robust payouts.

- Get ahead of tomorrow’s breakthroughs by focusing on firms revolutionizing medicine and diagnostics. Seize your chance with these 31 healthcare AI stocks.

- Catch early movers in digital currencies and blockchain. Harness the potential with these 78 cryptocurrency and blockchain stocks now before the next surge begins.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BB

Société BIC

Manufactures and sells stationery, lighter, shaver, and other products worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives