- France

- /

- Commercial Services

- /

- ENXTPA:ALESA

If You Had Bought Ecoslops (EPA:ALESA) Shares Five Years Ago You'd Have Earned 75% Returns

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And in our experience, buying the right stocks can give your wealth a significant boost. To wit, the Ecoslops share price has climbed 75% in five years, easily topping the market return of 46% (ignoring dividends).

See our latest analysis for Ecoslops

Ecoslops wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

For the last half decade, Ecoslops can boast revenue growth at a rate of 28% per year. Even measured against other revenue-focussed companies, that's a good result. While the compound gain of 12% per year is good, it's not unreasonable given the strong revenue growth. If the strong revenue growth continues, we'd expect the share price to follow, in time. Opportunity lies where the market hasn't fully priced growth in the underlying business.

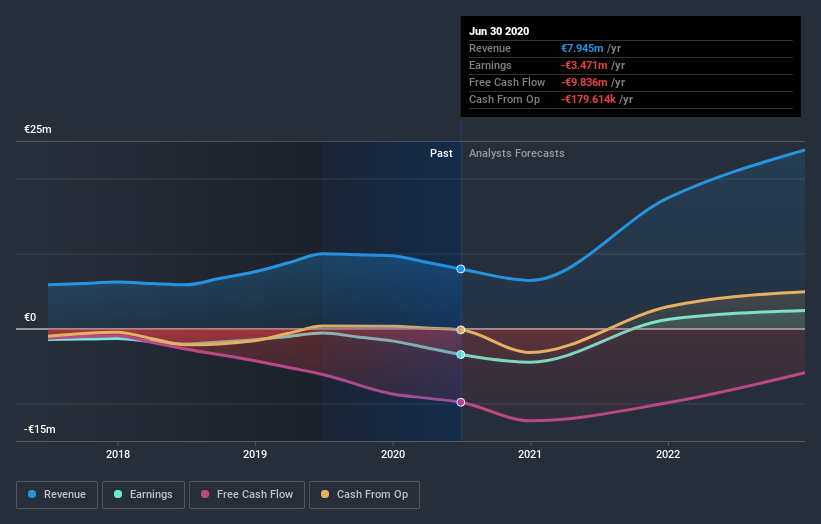

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Ecoslops' financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Ecoslops' total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Ecoslops hasn't been paying dividends, but its TSR of 78% exceeds its share price return of 75%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

We regret to report that Ecoslops shareholders are down 12% for the year. Unfortunately, that's worse than the broader market decline of 1.0%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 12% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 2 warning signs we've spotted with Ecoslops (including 1 which shouldn't be ignored) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

When trading Ecoslops or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Ecoslops might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ALESA

Ecoslops

Ecoslops S.A. regenerates oil residues into new fuels and light bitumen in France and Portugal.

Low and slightly overvalued.

Market Insights

Community Narratives