- France

- /

- Commercial Services

- /

- ENXTPA:ALESA

Ecoslops S.A.'s (EPA:ALESA) Stock Retreats 26% But Revenues Haven't Escaped The Attention Of Investors

To the annoyance of some shareholders, Ecoslops S.A. (EPA:ALESA) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 63% loss during that time.

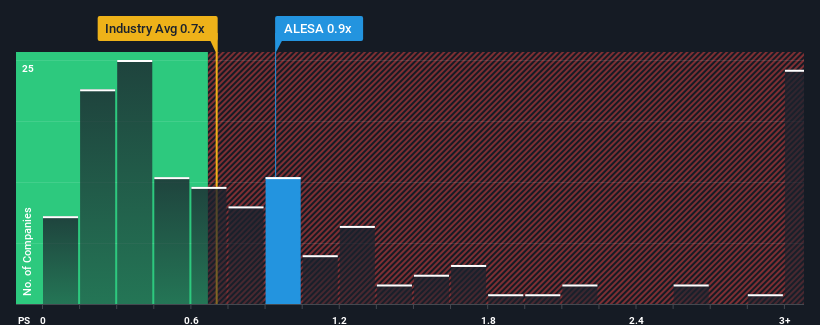

Even after such a large drop in price, when almost half of the companies in France's Commercial Services industry have price-to-sales ratios (or "P/S") below 0.3x, you may still consider Ecoslops as a stock probably not worth researching with its 0.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Ecoslops

What Does Ecoslops' P/S Mean For Shareholders?

Ecoslops certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Ecoslops' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Ecoslops?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Ecoslops' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 50% gain to the company's top line. Pleasingly, revenue has also lifted 96% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 21% per year as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 4.4% each year growth forecast for the broader industry.

In light of this, it's understandable that Ecoslops' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Ecoslops' P/S?

Despite the recent share price weakness, Ecoslops' P/S remains higher than most other companies in the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Ecoslops maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Commercial Services industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Plus, you should also learn about these 2 warning signs we've spotted with Ecoslops.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Ecoslops might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALESA

Ecoslops

Ecoslops S.A. regenerates oil residues into new fuels and light bitumen in France and Portugal.

Low and slightly overvalued.

Market Insights

Community Narratives