Tarkett (ENXTPA:TKTT): Exploring Valuation After a Strong Run and Recent Pause in Share Price

Reviewed by Kshitija Bhandaru

Tarkett (ENXTPA:TKTT) might not be making headlines with a major event today, but its recent moves can still prompt investors to pause and reflect. Sometimes, a period of calm is the signal itself. Are we seeing the market take a breather after a strong run, or is there something lurking beneath the surface that deserves a closer look? With industrial stocks increasingly under the microscope, it’s worth examining what stability in the share price could mean for opportunity, or for caution.

Over the past year, Tarkett’s share price has climbed an impressive 86%, handily outpacing much of its sector and signaling that momentum has been on its side. The gains are even more noticeable when looking back five years, but the latest quarter has told a different story, with the stock cooling off just a bit and retracing slightly. While there haven’t been any major newsflash moments in recent weeks, this kind of pause can sometimes reset valuations or shift market attention to the fundamentals.

After such a strong year, the real question for investors is whether Tarkett is now priced for perfection, or if this is a window for value seekers to step in before the next move.

Price-to-Sales of 0.3x: Is it justified?

Tarkett’s shares currently trade at a Price-To-Sales (P/S) ratio of 0.3x, which is substantially below both the European Building industry average of 0.8x and the peer average of 0.6x. This suggests the stock is trading at a discount relative to its sector peers when looking at revenue multiples.

The Price-To-Sales ratio measures the company’s market capitalization relative to its revenue, making it a popular metric for evaluating companies where earnings may be volatile or negative. For industrial firms like Tarkett, with recent unprofitability and earnings headwinds, this ratio shows how much investors are willing to pay per euro of sales, regardless of bottom-line results.

With Tarkett trading significantly below sector and industry P/S ratios, the implication is the market could be underestimating its potential to recover, or it could be pricing in risks such as persistent losses or uncertain growth prospects. This low multiple positions the stock as potentially undervalued on a sales basis if the company can stabilize its performance going forward.

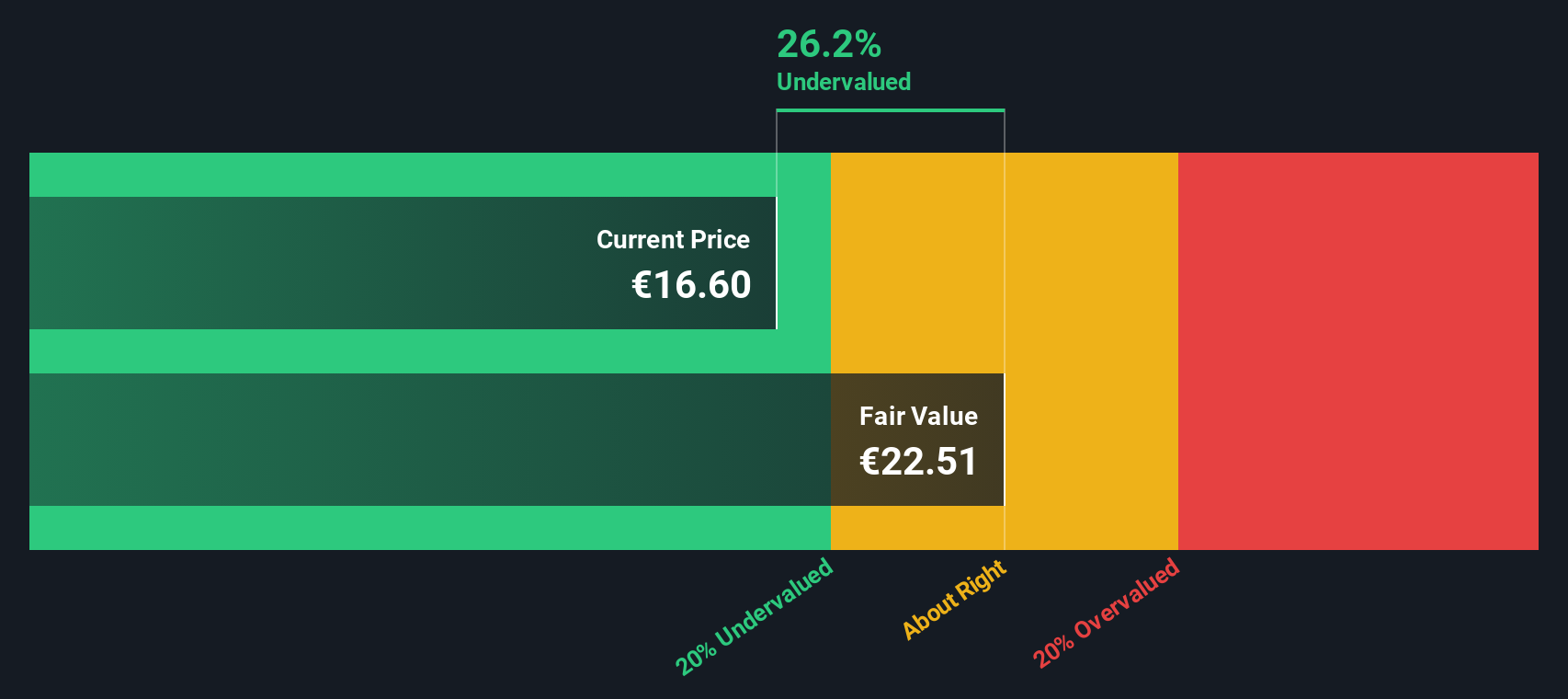

Result: Fair Value of €22.54 (UNDERVALUED)

See our latest analysis for Tarkett.However, ongoing net losses and uncertain growth trends could challenge Tarkett’s rebound. This makes sustained recovery less certain for investors watching closely.

Find out about the key risks to this Tarkett narrative.Another View: What Does the SWS DCF Model Say?

Looking at Tarkett through the SWS DCF model, we see reinforcement rather than contradiction of the earlier sales-based valuation. This second approach points to the shares trading below intrinsic value. Could this be the confirmation value hunters needed, or is caution still warranted?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Tarkett Narrative

If you see things differently or want to dig deeper into the numbers yourself, why not shape your own investment case from scratch in just a few minutes? Do it your way

A great starting point for your Tarkett research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investment Ideas?

Don't let your next opportunity slip away. Put Simply Wall Street's powerful screener to work and find innovative stocks that could fit your goals.

- Spot companies harnessing artificial intelligence in healthcare and tap into this fast-growing trend with our healthcare AI stocks.

- Unlock a world of income potential by searching for reliable payouts with our dividend stocks with yields > 3%.

- Jump on stocks marked as undervalued based on robust cash flow analysis with our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tarkett might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TKTT

Tarkett

Provides flooring and sports surface solutions to businesses and residential end users in Europe, the Middle East, Africa, North America, the Commonwealth of Independent States, the Asia Pacific, and Latin America.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives