- France

- /

- Electrical

- /

- ENXTPA:SU

Schneider Electric (ENXTPA:SU): Reassessing Valuation After Strong Multi‑Year Shareholder Returns

Reviewed by Simply Wall St

Schneider Electric (ENXTPA:SU) has quietly outperformed many European industrial peers over the past year, even with a small dip this month. This makes its current share price worth a closer look.

See our latest analysis for Schneider Electric.

The recent 1 day share price return of 3.51 percent and solid 90 day share price return of 8.82 percent suggest momentum is rebuilding, while the 3 year total shareholder return of 84.01 percent shows the longer term story still looks compelling.

If Schneider Electric has caught your eye, this could also be a good moment to scan fast growing stocks with high insider ownership for other fast growing names with committed insiders.

Yet with the shares trading below analyst targets but at a premium to some traditional valuation metrics, investors are left wondering whether Schneider Electric is still a smart buy or if markets already price in its future growth.

Most Popular Narrative Narrative: 10.1% Undervalued

With Schneider Electric closing at €237.55 against a narrative fair value of about €264.25, the valuation story leans supportive of further upside.

The company's transition toward software and recurring digital services, notably EcoStruxure, AVEVA SaaS, and EcoCare, now representing 60% of revenues and growing at double-digit rates, should drive higher margins and recurring earnings, with further upside potential as AVEVA's SaaS conversion completes by 2027.

Curious how a traditional industrial earns a premium tag usually reserved for software heavyweights? The answer lies in bold growth, fatter margins, and a punchy future earnings multiple. Want to see the exact roadmap behind that outcome?

Result: Fair Value of €264.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure and structurally weaker Industrial Automation performance could derail the bullish data center and electrification-driven growth story.

Find out about the key risks to this Schneider Electric narrative.

Another View: Premium Multiple, Different Story

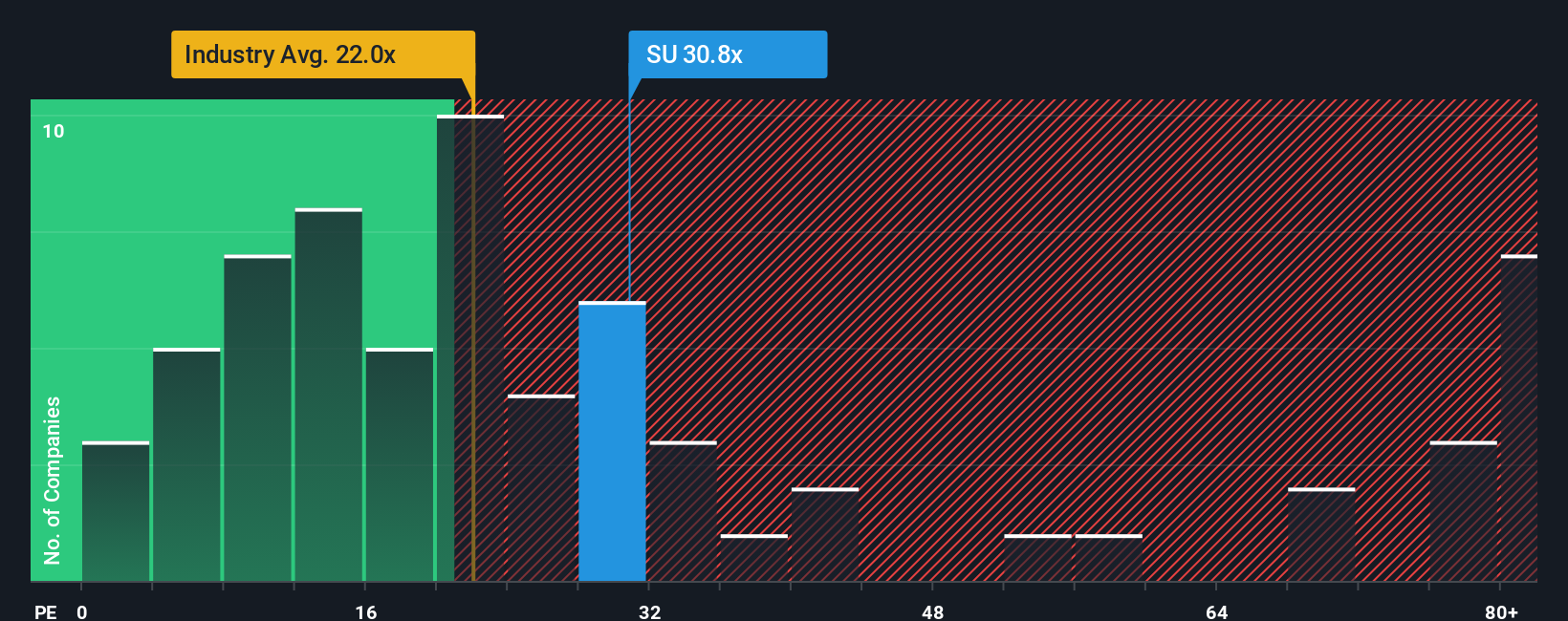

Our valuation using earnings multiples is less generous. Schneider Electric trades on a price to earnings ratio of 31.1x, richer than both the European Electrical industry at 23.3x and peers at 24.7x, and even above a fair ratio of 33.5x the market could drift toward. That premium suggests less room for error if growth stumbles. How comfortable are you paying up for the story?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Schneider Electric for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Schneider Electric Narrative

If you see the story differently or want to stress test the numbers yourself, you can craft a fresh perspective in minutes, Do it your way.

A great starting point for your Schneider Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, take a moment to uncover fresh opportunities with the Simply Wall Street Screener, or you risk missing the next standout performer.

- Capture potential bargain opportunities by reviewing these 913 undervalued stocks based on cash flows that appear mispriced relative to their cash flows and future prospects.

- Position your portfolio for the AI transformation by evaluating these 26 AI penny stocks pushing boundaries in automation, data intelligence, and digital infrastructure.

- Strengthen your passive income strategy by assessing these 15 dividend stocks with yields > 3% offering yields above 3 percent with the potential for sustainable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SU

Schneider Electric

Engages in the energy management and industrial automation businesses worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026