- France

- /

- Electrical

- /

- ENXTPA:SU

Schneider Electric (ENXTPA:SU): Evaluating Valuation After a 19% Monthly Rally

Reviewed by Kshitija Bhandaru

Schneider Electric (ENXTPA:SU) shares have moved up around 2% over the past day, supported by a month-long rally of nearly 19%. Recent gains may prompt investors to reassess the stock’s current valuation and future prospects.

See our latest analysis for Schneider Electric.

Schneider Electric’s upswing isn’t coming out of nowhere. Over the past year, the company’s total shareholder return climbed a respectable 9%, and momentum has clearly picked up in recent weeks as investors respond to its steady growth and earnings delivery. That recent rally suggests confidence is building around the company’s prospects, with short-term performance adding an extra tailwind to its solid long-term track record.

If Schneider’s momentum has your attention, it could be the perfect moment to broaden your research and discover fast growing stocks with high insider ownership

With the shares trading just shy of analyst targets after recent gains, the key question now is whether Schneider Electric remains undervalued and presents a potential buying opportunity, or if robust growth is already reflected in the current price.

Most Popular Narrative: 2.7% Undervalued

The most widely followed narrative puts Schneider Electric’s fair value at €257.55, just above its last close of €250.5. This small yet notable gap has caught the market’s attention and reflects optimism anchored in both structural growth drivers and recent earnings momentum. Here’s a direct look at one of the key catalysts behind the valuation:

The accelerating global shift towards electrification, renewable energy, and energy efficiency, supported by both corporate and government sustainability initiatives, continues to expand Schneider's addressable market and supports steady long-term revenue growth, particularly in energy management and grid modernization.

What supports this price target? There is one critical financial lever that is expected to outpace the sector, coupled with ambitious margin expansion and a multiple rarely seen outside the world’s most disruptive companies. Wondering which bold projections are driving such a confident fair value? Dig into the full narrative to see what is powering this premium story before the rest of the market catches up.

Result: Fair Value of €257.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure or weaker-than-expected performance in Industrial Automation could quickly challenge this upbeat narrative and reduce market optimism.

Find out about the key risks to this Schneider Electric narrative.

Another View: Discounted Cash Flow Tells a Different Story

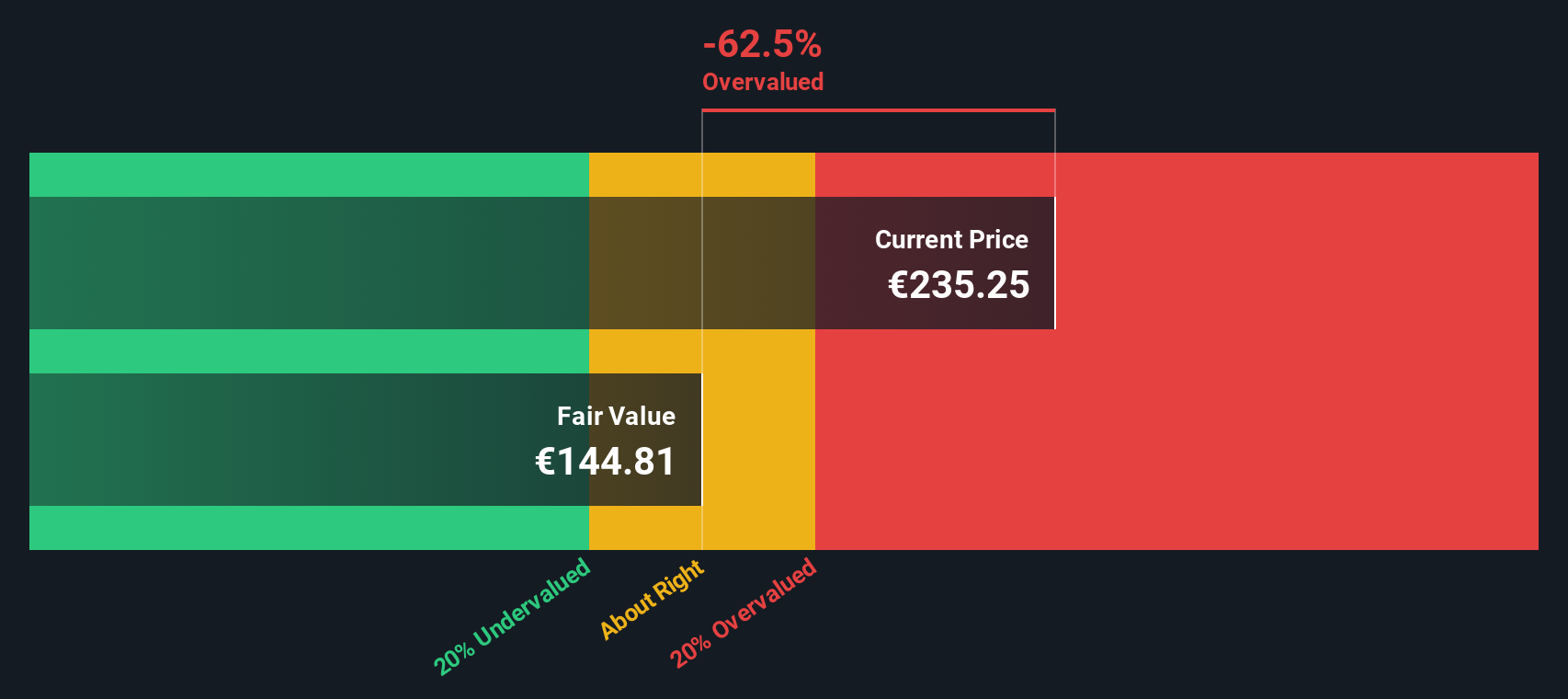

While analysts see Schneider Electric as modestly undervalued on a fair value basis, our DCF model paints a less optimistic picture. According to this approach, the shares are trading well above our estimated fair value of €141.91, suggesting potential overvaluation if cash flows fall short of growth expectations. Which outlook will ultimately prove more accurate?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Schneider Electric for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Schneider Electric Narrative

If these narratives spark your curiosity or if you prefer drawing your own conclusions from the numbers, you can easily build your own viewpoint in just minutes and Do it your way

A great starting point for your Schneider Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Opportunities do not wait, and neither should you. Supercharge your strategy with the right tools. Let Simply Wall Street's screeners guide you toward the smartest investment moves:

- Unlock the potential of financial innovation by tapping into these 78 cryptocurrency and blockchain stocks, featuring companies shaping the next wave of digital assets and blockchain breakthroughs.

- Capture steady income flows and attractive yields with these 19 dividend stocks with yields > 3%, perfect for investors seeking reliable returns in any market.

- Stay ahead of AI-driven disruption by targeting these 24 AI penny stocks, where growth meets transformation in the world’s most dynamic sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SU

Schneider Electric

Engages in the energy management and industrial automation businesses worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives