- France

- /

- Electrical

- /

- ENXTPA:SU

Is Schneider Electric’s Share Price Justified After Its 10% Surge and Digital Push?

Reviewed by Bailey Pemberton

If you’re watching Schneider Electric and wondering whether now is the right time to buy, hold or cash out, you’re in good company. The stock has been anything but dull these days, with a steady YTD climb of 3.0% and a recent 10.0% jump over the past month. Just looking back over five years, the share price has rocketed 145.4%, reflecting a remarkable run for long-term investors. Even its 1.6% rise over the last week hints at renewed optimism, possibly tied to broader shifts in the energy and automation sectors that favor Schneider’s strategy.

But with momentum like this, the big question is whether the market is accurately pricing Schneider Electric or if there’s still some hidden value to be unlocked. That’s where valuation frameworks come into play. Currently, Schneider’s value score stands at 1 out of 6, meaning it only meets one of the key undervaluation criteria analysts look for. That figure might make you pause, especially after such a strong streak, but as we dig deeper into each approach, you’ll see why a single number never tells the whole story.

Let’s run through how analysts typically assess Schneider’s valuation and, more importantly, why there may be a smarter way to gauge whether the shares are priced right for you.

Schneider Electric scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Schneider Electric Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company’s future free cash flows and discounts them back to today’s value to estimate what the business is really worth. This method is often viewed as one of the more rigorous ways to determine intrinsic value because it accounts for both current performance and anticipated growth.

For Schneider Electric, the latest reported Free Cash Flow (FCF) stands at €3.79 billion. Analysts expect this figure to steadily rise, projecting FCF to reach approximately €5.73 billion by the end of 2029. While market analysts typically provide forecasts for the next five years, estimates beyond that are extrapolated using reasonable growth assumptions. The model here forecasts FCF up to 2035.

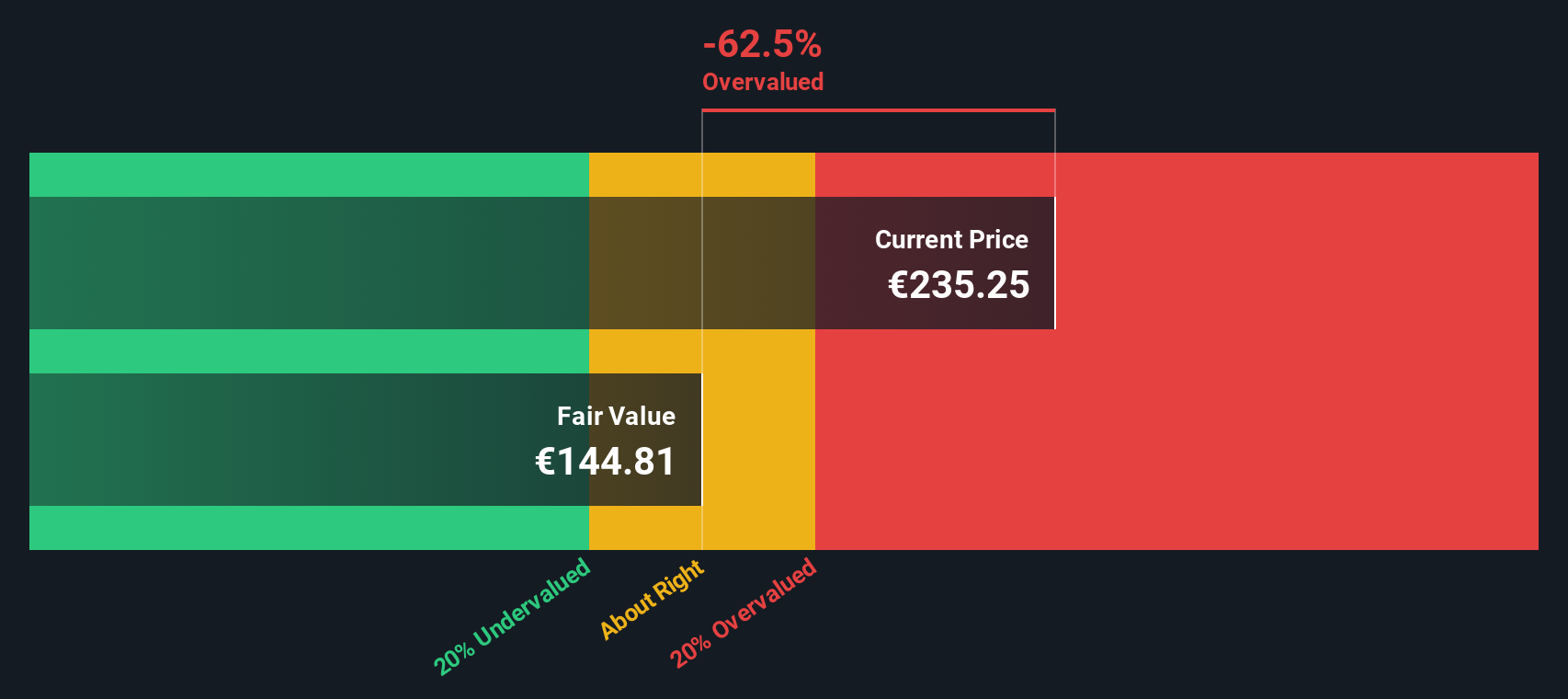

Using these projections, the DCF model estimates Schneider Electric’s fair value at €141.73 per share. However, this value is 75.5% lower than the current share price. Based on this approach, Schneider Electric may be significantly overvalued from a cash flow perspective.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Schneider Electric may be overvalued by 75.5%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Schneider Electric Price vs Earnings (P/E)

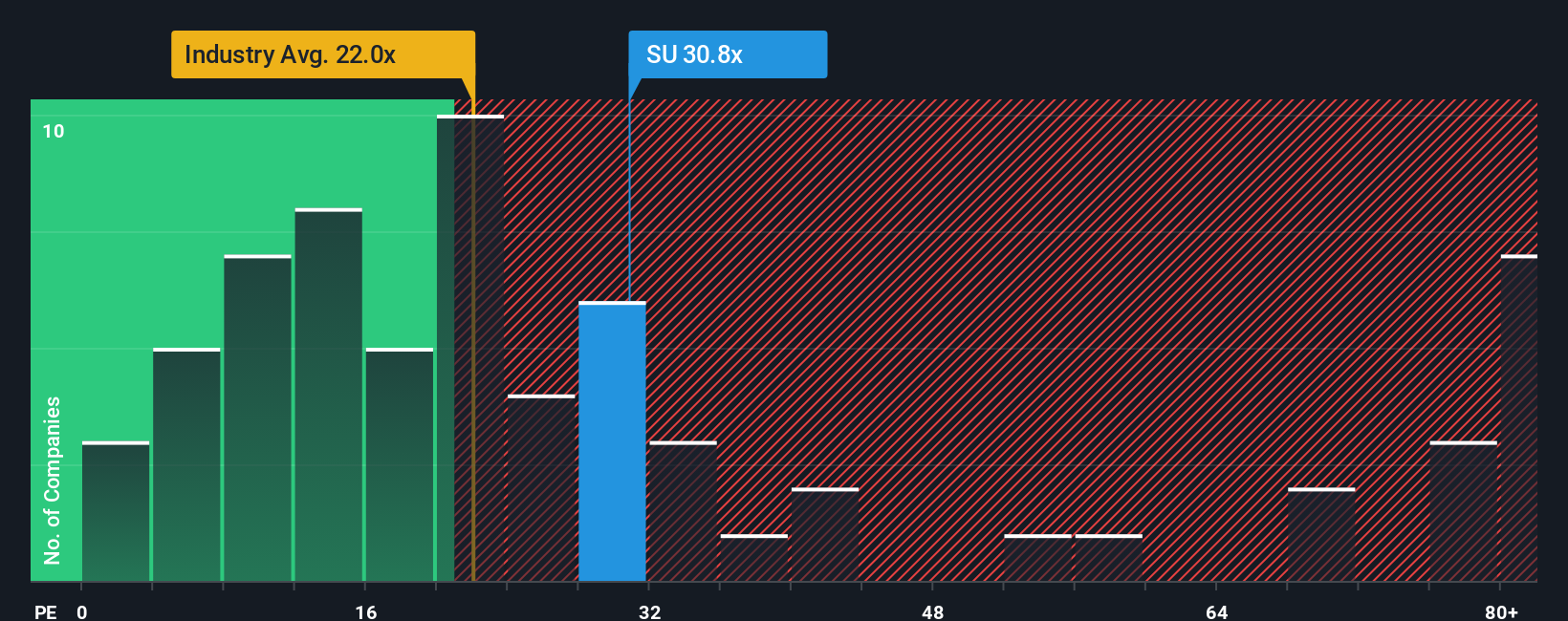

The price-to-earnings (P/E) ratio is a popular way to value profitable companies like Schneider Electric, as it relates a company’s share price to its current earnings. This helps investors assess whether those shares look expensive or cheap relative to profits. A P/E ratio provides quick insight into how much the market is willing to pay for each euro of earnings, but it is important to factor in growth expectations and risk. Generally, higher growth prospects or lower risk justify higher P/E ratios, while slower growth or higher risk often mean a lower “normal” P/E is appropriate.

Right now, Schneider Electric trades at a P/E of 32.6x. Compared to the Electrical industry average of 31.6x and the peer average of 26.4x, this suggests the shares are commanding a premium. However, context is key. Simply Wall St's proprietary “Fair Ratio” for Schneider Electric is 34.1x, which is a calculated benchmark that takes into account not only the company’s earnings growth, but also its profit margin, industry, market cap, and risk profile. This Fair Ratio provides a more nuanced picture than simply comparing the company to peers or the industry at large.

Since Schneider Electric’s current P/E of 32.6x is very close to the Fair Ratio of 34.1x, the stock appears to be priced about right on an earnings basis. This suggests the market is already factoring in the company’s strengths and risks.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Schneider Electric Narrative

Earlier we mentioned there is a smarter way to gauge valuation, so let’s introduce you to Narratives, a dynamic tool that helps investors connect the story they believe about a company, like Schneider Electric, with their financial forecasts and fair value assumptions.

A Narrative makes investing personal and actionable by letting you blend your perspective on a company’s future, such as how you think revenues, margins, and earnings will play out, with real numbers. This creates a clear picture of fair value that is grounded both in facts and your unique outlook.

Narratives, available to everyone on Simply Wall St’s Community page, are easy to use and constantly update when new information or news is released, so your view stays relevant and up-to-date.

This approach empowers you to decide whether to buy or sell by comparing your own Fair Value against the live market price. It makes investment decisions more transparent and based on your convictions rather than static models alone.

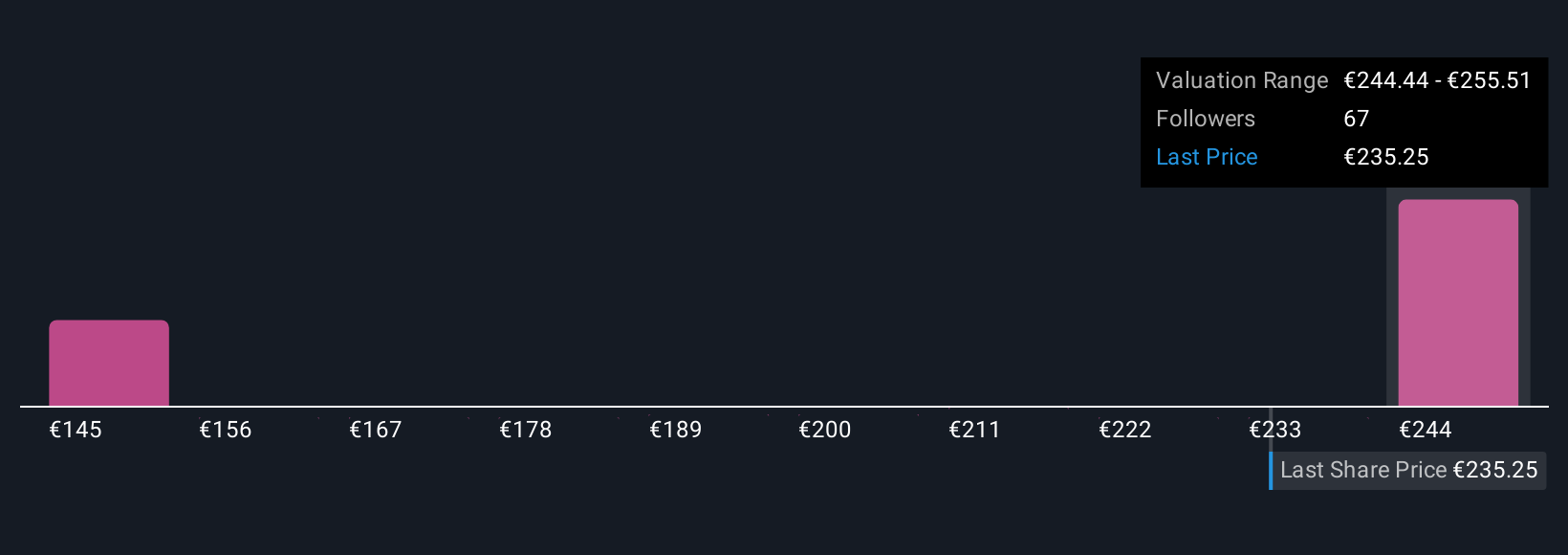

For example, while some investors’ Narratives project Schneider Electric’s fair value as high as €289, citing confidence in its AI-driven digital services and global electrification trends, others see it as low as €220, stressing risks like margin pressures and currency volatility. Your Narrative captures your story and turns it into an actionable investment guide.

Do you think there's more to the story for Schneider Electric? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SU

Schneider Electric

Engages in the energy management and industrial automation businesses worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.