- France

- /

- Electrical

- /

- ENXTPA:SU

AI-Driven Data Center Partnership With NVIDIA Could Be a Game Changer for Schneider Electric (ENXTPA:SU)

Reviewed by Sasha Jovanovic

- Schneider Electric recently announced new reference designs developed with NVIDIA, introducing integrated power management and liquid cooling control systems specifically tailored for AI-ready infrastructure in next-generation data centers.

- This partnership highlights Schneider Electric's advancement towards seamless, AI-driven infrastructure solutions, positioning the company at the forefront of sustainable digital transformation in data center operations.

- We'll explore how Schneider Electric's collaboration with NVIDIA on AI-ready infrastructure could influence its long-term investment case.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Schneider Electric Investment Narrative Recap

Schneider Electric’s long-term appeal rests on the ongoing digitalization of infrastructure and growth in data centers, especially where power reliability and energy efficiency are essential. The recent NVIDIA collaboration showcases innovation in AI-ready infrastructure, which could strengthen the company’s position in next-generation data centers, but does not appear to meaningfully change the most important short-term catalyst: sustained growth in the data center segment. Margin pressure from continued R&D and investment remains the biggest near-term risk for shareholders.

Among recent announcements, the partnership with Compass Datacenters to deliver prefabricated modular data centers stands out as highly relevant, offering another avenue to accelerate deployment and tap further into AI-driven demand, a critical catalyst for revenue and margin growth. With multiple industry partnerships in motion, Schneider Electric is actively reinforcing its role in digital infrastructure evolution.

On the other hand, heavy investment in R&D and ramp-up for data center capacity could still leave Schneider Electric exposed to...

Read the full narrative on Schneider Electric (it's free!)

Schneider Electric's outlook forecasts €48.6 billion in revenue and €6.7 billion in earnings by 2028. This is based on a 7.3% annual revenue growth rate and a €2.4 billion earnings increase from the current €4.3 billion.

Uncover how Schneider Electric's forecasts yield a €257.55 fair value, a 5% upside to its current price.

Exploring Other Perspectives

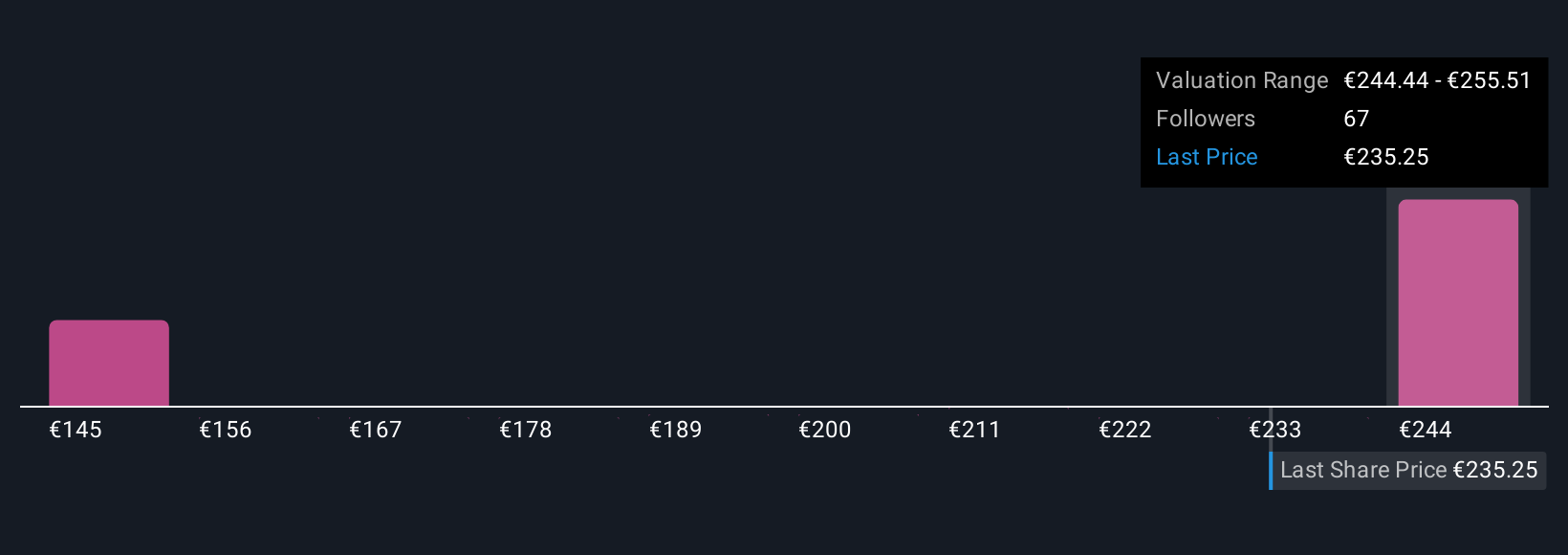

Simply Wall St Community members posted nine fair value estimates for Schneider Electric, ranging from €142.83 to €259.73 per share. As digital infrastructure demand grows, margin pressure from increased investment could still impact the company’s earnings profile, see how different investors are assessing long-term potential.

Explore 9 other fair value estimates on Schneider Electric - why the stock might be worth as much as 6% more than the current price!

Build Your Own Schneider Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Schneider Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Schneider Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Schneider Electric's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SU

Schneider Electric

Engages in the energy management and industrial automation businesses worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives