Compagnie de Saint-Gobain (EPA:SGO) Takes On Some Risk With Its Use Of Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Compagnie de Saint-Gobain S.A. (EPA:SGO) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Compagnie de Saint-Gobain

What Is Compagnie de Saint-Gobain's Debt?

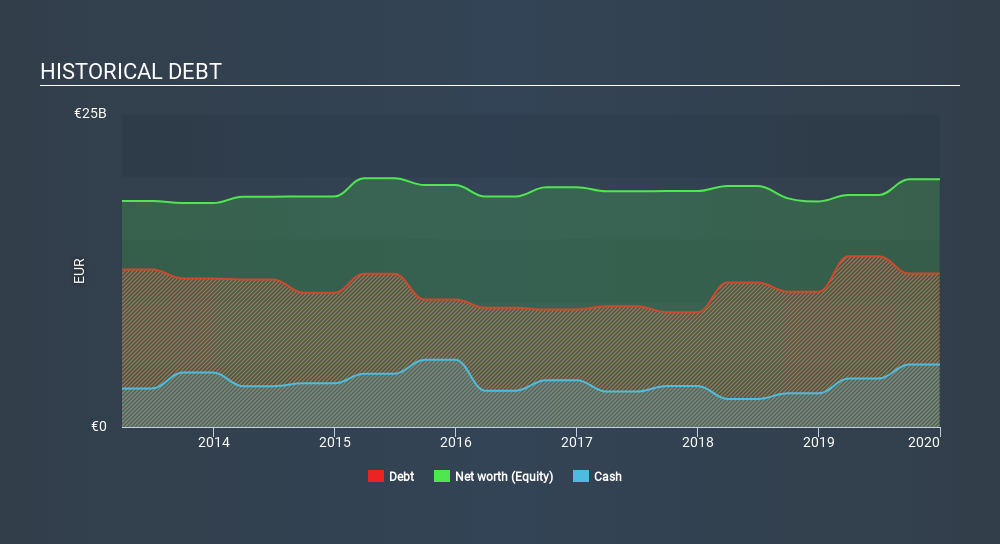

The image below, which you can click on for greater detail, shows that at December 2019 Compagnie de Saint-Gobain had debt of €12.3b, up from €10.8b in one year. However, it does have €4.99b in cash offsetting this, leading to net debt of about €7.27b.

A Look At Compagnie de Saint-Gobain's Liabilities

According to the last reported balance sheet, Compagnie de Saint-Gobain had liabilities of €13.1b due within 12 months, and liabilities of €17.1b due beyond 12 months. On the other hand, it had cash of €4.99b and €5.45b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €19.8b.

The deficiency here weighs heavily on the €9.76b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Compagnie de Saint-Gobain would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Compagnie de Saint-Gobain's net debt to EBITDA ratio of about 1.6 suggests only moderate use of debt. And its commanding EBIT of 10.5 times its interest expense, implies the debt load is as light as a peacock feather. The good news is that Compagnie de Saint-Gobain has increased its EBIT by 6.2% over twelve months, which should ease any concerns about debt repayment. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Compagnie de Saint-Gobain's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Compagnie de Saint-Gobain's free cash flow amounted to 47% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

We'd go so far as to say Compagnie de Saint-Gobain's level of total liabilities was disappointing. But at least it's pretty decent at covering its interest expense with its EBIT; that's encouraging. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Compagnie de Saint-Gobain stock a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 3 warning signs for Compagnie de Saint-Gobain that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTPA:SGO

Compagnie de Saint-Gobain

Designs, manufactures, and distributes materials and solutions for the construction and industrial markets worldwide.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026