- France

- /

- Aerospace & Defense

- /

- ENXTPA:SAF

3 Stocks Estimated To Be Trading At Discounts Up To 46.9%

Reviewed by Simply Wall St

In recent weeks, global markets have experienced fluctuations driven by uncertainties surrounding the incoming Trump administration's policies and their potential impacts on various sectors. As investors navigate these turbulent waters, some stocks may present opportunities for those looking to capitalize on perceived undervaluations. Identifying such stocks involves assessing factors like strong fundamentals and resilience in challenging economic conditions, which can offer potential value amidst broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Giant Biogene Holding (SEHK:2367) | HK$49.10 | HK$97.68 | 49.7% |

| Oddity Tech (NasdaqGM:ODD) | US$43.12 | US$85.73 | 49.7% |

| Wistron (TWSE:3231) | NT$114.00 | NT$227.48 | 49.9% |

| SeSa (BIT:SES) | €75.75 | €150.40 | 49.6% |

| Jetpak Top Holding (OM:JETPAK) | SEK106.00 | SEK211.87 | 50% |

| Loihde Oyj (HLSE:LOIHDE) | €10.80 | €21.48 | 49.7% |

| Telix Pharmaceuticals (ASX:TLX) | A$22.20 | A$44.22 | 49.8% |

| EnomotoLtd (TSE:6928) | ¥1477.00 | ¥2942.16 | 49.8% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.96 | THB9.88 | 49.8% |

| Nokian Renkaat Oyj (HLSE:TYRES) | €7.388 | €14.69 | 49.7% |

Here's a peek at a few of the choices from the screener.

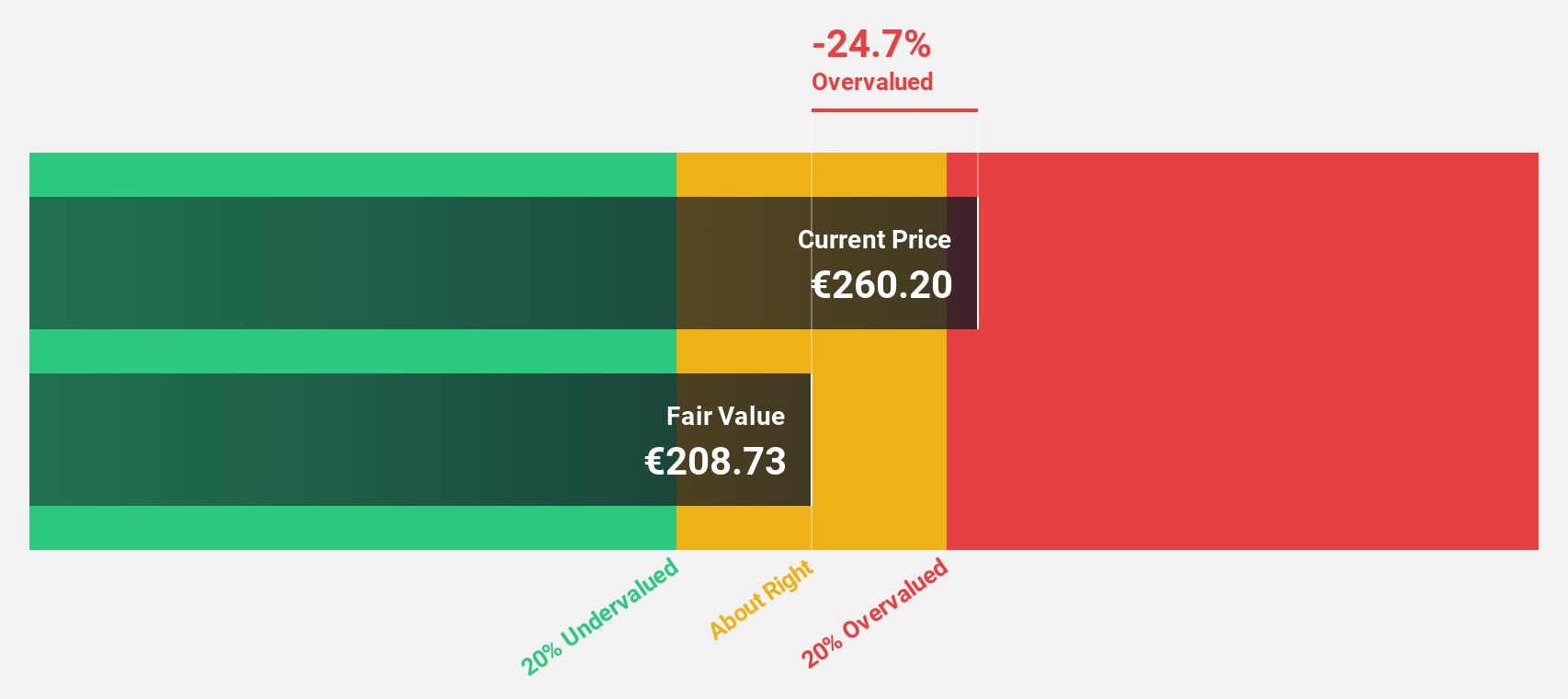

Safran (ENXTPA:SAF)

Overview: Safran SA, along with its subsidiaries, operates in the aerospace and defense sectors globally and has a market cap of €92.23 billion.

Operations: Safran's revenue is primarily derived from Aerospace Propulsion (€12.66 billion), Aeronautical Equipment, Defense and Aerosystems (€9.91 billion), and Aircraft Interiors (€2.73 billion).

Estimated Discount To Fair Value: 32.3%

Safran is trading at €219.4, significantly below its estimated fair value of €324.23, suggesting it may be undervalued based on cash flows. Despite recent revenue guidance being lowered to €27.1 billion for 2024, its earnings are projected to grow at 20% annually, outpacing the French market's 12.5%. However, profit margins have decreased from last year’s 14.4% to 6.4%, which could affect overall valuation perceptions.

- Our earnings growth report unveils the potential for significant increases in Safran's future results.

- Click here to discover the nuances of Safran with our detailed financial health report.

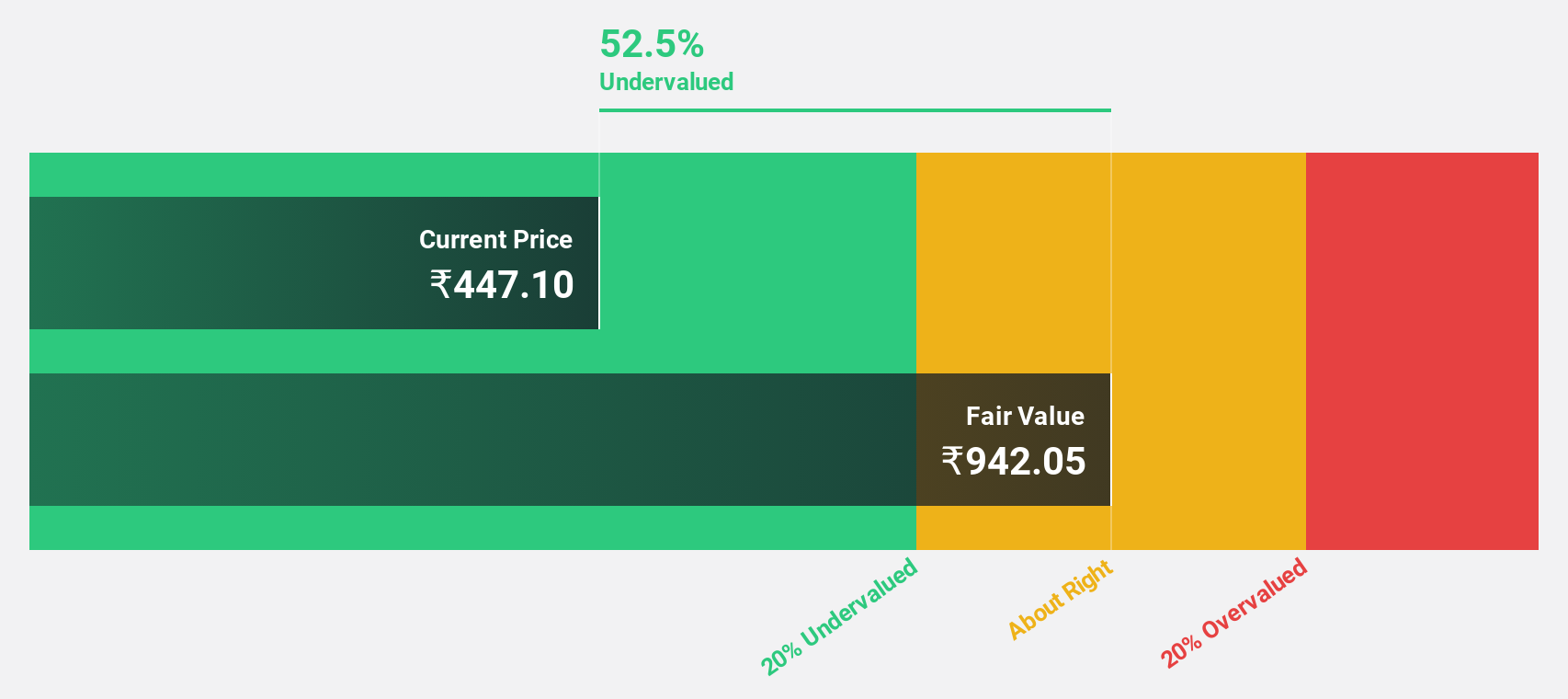

Vedanta (NSEI:VEDL)

Overview: Vedanta Limited is a diversified natural resources company involved in exploring, extracting, and processing minerals as well as oil and gas across India and internationally, with a market cap of ₹1.73 trillion.

Operations: The company's revenue is primarily derived from its Aluminium segment at ₹517.63 billion, followed by Copper at ₹215.01 billion, Oil and Gas at ₹125.01 billion, Iron Ore at ₹76.42 billion, Power at ₹64.12 billion, and Zinc - International contributing ₹31.37 billion.

Estimated Discount To Fair Value: 46.9%

Vedanta, trading at ₹442.8, is significantly below its estimated fair value of ₹833.97, indicating potential undervaluation based on cash flows. Despite high debt levels and a history of shareholder dilution, earnings grew 118% last year and are forecast to grow significantly over the next three years. Recent financial results show improved net income from a loss to ₹43.52 billion in Q2 2024, though revenue growth remains modest compared to market expectations.

- Insights from our recent growth report point to a promising forecast for Vedanta's business outlook.

- Get an in-depth perspective on Vedanta's balance sheet by reading our health report here.

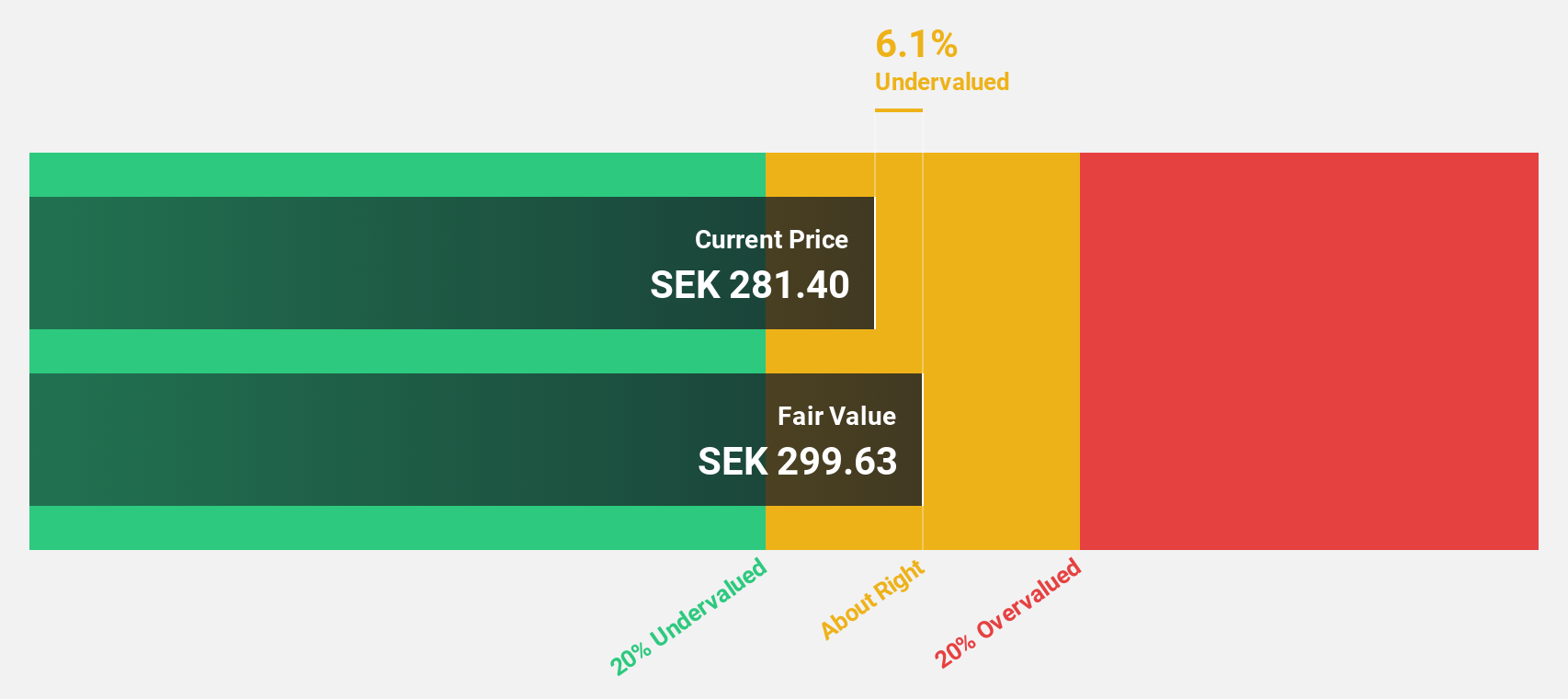

EQT (OM:EQT)

Overview: EQT AB (publ) is a global private equity firm focused on private capital and real asset segments, with a market cap of SEK353.69 billion.

Operations: The company's revenue segments include €1.28 billion from Private Capital, €878.70 million from Real Assets, and €37.20 million from Central operations.

Estimated Discount To Fair Value: 12.1%

EQT, trading below its estimated fair value of SEK340.51 at SEK299.4, shows potential undervaluation based on cash flows despite not being significantly below fair value. Earnings grew 384.2% last year and are forecast to grow 33.5% annually, outpacing the Swedish market's growth rate of 15%. Recent M&A activity includes exploring options for companies like Rapid7 and Banking Circle, which could impact future cash flow dynamics positively or negatively depending on outcomes.

- The growth report we've compiled suggests that EQT's future prospects could be on the up.

- Dive into the specifics of EQT here with our thorough financial health report.

Make It Happen

- Discover the full array of 915 Undervalued Stocks Based On Cash Flows right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SAF

Excellent balance sheet with reasonable growth potential.