Shareholders 49% loss in Haulotte Group (EPA:PIG) partly attributable to the company's decline in earnings over past five years

It's nice to see the Haulotte Group SA (EPA:PIG) share price up 11% in a week. But that doesn't change the fact that the returns over the last five years have been less than pleasing. In fact, the share price is down 54%, which falls well short of the return you could get by buying an index fund.

While the last five years has been tough for Haulotte Group shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for Haulotte Group

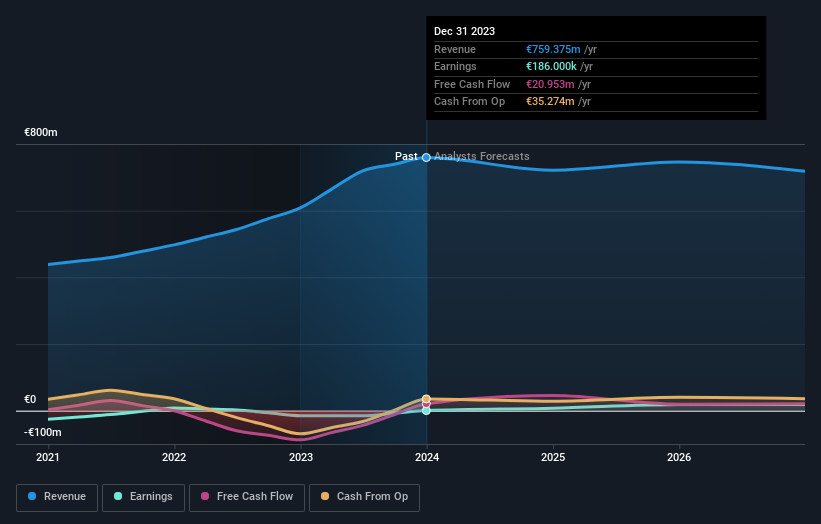

Given that Haulotte Group only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last half decade, Haulotte Group saw its revenue increase by 4.8% per year. That's far from impressive given all the money it is losing. This lacklustre growth has no doubt fueled the loss of 9% per year, in that time. We want to see an acceleration of revenue growth (or profits) before showing much interest in this one. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term).

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Haulotte Group has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Haulotte Group's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Haulotte Group shareholders, and that cash payout explains why its total shareholder loss of 49%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

While the broader market gained around 3.7% in the last year, Haulotte Group shareholders lost 1.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 8% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Haulotte Group (1 can't be ignored!) that you should be aware of before investing here.

Of course Haulotte Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Haulotte Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:PIG

Haulotte Group

Through its subsidiaries, designs, manufactures, and markets people and material lifting equipment.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives