- France

- /

- Electrical

- /

- ENXTPA:NHOA

Positive Sentiment Still Eludes NHOA S.A. (EPA:NHOA) Following 74% Share Price Slump

The NHOA S.A. (EPA:NHOA) share price has fared very poorly over the last month, falling by a substantial 74%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 92% loss during that time.

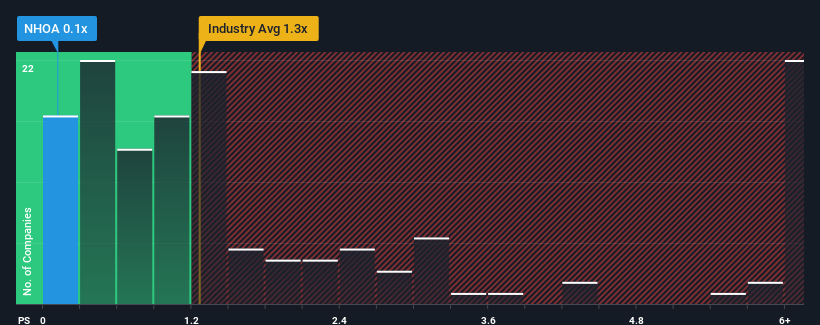

Since its price has dipped substantially, it would be understandable if you think NHOA is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in France's Electrical industry have P/S ratios above 1.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for NHOA

What Does NHOA's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, NHOA has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on NHOA will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For NHOA?

In order to justify its P/S ratio, NHOA would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 101%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 59% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 2.5%, which is noticeably less attractive.

With this in consideration, we find it intriguing that NHOA's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does NHOA's P/S Mean For Investors?

NHOA's P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

NHOA's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with NHOA (at least 3 which are significant), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if NHOA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:NHOA

NHOA

Provides energy storage, E-mobility, and EV fastcharging infrastructure related solutions in France.

Adequate balance sheet very low.

Similar Companies

Market Insights

Community Narratives