- France

- /

- Electrical

- /

- ENXTPA:NHOA

Investors Still Aren't Entirely Convinced By NHOA S.A.'s (EPA:NHOA) Revenues Despite 74% Price Jump

The NHOA S.A. (EPA:NHOA) share price has done very well over the last month, posting an excellent gain of 74%. But the last month did very little to improve the 76% share price decline over the last year.

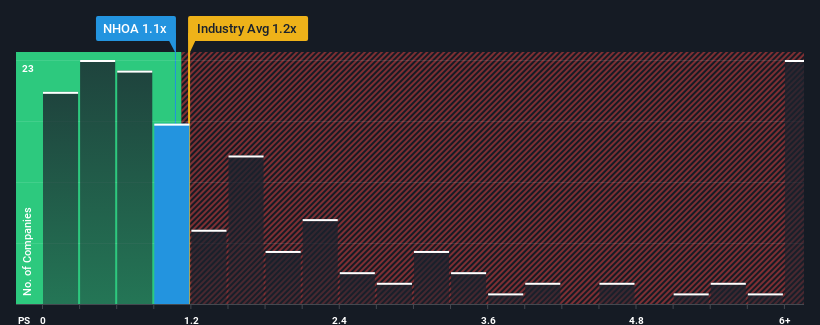

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about NHOA's P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in France is also close to 1.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for NHOA

How NHOA Has Been Performing

With revenue growth that's superior to most other companies of late, NHOA has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on NHOA will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, NHOA would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 65%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 60% during the coming year according to the lone analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 4.6%, which is noticeably less attractive.

In light of this, it's curious that NHOA's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From NHOA's P/S?

Its shares have lifted substantially and now NHOA's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at NHOA's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware NHOA is showing 5 warning signs in our investment analysis, and 4 of those can't be ignored.

If you're unsure about the strength of NHOA's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if NHOA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:NHOA

NHOA

Provides energy storage, E-mobility, and EV fastcharging infrastructure related solutions in France.

Adequate balance sheet very low.

Similar Companies

Market Insights

Community Narratives