- Switzerland

- /

- Electric Utilities

- /

- SWX:NEAG

Undiscovered Gems In Europe To Explore This October 2025

Reviewed by Simply Wall St

As the European markets navigate a mixed landscape with the pan-European STOXX Europe 600 Index inching higher amid dovish signals from the U.S. Fed and easing trade tensions, investors are keenly observing key economic indicators such as industrial production and labor market trends. In this dynamic environment, identifying stocks that exhibit strong fundamentals and resilience to economic fluctuations can be crucial for uncovering potential opportunities in lesser-known segments of the market.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Intellego Technologies | 6.00% | 71.62% | 80.06% | ★★★★★★ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Dn Agrar Group | 63.27% | 15.46% | 33.00% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

H&K (ENXTPA:MLHK)

Simply Wall St Value Rating: ★★★★★☆

Overview: H&K AG, along with its subsidiary, specializes in the development, manufacturing, marketing, and distribution of infantry and small arms for military and governmental authorities across Germany, the European Union, and NATO countries; it has a market capitalization of approximately €1.70 billion.

Operations: H&K generates revenue primarily through the sale of infantry and small arms to military and governmental authorities. The company's financial performance is reflected in its market capitalization of approximately €1.70 billion.

H&K, a nimble player in the Aerospace & Defense sector, has been trading at 20.4% below its estimated fair value, suggesting potential upside. Over the last five years, its earnings have grown at an impressive 12.1% annually, although recent growth of 7.8% lagged behind industry benchmarks of 13.1%. The company boasts high-quality past earnings and has improved shareholder equity from negative to positive over this period. Despite a high net debt to equity ratio of 44.1%, interest payments are well covered with EBIT covering them by 9.6 times, reflecting solid financial management amidst volatility in share prices recently observed.

- Dive into the specifics of H&K here with our thorough health report.

Evaluate H&K's historical performance by accessing our past performance report.

naturenergie holding (SWX:NEAG)

Simply Wall St Value Rating: ★★★★★★

Overview: Naturenergie Holding AG, with a market cap of CHF1.12 billion, operates through its subsidiaries to produce, distribute, and sell electricity under the Naturenergie brand both in Switzerland and internationally.

Operations: Naturenergie Holding AG generates revenue primarily from Customer-Oriented Energy Solutions (€912.90 million), Renewable Generation Infrastructure (€845.40 million), and System Relevant Infrastructure (€482.50 million).

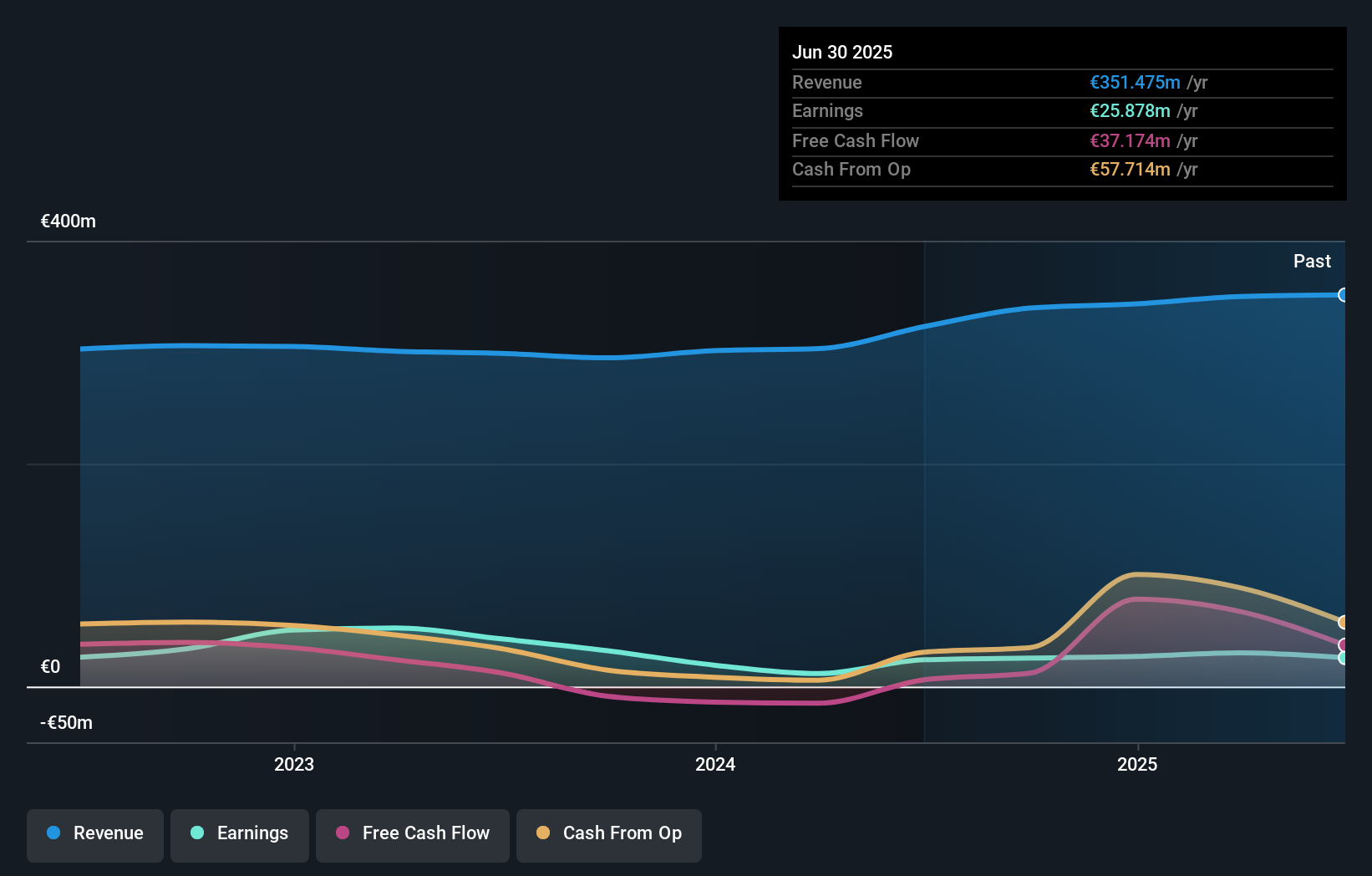

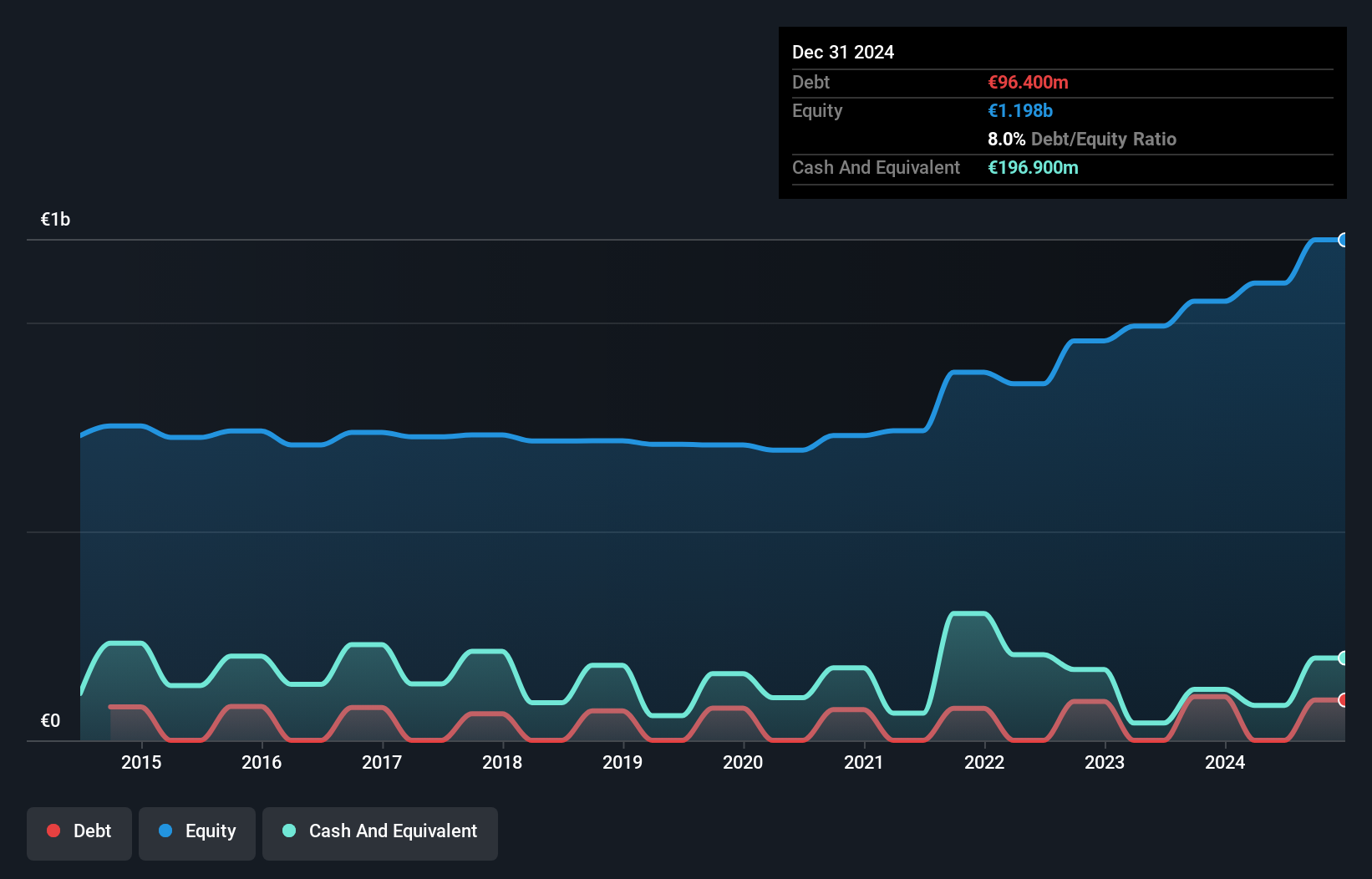

Naturenergie Holding AG, a nimble player in the energy sector, showcases impressive growth with earnings surging 48.2% over the past year, outpacing industry averages. Despite a dip in recent sales to €810.2 million from €868.6 million and net income slipping to €69.7 million from €77.2 million, it trades at 38.5% below its fair value estimate, suggesting potential upside for investors seeking value opportunities within this space. With no debt burden and high-quality earnings reported consistently, Naturenergie's financial health appears robust even as future earnings might face an average annual decline of 8.5%.

Astarta Holding (WSE:AST)

Simply Wall St Value Rating: ★★★★★★

Overview: Astarta Holding PLC operates in sugar production, crop growing, soybean processing, and cattle farming across Ukraine and international markets, with a market capitalization of PLN 1.14 billion.

Operations: Astarta Holding PLC generates revenue primarily from agriculture (UAH 13.68 billion), sugar production (UAH 8.14 billion), and soybean processing (UAH 4.62 billion). Cattle farming contributes UAH 2.57 billion to the total revenue stream.

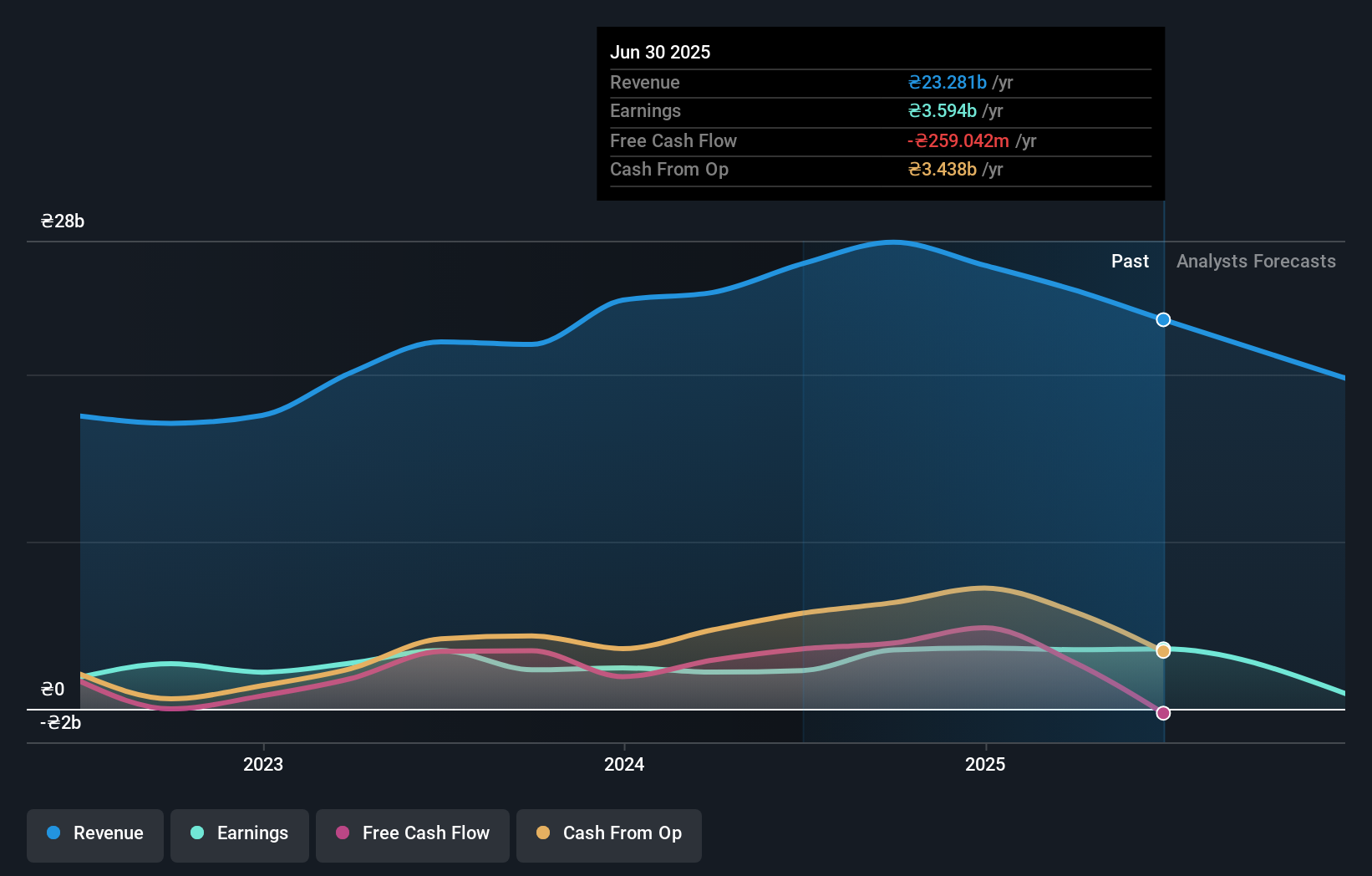

Astarta Holding, a notable player in the European agricultural sector, has shown impressive earnings growth of 56.8% over the past year, outpacing the food industry average. Despite a dip in sales across several product lines like sugar and corn, net income for H1 2025 was UAH 1,968 million. The company benefits from strong debt management with its debt-to-equity ratio dropping to 11.2% over five years and interest payments well covered by EBIT at 3.9 times. Trading at a discount of 25% below estimated fair value suggests potential upside for investors seeking undervalued opportunities in agriculture.

- Navigate through the intricacies of Astarta Holding with our comprehensive health report here.

Gain insights into Astarta Holding's past trends and performance with our Past report.

Where To Now?

- Navigate through the entire inventory of 328 European Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NEAG

naturenergie holding

Through its subsidiaries, engages in the production, distribution, and sale of electricity under the Naturenergie brand in Switzerland and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives