- France

- /

- Electrical

- /

- ENXTPA:LR

Legrand (ENXTPA:LR): Is There Untapped Value in the Stock’s Recent Quiet Rally?

Reviewed by Simply Wall St

Most Popular Narrative: 3.7% Overvalued

The most widely followed narrative currently suggests that Legrand’s share price is trading at a small premium compared to fair value, based on growth estimates and long-term market trends.

Surging investment in data centers, driven by the growth of artificial intelligence and the increasing digitalization of infrastructure globally, is fueling exceptionally strong demand for Legrand's white space products. This trend, supported by a large backlog and an above-1x book-to-bill ratio, is expected to sustain high organic revenue growth through at least 2030.

Curious how bold growth bets could make or break this valuation? The narrative hinges on aggressive long-term projections for both revenue and earnings, in addition to a profit multiple that outpaces most industry peers. Wondering what specific assumptions are boosting Legrand’s fair value above market consensus? Discover the numbers and tension points that could shape the company's premium price in the years ahead.

Result: Fair Value of €129.52 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, caution is warranted if data center demand falters or if U.S. construction weakness persists longer than expected. This could potentially challenge Legrand’s growth outlook.

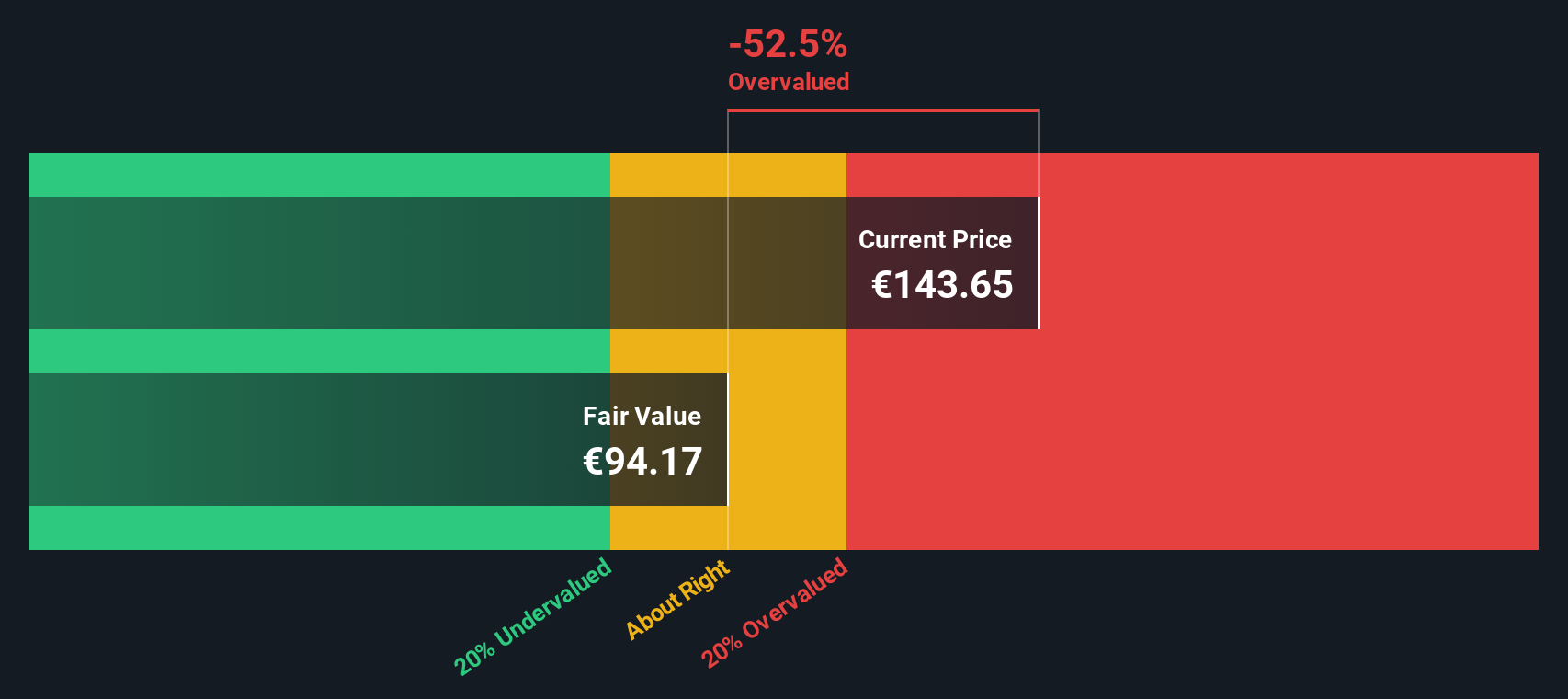

Find out about the key risks to this Legrand narrative.Another View: Our DCF Model Tells a Different Story

Taking a step back, the SWS DCF model points to a much more cautious outlook for Legrand’s value. This suggests shares might be well above fair value by this measure. Could reliance on simple multiples be missing key risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Legrand Narrative

If you’re keen to dig deeper or challenge these conclusions, it's simple to build your own story using the same data in just a few minutes. Do it your way

A great starting point for your Legrand research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Angles?

Don’t let the next breakout slip past you while the market’s attention is elsewhere. Equip yourself with powerful insights and spot tomorrow’s leaders now using these investor-favorite search tools:

- Jump ahead of the trends by tapping into the potential of companies at the forefront of health technology. Start your search with healthcare AI stocks.

- Unlock overlooked value by zeroing in on stocks that may be underpriced relative to their growth. Check them out with undervalued stocks based on cash flows.

- Expand your universe with opportunities in next-generation money and digital assets. Begin your hunt with cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:LR

Legrand

Manufactures, distributes, and sells electrical and digital building infrastructures in Europe, North and Central America, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives