- France

- /

- Aerospace & Defense

- /

- ENXTPA:HO

Thales (ENXTPA:HO): Evaluating Valuation as Satellite Alliance Talks With Airbus and Leonardo Continue

Reviewed by Kshitija Bhandaru

Thales (ENXTPA:HO) addressed recent media reports claiming it had reached an agreement with Airbus and Leonardo for a European satellite joint venture, clarifying that no deal has been finalized yet. Ongoing talks highlight growing competition with Starlink.

See our latest analysis for Thales.

Thales shares have soared more than 78% year-to-date, lifted by rising demand for defense and aerospace technology as well as speculation about a potential European satellite alliance. Despite a recent dip, the 1-year total shareholder return stands at an impressive 62.7%, signalling robust long-term momentum and investor confidence.

If headline-making moves like Thales’s have you curious about other industry leaders, now is the perfect time to check out the latest opportunities in aerospace and defense with our See the full list for free.

But after such a strong rally and years of rapid returns, is Thales still trading at an attractive valuation? Or has the market already priced in all the company’s future growth potential?

Most Popular Narrative: 10.9% Undervalued

Thales’s most widely followed narrative points to a fair value above its latest close, reflecting analyst optimism about the company’s growth outlook amid surging European defense spending. The valuation is based on forward-looking sector trends and key financial drivers that push analyst targets higher than current market levels.

Acceleration of defense spending in France and across Europe (for example, France raising its defense budget from €50 billion in 2025 to €64 billion by 2027, earlier than previously planned) is set to significantly boost order intake and revenue for Thales' defense segment, supporting multi-year revenue growth visibility.

What are the forecasts powering this narrative? Behind the scenes: bold revenue targets, ambitious margin improvements, and future profit multiples more common in fast-growth sectors. Want to see exactly which projections are woven into the fair value calculation? Read the full story and discover what’s driving analyst confidence.

Result: Fair Value of €275.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution challenges in Thales’ digital transformation or sudden shifts in European government defense budgets could dampen the otherwise bright outlook for growth.

Find out about the key risks to this Thales narrative.

Another View: Looking at the Market Multiple

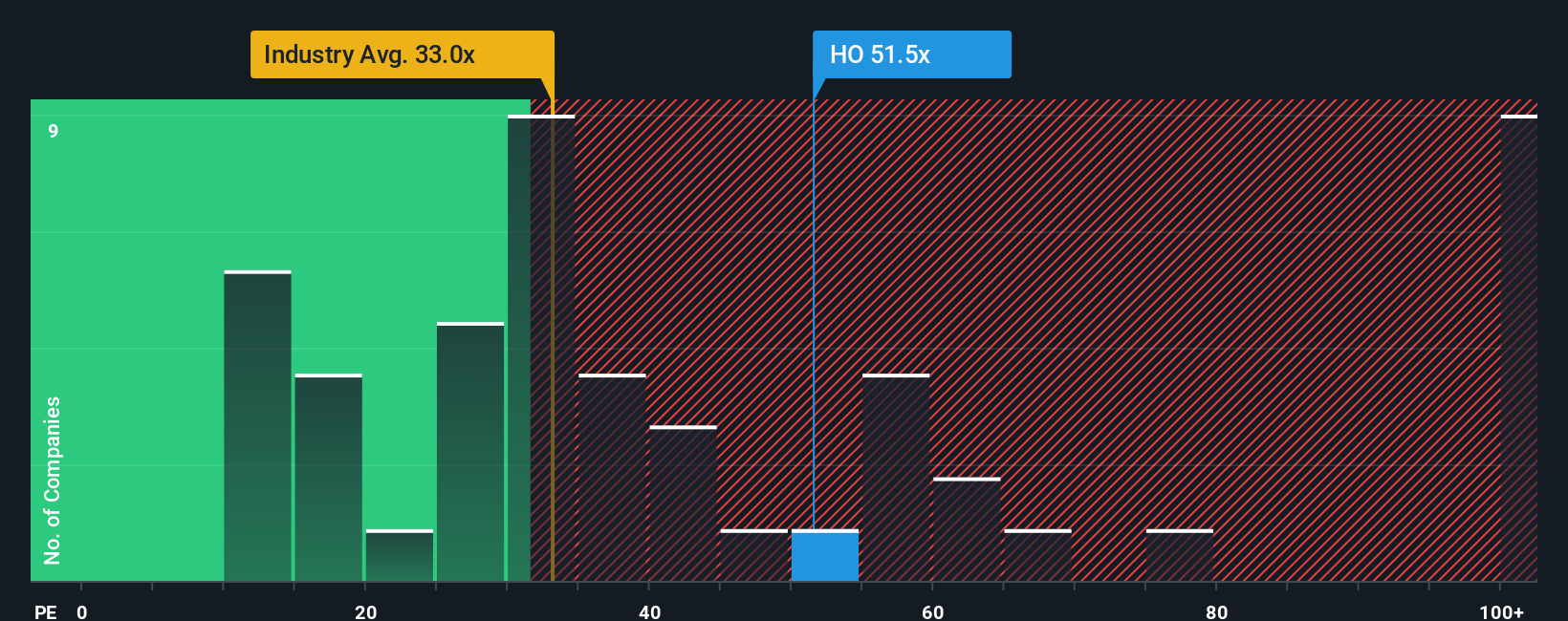

While many analysts consider Thales undervalued against future cash flow, a closer look at its price-to-earnings ratio reveals a different story. Thales trades at 48.2x earnings, noticeably higher than the industry average of 33.5x and even above its own fair ratio, which suggests potential overvaluation. Does this premium signal leadership or simply reflect high expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Thales Narrative

If you’d rather dig into the numbers yourself and shape your own perspective, you can quickly assemble and customize your own view in just a few minutes. Do it your way

A great starting point for your Thales research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your strategy to just one stock. Uncover fresh opportunities right now before everyone else by tapping into innovative investment angles below.

- Profit from emerging artificial intelligence trends by checking out these 24 AI penny stocks, delivering game-changing applications and transformative business models.

- Access steady payouts and rising yields with these 18 dividend stocks with yields > 3%, featuring companies rewarding investors with robust, above-average dividends.

- Spot tomorrow’s biggest growth stories early. Zero in on undervalued gems using these 869 undervalued stocks based on cash flows based on smart cash flow insights.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thales might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:HO

Thales

Provides various solutions in the defence and security, aerospace and space, and digital identity and security markets worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives